A Strategic Exposure to Emerging Markets

Emerging markets (EM) have struggled to find footing this year.

After a strong end to 2020, the asset class—which has become slightly growth-tilted in recent years—has been impacted by a value run-up, regulatory clampdown of technology companies in China and rising U.S. rates. All of this as U.S. markets continue to surge.

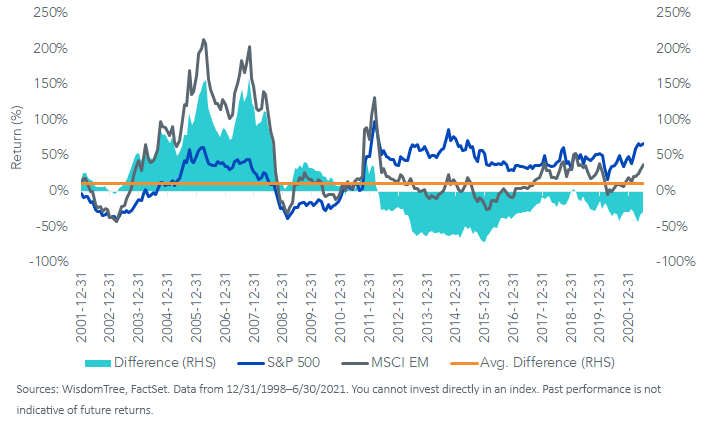

As seen below, the difference in trailing three-year returns between the S&P 500 Index and the MSCI EM Index is at levels not seen since 2016, and market cycles have shown that this difference tends to revert to the long-term mean (+10%). We therefore encourage investors to look for the best strategic exposure to EM for their portfolio.

Rolling 36-Month Return

Strategically Removing State-Owned Enterprises

The WisdomTree Emerging Markets ex-State-Owned Enterprises Index (EMXSOE), which excludes companies with significant government ownership, was designed to be a low tracking error/high-correlation portfolio as compared to the MSCI EM Index.

Trailing 12-Month Correlation

EMXSOE vs. MSCI EM Index

State-owned enterprises (SOEs) may be influenced by a broader set of national interests other than focusing solely on maximizing shareholder value. These conflicts of interest can cause stagnation in the long-term growth potential of these companies, which can result in operational inefficiencies and weaker levels of profitability. State-owned banks in China are a prime example of these other interests—they are often asked to extend loans to troubled companies in the name of “national service.”

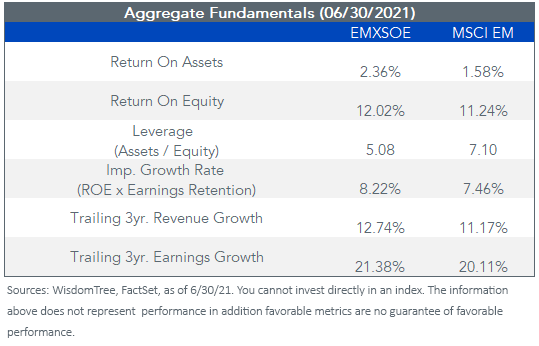

By removing SOEs, EMXSOE has higher profitability, lower leverage, and faster revenue and earnings growth rates than the MSCI Emerging Markets (EM) Index.

Removing SOEs, which tend to be concentrated in “old economy” sectors like Financials, Energy and Materials, results in EMXSOE having modest structural tilts toward “new economy” sectors like Information Technology, Consumer Discretionary and Communication Services.

New economy sectors may be better positioned to take advantage of a growing middle class and increased domestic consumption—trends we believe will persist into the future. Meanwhile, old economy sectors rely more on international growth and could be more prone to suffer from global trade and unfavorable currency moves.

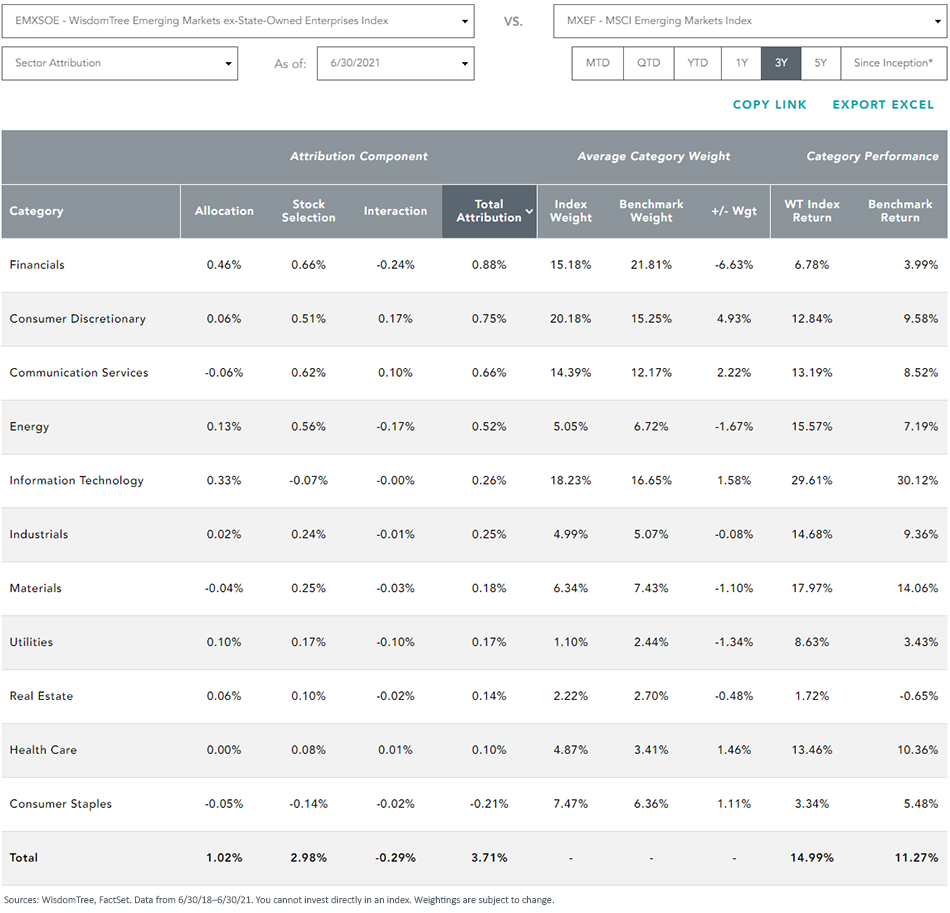

The table below, which comes from our performance attribution tool, highlights how, over the past three years, EMXSOE’s 3.71% annual outperformance versus MSCI has been driven by both the resulting sector exposures (Allocation column) and the SOE screen (shown as the Stock Selection component).

Better Quality = Better Performance

Excluding SOEs has caused EMXSOE to overweight more efficient companies, translating into better aggregate profitability.

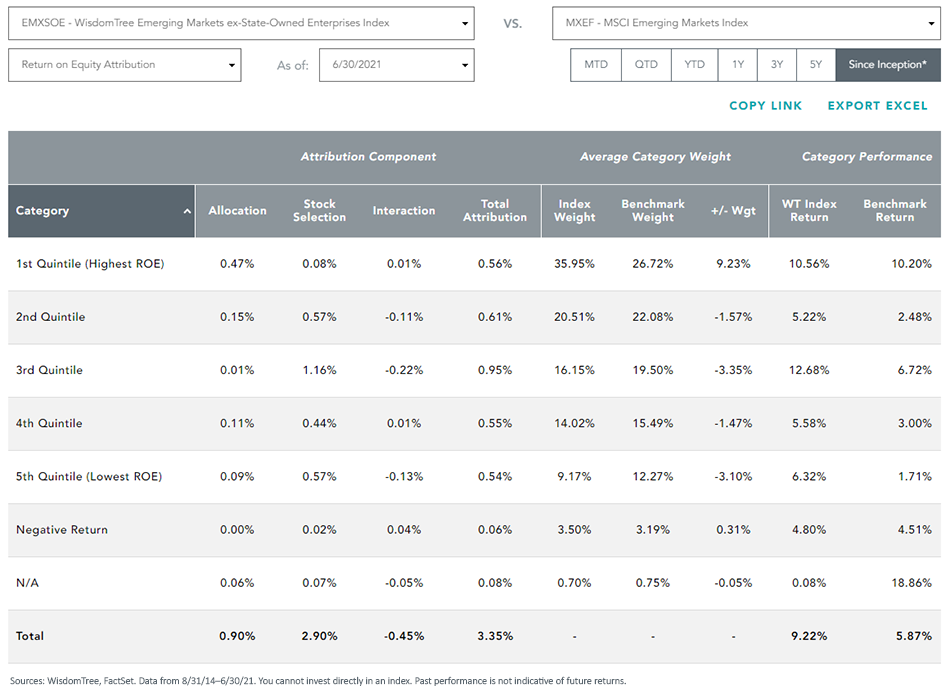

Since its inception in August 2014, we can see how EMXSOE’s persistent overweight to companies with higher ROE and underweight to less-profitable companies have significantly contributed to its 3.35% annualized outperformance.

Using the WisdomTree Emerging Markets ex-State-Owned Enterprise Fund (XSOE), which seeks to track EMXSOE, as the strategic EM holding within your portfolio can help on several levels.

XSOE seeks to provide investors with a broad exposure to the EM space, avoiding significant country and sector tilts and maintaining a high correlation to the MSCI EM Index.

XSOE seeks to have better aggregate quality (profitability) than the broad market and can help mitigate drawdowns.

XSOE seeks to achieve a balance between higher growth potential and reducing downside risk compared to the broad market.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.