Quality Dividend Growth: A European Portfolio’s Centerpiece

For much of the past decade, investing in Europe has been a challenge. The S&P 500 Index has outperformed the MSCI Europe Index more than 70% of the time over the past seven years when looking at monthly returns in U.S. dollar terms. During these outperforming months, the U.S. eclipsed Europe by an average of 3.8%.

But an investor intent on globally diversifying their portfolio cannot ignore an entire continent in the hope that U.S. outperformance will continue indefinitely. Even U.S. investors understand that international investing can provide access to new growth opportunities and may mitigate volatility if American markets begin to stumble.

But this prompts a difficult question: How does one invest in Europe without sinking money into a market that has historically lagged the U.S.?

A Quality Dividend Growth Approach

This year, we’ve written extensively about the benefits of a quality dividend growth investment framework. While much of our content has focused on applying this thesis throughout the U.S. and developed regions, we think there are still benefits to reap when you focus solely on Europe.

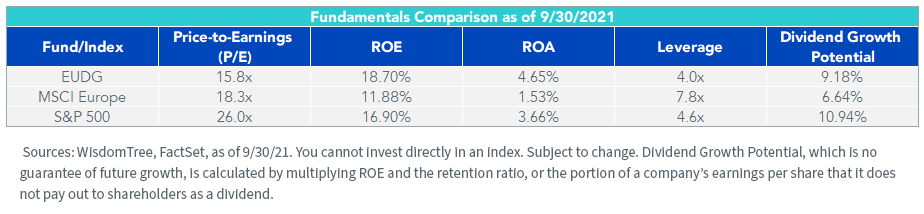

The WisdomTree Europe Quality Dividend Growth Fund (EUDG) was launched in May 2014 and seeks to combine the virtues of the quality factor with our roots in dividend investing. The Fund comprises 300 European equities scoring highest on a combination of quality and growth measurements, weighted by dividends. The quality score is based on three-year trends in return on equity (ROE) and return on assets (ROA), while the growth score assesses long-term earnings growth expectations.

The unique methodology results in an equity basket exhibiting high-quality characteristics: healthy balance sheets, efficient operations, lower leverage and the capability to generate strong returns from equity and asset bases.

The companies’ fundamental health also enables greater financial flexibility, including the ability to potentially raise dividends for shareholders. Quality measurements lend themselves well to dividend growth potential, since companies can profitably reinvest in their business (through high ROE) with the earnings that remain after paying a cash dividend.

In Europe, the methodology has delivered higher quality measures, as expected.

But it is also available at a 13% valuation discount to the region while Europe already tends to trade at a large discount to the U.S., partly because of a lack of high-quality companies. EUDG evidently improves on these measures at home, but also overshadows the U.S. market by allocating to the 300 highest quality stocks.

Sector Benefits

Sector Benefits

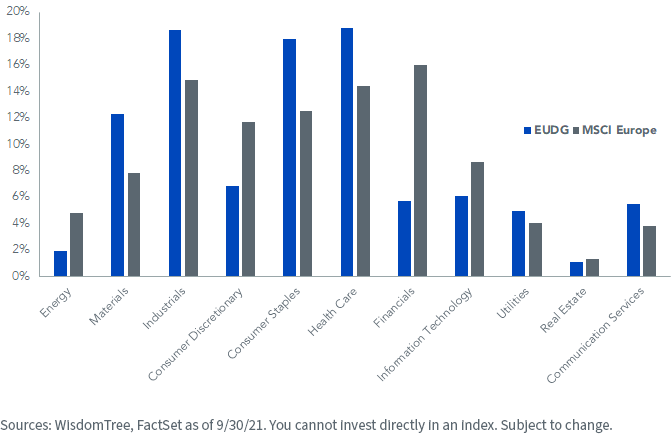

But quality and cheaper valuations are not the only benefits that EUDG seeks to deliver. It’s also an avenue to potentially access the newer growth opportunities in Europe.

Historically, the continent has been heavily constituted of old, stodgy industries, such as banking and broader Financials. The sector makes up 16% of the MSCI Europe Index, nearly three times more than its corresponding position in EUDG.

The latter also has an average 4.5% over-weight allocation to the Health Care, Consumer Staples, Industrials and Materials sectors, which collectively add some growth, cyclical and defensive positioning all at once.

Sector Comparison

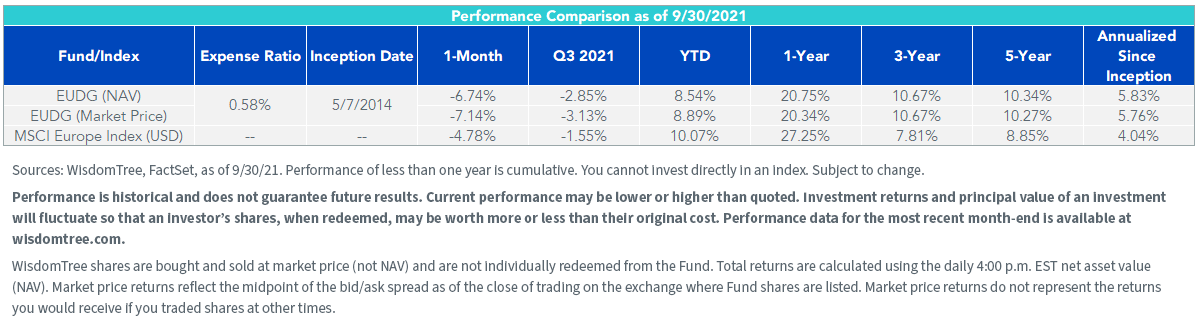

A European Strategy for the Long Term

We believe EUDG’s emphasis on quality has provided a compelling history of outperformance over the long term as well. The three-year, five-year and since-inception periods comfortably best the performance of the broader region.

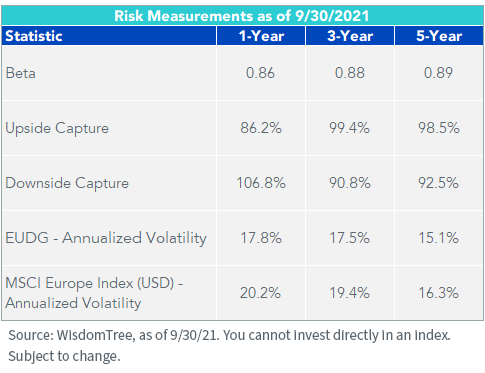

More impressively, EUDG achieved its longer-term success with a lower beta. It also captured virtually all of the MSCI Europe Index’s gains in up periods, while only absorbing about 90%–92% of its corresponding losses in down periods. That resulted in reduced volatility over the same timeframes.

More impressively, EUDG achieved its longer-term success with a lower beta. It also captured virtually all of the MSCI Europe Index’s gains in up periods, while only absorbing about 90%–92% of its corresponding losses in down periods. That resulted in reduced volatility over the same timeframes.

For definitions of terms in the chart please visit the glossary.

These measurements indicate that a quality dividend growth framework has the potential to outperform on both the upside and downside over a full market cycle. Likewise, it can potentially do so with less volatility and connection to the broader market if Europe continues to lag other regions.

All things considered, we believe that EUDG can be a centerpiece in investors’ portfolios.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in Europe, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Dividends are not guaranteed and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.