The Sector Differences of Mid and Small Cap Dividends

For definitions of indexes in the chart, visit our Glossary.

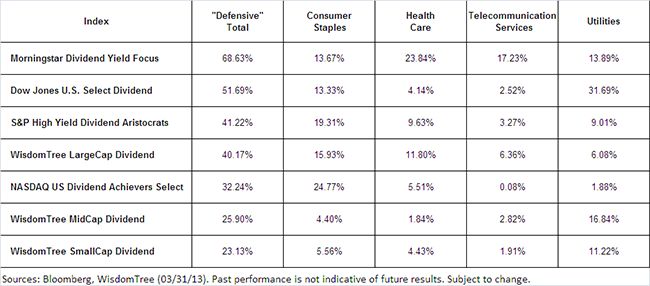

• Large Caps and High-Yield Focus Tend to Over-Weight Defensives – The large-cap dividend stocks tend to have much larger weight in the defensive sectors than do either the WisdomTree MidCap or SmallCap Dividend Indexes. The Morningstar Dividend Yield Focus Index has the highest percentage, with nearly 70% weight, in the defensive sectors and its highest exposure in the Health Care sector. The WisdomTree MidCap Dividend Index might make a good complement to that type of exposure, given the fact that it’s the least exposed to the Health Care sector of all dividend indexes on this list.

• Unbalanced Sector Weights – To achieve such a high over-weight in the defensive sectors, some indexes show significant over-weight in individual sectors. The Dow Jones U.S. Select Dividend Index, for example, has over 31% exposure in the Utilities sector; the Morningstar Dividend Yield Focus Index has almost 24% exposure in the Health Care sector; and the NASDAQ US Dividend Achievers Select Index has almost 25% exposure in the Consumer Staples sector.

• The WisdomTree LargeCap Dividend Index has good representation across all defensive sectors and avoids being substantially over-weight or under-weight in any one particular sector, when compared to the large-cap dividend-focused indexes above. We feel this balanced representation across the different sectors increases the diversification potential and provides potentially broader exposure to the large-cap dividend payers.

• Different Weighting in Mid and Small Caps – The WisdomTree MidCap and SmallCap Dividend Indexes both have very noticeable differences in sector weights compared to the large caps above. They both have less total exposure to the defensive sectors, as evidenced by their lower weightings in Consumer Staples, Healthcare and Telecom.

Diversification Benefits of Mid and Small Caps

It is impossible to know which sector or sector groups will perform the best going forward, so we believe it is important to remain diversified. Complementing large-cap dividend strategies with mid- and small-cap dividends has the potential to provide increased diversification by balancing the sector allocations of the market. Also, for individuals who feel the defensive sectors have moved too much in early 2013, the mid- and small-cap dividend payers might offer an alternative for capturing the dividend payers without being over-weight in the defensive sectors.

1Throughout this piece we refer to the large-cap dividend indexes as a group that includes the Morningstar Dividend Yield Focus Index, Dow Jones U.S. Select Dividend Index, S&P High Yield Dividend Aristocrats Index, NASDAQ US Dividend Achievers Select Index and WisdomTree LargeCap Dividend Index. These indexes were selected because they are some of the largest, based on assets tracking the index.

For definitions of indexes in the chart, visit our Glossary.

• Large Caps and High-Yield Focus Tend to Over-Weight Defensives – The large-cap dividend stocks tend to have much larger weight in the defensive sectors than do either the WisdomTree MidCap or SmallCap Dividend Indexes. The Morningstar Dividend Yield Focus Index has the highest percentage, with nearly 70% weight, in the defensive sectors and its highest exposure in the Health Care sector. The WisdomTree MidCap Dividend Index might make a good complement to that type of exposure, given the fact that it’s the least exposed to the Health Care sector of all dividend indexes on this list.

• Unbalanced Sector Weights – To achieve such a high over-weight in the defensive sectors, some indexes show significant over-weight in individual sectors. The Dow Jones U.S. Select Dividend Index, for example, has over 31% exposure in the Utilities sector; the Morningstar Dividend Yield Focus Index has almost 24% exposure in the Health Care sector; and the NASDAQ US Dividend Achievers Select Index has almost 25% exposure in the Consumer Staples sector.

• The WisdomTree LargeCap Dividend Index has good representation across all defensive sectors and avoids being substantially over-weight or under-weight in any one particular sector, when compared to the large-cap dividend-focused indexes above. We feel this balanced representation across the different sectors increases the diversification potential and provides potentially broader exposure to the large-cap dividend payers.

• Different Weighting in Mid and Small Caps – The WisdomTree MidCap and SmallCap Dividend Indexes both have very noticeable differences in sector weights compared to the large caps above. They both have less total exposure to the defensive sectors, as evidenced by their lower weightings in Consumer Staples, Healthcare and Telecom.

Diversification Benefits of Mid and Small Caps

It is impossible to know which sector or sector groups will perform the best going forward, so we believe it is important to remain diversified. Complementing large-cap dividend strategies with mid- and small-cap dividends has the potential to provide increased diversification by balancing the sector allocations of the market. Also, for individuals who feel the defensive sectors have moved too much in early 2013, the mid- and small-cap dividend payers might offer an alternative for capturing the dividend payers without being over-weight in the defensive sectors.

1Throughout this piece we refer to the large-cap dividend indexes as a group that includes the Morningstar Dividend Yield Focus Index, Dow Jones U.S. Select Dividend Index, S&P High Yield Dividend Aristocrats Index, NASDAQ US Dividend Achievers Select Index and WisdomTree LargeCap Dividend Index. These indexes were selected because they are some of the largest, based on assets tracking the index.Important Risks Related to this Article

You cannot directly invest in an index. Diversification does not eliminate the risk of experiencing investment losses. Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Funds that emphasize investments in small/mid-cap companies generally experience greater price volatility.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.