Focus on European Exporters

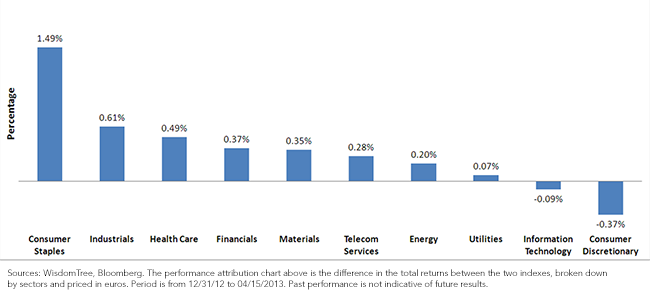

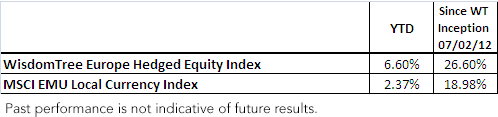

• Positive Outperformance – The WisdomTree Europe Hedged Equity Index had positive performance attribution in 8 out of 10 sectors. The WisdomTree Europe Hedged Equity Index was up 5.46% through 04/15/2013, compared to the MSCI EMU Local Currency Index, which returned 2.07% for the same period.

• Over-weight Consumer Staples – The WisdomTree Europe Hedged Equity Index’ largest over-weight was toward the consumer staples sector, which includes many multinational companies with large exports. At almost a 10% over-weight compared to the MSCI EMU Local Currency Index, it has contributed to 1.49% of total outperformance.

• Under-weight Financials – Noticeable under-weights of around 12.5% for the financial sector also contributed 0.37% to the total outperformance.

Hedge Your Currency Risk

WisdomTree’s focus on European exporters has started to provide important performance benefits, but we also believe there is a benefit to hedging your currency risks. As the euro weakens, European exporters benefit because their goods become more attractively priced for global consumers abroad; and when they bring the overseas sales profit back to Europe, they can convert the foreign currency at a higher exchange rate. On the other hand, a weakening euro is not good for U.S. investors in European equities—unless they hedge the currency. Currency-hedged strategies allow investors to focus on European exporters without the worry over currency declines.

Conclusion

In my opinion, many investors dismiss Europe because of its uncertain economic situation. But Europe is a big region of the world—and investors may be missing strong exporting companies that have a strong global revenue base. Focusing on these European equities with a currency hedge may help to lower the volatility of the region with stocks that are performing better than other European equities.

• Positive Outperformance – The WisdomTree Europe Hedged Equity Index had positive performance attribution in 8 out of 10 sectors. The WisdomTree Europe Hedged Equity Index was up 5.46% through 04/15/2013, compared to the MSCI EMU Local Currency Index, which returned 2.07% for the same period.

• Over-weight Consumer Staples – The WisdomTree Europe Hedged Equity Index’ largest over-weight was toward the consumer staples sector, which includes many multinational companies with large exports. At almost a 10% over-weight compared to the MSCI EMU Local Currency Index, it has contributed to 1.49% of total outperformance.

• Under-weight Financials – Noticeable under-weights of around 12.5% for the financial sector also contributed 0.37% to the total outperformance.

Hedge Your Currency Risk

WisdomTree’s focus on European exporters has started to provide important performance benefits, but we also believe there is a benefit to hedging your currency risks. As the euro weakens, European exporters benefit because their goods become more attractively priced for global consumers abroad; and when they bring the overseas sales profit back to Europe, they can convert the foreign currency at a higher exchange rate. On the other hand, a weakening euro is not good for U.S. investors in European equities—unless they hedge the currency. Currency-hedged strategies allow investors to focus on European exporters without the worry over currency declines.

Conclusion

In my opinion, many investors dismiss Europe because of its uncertain economic situation. But Europe is a big region of the world—and investors may be missing strong exporting companies that have a strong global revenue base. Focusing on these European equities with a currency hedge may help to lower the volatility of the region with stocks that are performing better than other European equities.

Take the euro out of Europe (Video)

Take the euro out of Europe (Video)Important Risks Related to this Article

You cannot invest directly in an index. Diversification does not eliminate the risk of experiencing investment losses. The recent growth rate in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.