The Great Rotation May Just Be Getting Started

The year began with a sharp reversal in the relative performance of sectors and styles. In our view, we may still be early in this rotation.

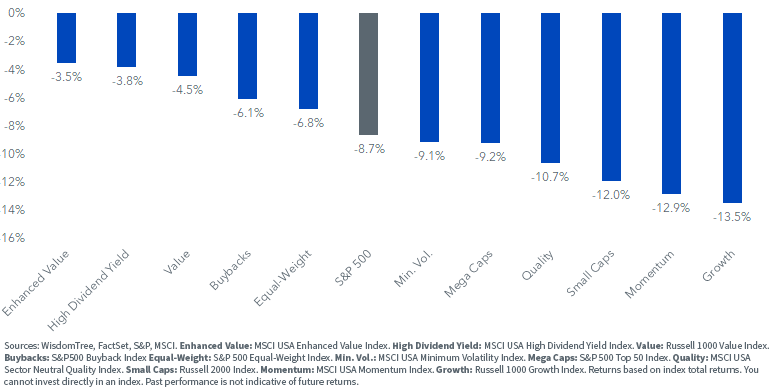

Mega-caps and growth styles have been particularly sharp underperformers, while value-oriented and high dividend strategies have outperformed.

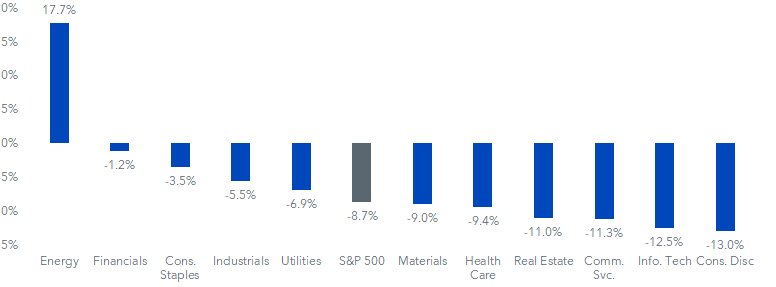

From a sector standpoint, Technology and the parts of the Consumer Discretionary sector that have a technology focus (Amazon, as example), are down the most. Energy is leading the market higher, and Financials and Consumer Staples are proving to be defensive assets during the rotation.

When you look at factor index performance, it may be surprising to see that Minimum Volatility and Quality are not outperforming the market. One would typically expect these factors to hold up well during periods of volatility. Given the MSCI factor definition and weighting process for these indexes, it is rewarding many of the same technology and growth stocks that have come under pressure recently. Those are also the same stocks that had become low volatility.

Netflix, a pandemic darling, found its way into the MSCI Minimum Volatility Index—unfortunately, its disappointing earnings and 20% fall last week will not likely let it remain in the min vol index.

Year-to-Date Sector Index Returns, as of 1/26/22

Year-to-Date Factor Index Returns, as of 1/26/22

For definitions of terms in the chart above please visit the glossary.

What caused this market rotation? In a recent blog post, “The Most Important Charts for 2022,” we talked about inflation being the top theme for 2022.

Stocks are great long-term inflation hedges, as companies pass along their cost increases to consumers with higher prices. Companies with the most pricing power (those with higher profit margins and better return on capital metrics) should hold up better over an inflationary cycle.

But the Fed’s reaction to inflation and tighter monetary policy has caused the volatility that we are seeing in high-duration growth assets, where cash flows are coming in many years to the future. Our view is that the market still has more adjusting to do, and the Fed very well may have to become even more hawkish than the market expects.

There are two issues for growth stocks.

First, higher discount rates and interest rates from the Fed—that is one factor that kickstarted some of the rotation.

But second is earnings trajectories. Netflix sank on questions about its future earnings and whether subscriber growth will be the same in the face of higher competition.

Peloton sank because the market for its bikes became saturated and they had to halt production.

Cloud stocks like Zoom did well as companies and people flocked to Zoom calls, but will competition heat up and will they be able to continue with broader penetration and revenue growth?

A combination that works particularly well for this macro environment is stocks priced at discounted valuations, that are not reliant on far-out cash flows. That is exactly what we see with quality dividend growth stocks—which have been set apart from the standard quality indexes described earlier.

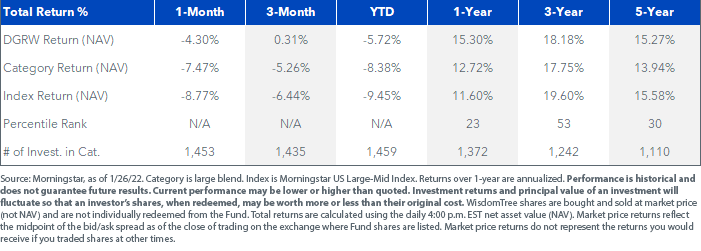

Over the last three months, our Quality Dividend Growth Fund (DGRW)—has returned 0.31% at NAV while the large blend category of 1,435 stocks was down 5.26% and the benchmark for the category was down 6.44%.

After the start of 2021, when higher beta assets ripped higher, the quality stocks had lower betas. But over the long-run, we can see that DGRW has benefited from its over-weight to quality names as it ranks in the 30th percentile over the past 5-years:

Fund and Category Return/Rankings

For the most recent standardized performance, 30-day SEC yield and month-end performance click here.

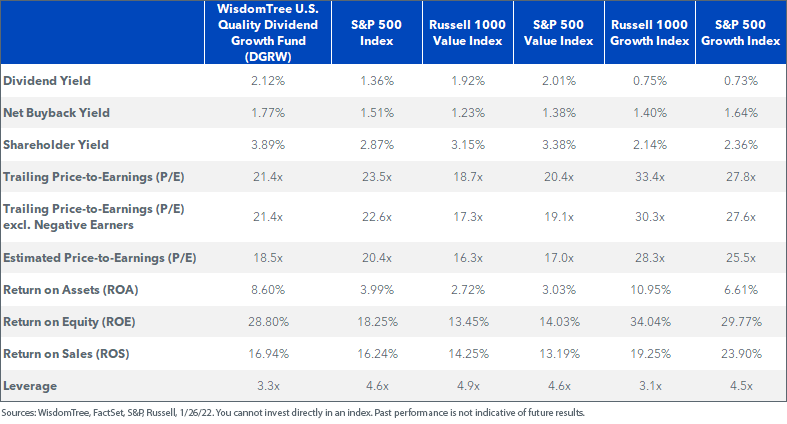

Again, what matters is valuations during this environment of tighter interest rate policy and higher interest rates.

We believe a combination of higher profitability and defensive assets priced at ‘value-like’ valuation multiples should hold up well in 2022’s inflation induced volatile market.

Fundamentals Comparison

For definitions of terms in the chart above please visit the glossary.

Is it Over?

Some market watchers believe we are at peak Fed hawkishness—and inflation will subside. Perhaps they will prove correct. WisdomTree Senior Investment Strategy Advisor Jeremy Siegel is on the most hawkish end of the curve, thinking the Fed will have to end the year with a 2% Federal Funds Rate. That is why on CNBC on Monday, he suggested the Nasdaq could very well enter bear market territory and have a continued rough patch this year.

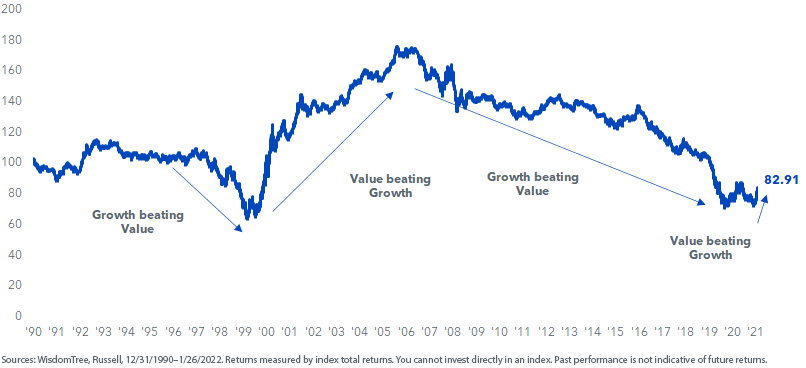

For those who believe we’ve already seen a dramatic repricing of value indexes, note this 30-year chart of the Russell Value versus Growth indexes on a total return basis.

This chart looks like a double bottom formed in 2020 and 2021 at similar points to the double bottom that occurred in 1999 and 2000. While this relative performance chart shows some reversal, the bounce for value versus growth in 2021 was even greater than what we saw over the last few weeks, while the 2022 bounce occurred in a shorter time frame.

Still, the last 15 years has been a steady march higher for growth indexes compared to value indexes.

Russell 1000 Value Index vs. Russell 1000 Growth Index

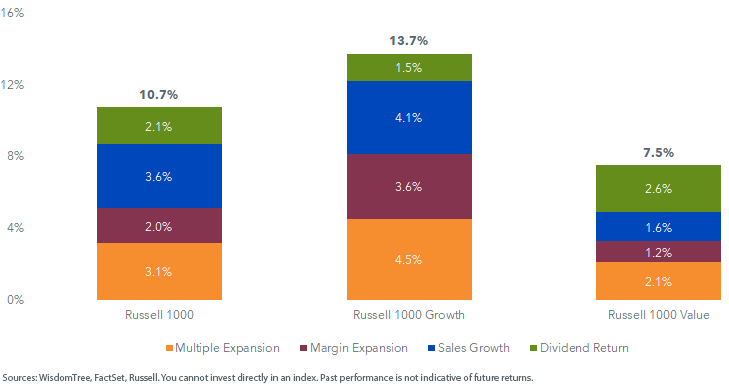

When we breakdown the drivers of performance over the past 15 years, we see the growth outperformance came from premium fundamental growth in sales and profit margins.

It was also driven by multiple expansion as the price-to-earnings multiples of growth stocks were propelled far higher than increases from its value counterpart.

One area where we saw greater contribution to return from value indexes was from the dividend return, where the value index had about an 111 basis points advantage.

With investors now focused on sky-high valuations in certain pockets of the market, growth stocks may be headed for multiple contraction in the coming years. This potential headwind could magnify the impact of the dividend return element of total returns, which is why we favor reasonably priced quality dividend growers in the current market environment.

Return Decomposition: 12-31/06—12/31/21

Important Risks Related to this Article

Please read the prospectus carefully before investing.

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.