Mark Carney Ushers In a Leadership Change at the Bank of England

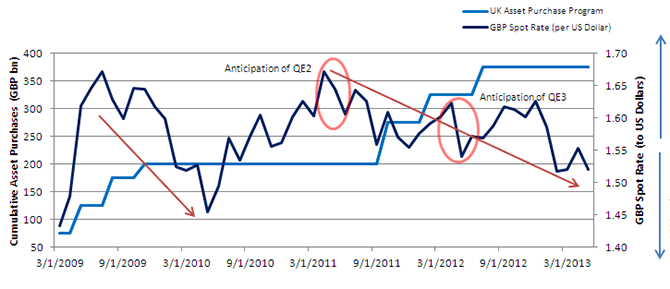

• During the anticipation phase of previous rounds of QE, the GBP weakened ahead of the formal policy announcements.

• QE1: QE1 was announced on 03/05/20095 and encompassed a value of GBP 200 billion. The policy was initiated in March of 2009 and completed in January of 2010. Although the pound appreciated roughly 11% in that period, markets internalized the impact of balance sheet expansion, and the currency subsequently depreciated by about 16% from August 2009 to May 2010.

• QE2: QE2 was announced on 10/06/20116 and encompassed a value of GBP 125 billion. From the initiation of the policy in October of 2011 to its completion in May of 2012, the pound depreciated about 4.5%.

• QE3: QE3 was announced on 07/05/20127 and encompassed a value of GBP 50 billion. From the initiation of the policy in July of 2011 to its completion in November of 2012, the pound depreciated about 4%.

Carney has also spoken widely in favor of unconventional and aggressive monetary policy action. He recently described Japan’s actions as “a bold policy experiment” from which Europe could draw lessons.8 Earlier this year at the World Economic Forum in Davos, Switzerland, Carney hinted strongly at a monetary policy overhaul when he said that central bankers should be prepared to take aggressive measures to help economies achieve what he called, “escape velocity.”9 This is especially crucial for the UK, which has been averaging 0.25% year-over-year growth in the past 6 years.10

We believe that Carney’s appointment could spark some much-needed change in the BOE’s policies, potentially contributing to GBP currency weakness and stronger economic growth—the pound certainly has recently responded to changes in monetary policy. Carney may be just the right catalyst to get the United Kingdom moving in a more positive direction, as he did for Canada.

1 Source: Heather Stewart, “Mark Carney: Bank governor’s journey from wilderness to heart of the City,” The Guardian, June 13, 2013.

2 Source: Budget 2013: Chancellor’s statement – Oral statement to parliament, https://www.gov.uk/government/speeches/budget-2013-chancellors-statement.

3Source: Budget 2013: Chancellor’s statement – Oral statement to parliament, https://www.gov.uk/government/speeches/budget-2013-chancellors-statement.

4British pound vs. the U.S. dollar

5 Source: “Bank of England Reduces Bank Rate by 0.5 Percentage Points to 0.5% and Announces £75 Billion Asset Purchase Programme,” Bank of England Publications.

6 Source: “Bank of England Maintains Bank Rate at 0.5% and Increases Size of Asset Purchase Programme by £75 billion to £275 billion,” Bank of England Publications.

7 Source: “Bank of England maintains Bank Rate at 0.5% and increases size of Asset Purchase Programme by £50 billion to £375 billion,” Bank of England Publications.

8Source: Katie Allen, “Mark Carney warns Europe against lost decade of austerity,” The Guardian, May 21, 2013.

9 Simon Kennedy & Jennifer Ryan, “Carney Says Policy Must Achieve ‘Escape Velocity,’” Bloomberg, January 28, 2013.

10 Source: World Economic Outlook, International Monetary Fund (IMF), April 2013.

• During the anticipation phase of previous rounds of QE, the GBP weakened ahead of the formal policy announcements.

• QE1: QE1 was announced on 03/05/20095 and encompassed a value of GBP 200 billion. The policy was initiated in March of 2009 and completed in January of 2010. Although the pound appreciated roughly 11% in that period, markets internalized the impact of balance sheet expansion, and the currency subsequently depreciated by about 16% from August 2009 to May 2010.

• QE2: QE2 was announced on 10/06/20116 and encompassed a value of GBP 125 billion. From the initiation of the policy in October of 2011 to its completion in May of 2012, the pound depreciated about 4.5%.

• QE3: QE3 was announced on 07/05/20127 and encompassed a value of GBP 50 billion. From the initiation of the policy in July of 2011 to its completion in November of 2012, the pound depreciated about 4%.

Carney has also spoken widely in favor of unconventional and aggressive monetary policy action. He recently described Japan’s actions as “a bold policy experiment” from which Europe could draw lessons.8 Earlier this year at the World Economic Forum in Davos, Switzerland, Carney hinted strongly at a monetary policy overhaul when he said that central bankers should be prepared to take aggressive measures to help economies achieve what he called, “escape velocity.”9 This is especially crucial for the UK, which has been averaging 0.25% year-over-year growth in the past 6 years.10

We believe that Carney’s appointment could spark some much-needed change in the BOE’s policies, potentially contributing to GBP currency weakness and stronger economic growth—the pound certainly has recently responded to changes in monetary policy. Carney may be just the right catalyst to get the United Kingdom moving in a more positive direction, as he did for Canada.

1 Source: Heather Stewart, “Mark Carney: Bank governor’s journey from wilderness to heart of the City,” The Guardian, June 13, 2013.

2 Source: Budget 2013: Chancellor’s statement – Oral statement to parliament, https://www.gov.uk/government/speeches/budget-2013-chancellors-statement.

3Source: Budget 2013: Chancellor’s statement – Oral statement to parliament, https://www.gov.uk/government/speeches/budget-2013-chancellors-statement.

4British pound vs. the U.S. dollar

5 Source: “Bank of England Reduces Bank Rate by 0.5 Percentage Points to 0.5% and Announces £75 Billion Asset Purchase Programme,” Bank of England Publications.

6 Source: “Bank of England Maintains Bank Rate at 0.5% and Increases Size of Asset Purchase Programme by £75 billion to £275 billion,” Bank of England Publications.

7 Source: “Bank of England maintains Bank Rate at 0.5% and increases size of Asset Purchase Programme by £50 billion to £375 billion,” Bank of England Publications.

8Source: Katie Allen, “Mark Carney warns Europe against lost decade of austerity,” The Guardian, May 21, 2013.

9 Simon Kennedy & Jennifer Ryan, “Carney Says Policy Must Achieve ‘Escape Velocity,’” Bloomberg, January 28, 2013.

10 Source: World Economic Outlook, International Monetary Fund (IMF), April 2013.Important Risks Related to this Article

Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.