Value and Quality: Balancing the Factors

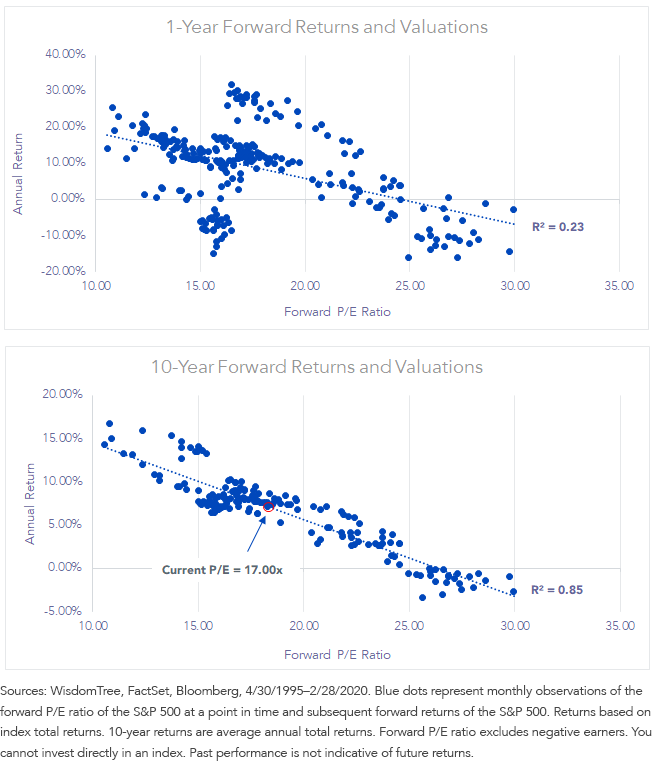

Starting valuations make a big difference when forecasting long-term equity index returns.

In the near term, not so much.

Take these charts of the S&P 500 Index. Intuitively, we know lower valuations tend to be associated with higher returns. Over 1-year return periods, the R2 between price-to-earnings (P/E) multiples and returns is a lackluster 0.23, but a remarkably convincing 0.85 for 10-year returns.

S&P 500 Index

For definitions of terms in the chart, please visit our glossary.

It’s important to note that U.S. valuations have come down significantly over the past two weeks, improving long-term forward earnings expectations. However, as analysts update earnings forecasts to reflect the negative impacts of the coronavirus, forward earnings multiples will likely be pushed up.

Tilting to Quality

Despite valuation’s correlation to long-term returns, many investors have shorter time horizons, where scouring for the least expensive market valuations may be of little use.

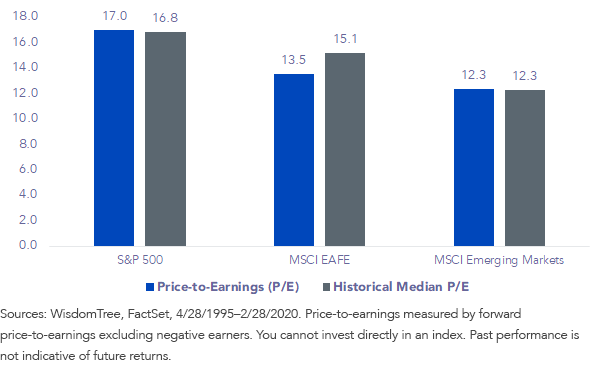

Given the backdrop of tepid growth outside the U.S.—or negative growth in major markets like China and Japan that have been more exposed to the coronavirus—broad index valuations are more attractive than in the U.S. These valuations support a case for over-weighting foreign equities, particularly developed international markets.

Index Valuations

But we believe more richly valued quality companies within these markets—those with higher earnings and less leverage—are likelier to outperform segments of the markets with the most depressed valuations, like European and Japanese banks, if a slower growth environment persists.

High-quality, sustainable dividend-payers make up a segment of the market that may fare well in a persistent low-growth, low-interest-rate environment outside the U.S. Given recent action and signaling by major global central banks, monetary policy looks likely to stay accommodative, making such companies relatively attractive.

WisdomTree’s family of international quality dividend growth ETFs targets dividend payers (approximately 300 securities) with high growth and profitability characteristics. Companies are then weighted by their cash dividends paid.

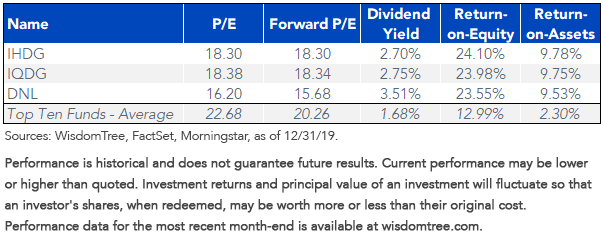

The table below illustrates the valuations of the WisdomTree Global ex-U.S. Quality Dividend Growth Fund (DNL), the WisdomTree International Quality Dividend Growth Fund (IQDG) and the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG) relative to the 10 largest mutual funds by assets in the Morningstar Foreign Large Growth Category.

(For a brief primer on the differences between ETFs and mutual funds, please click here.)

- IQDG and IHDG seek to track indexes with the same stock selection and weighting methodology for developed international equities. IHDG hedges the fluctuation of foreign currency returns.

- DNL utilizes a similar screening and weighting process for international developed and emerging markets companies.

Why do we compare these ETFs to active mutual funds?

These funds are defined as what WisdomTree terms Modern Alpha® ETFs: a rules-based approach to investing that seeks to combine the outperformance potential of active with the benefits of passive, such as daily transparency of holdings and usually lower expense ratios.

Unlike ETFs that track market-cap weighted indexes, these ETFs were created to have similar outperformance objectives as actively managed mutual funds.

As a result of their rules, these Funds have lower earnings-multiples and higher dividend yields, while also boasting significantly higher profitability (ROE and ROA) than the largest mutual funds.

Fundamentals vs. Top 10 Mutual Funds by Assets in Foreign Large Growth

For standardized performance of the Funds in the chart, please click their respective tickers: DNL, IQDG and IHDG.

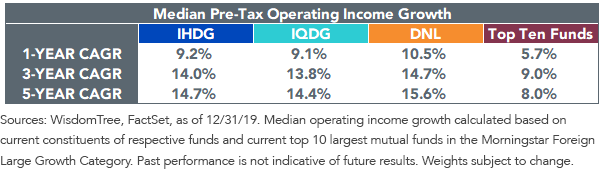

In the table below, we compare the same funds based on pre-tax operating income growth. In addition to the WisdomTree Funds’ higher profitability, this table shows their constituents also had faster compound annual growth rates (CAGR) in pre-tax operating profit.

For definitions of terms in the chart, please visit our glossary.

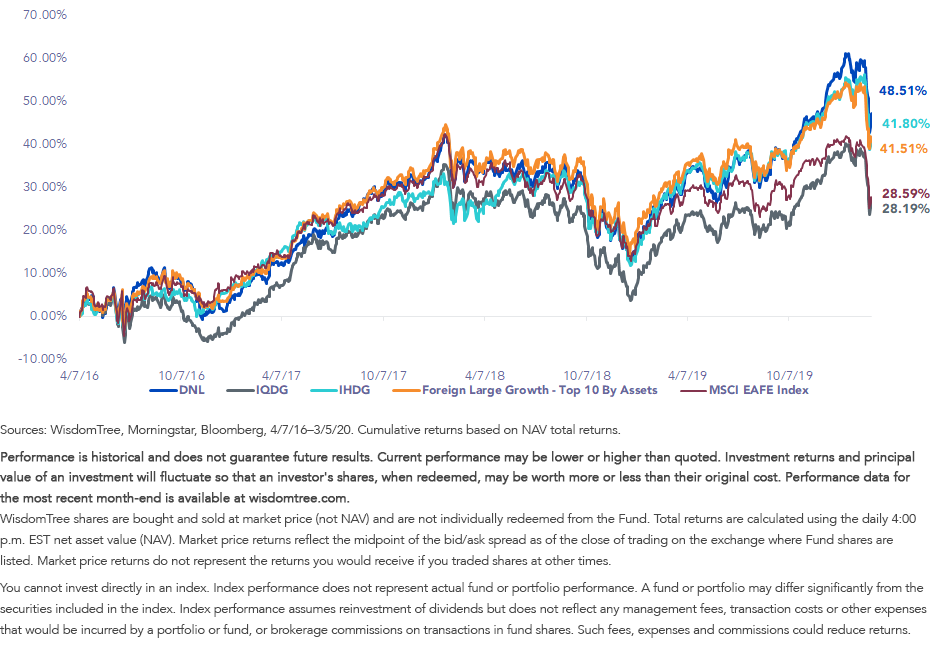

For a little more than three years1, DNL has been one of the best-performing funds in its category, outpacing the average returns of the ten largest mutual funds by assets by 700 basis points (bps) cumulatively. IHDG, which benefitted from a strengthening dollar environment, also bested this group by 29 bps2.

Performance vs. Average of Top 10 Mutual Funds in Morningstar Foreign Large Growth

We believe U.S. large-cap growth valuations have become increasingly stretched after a recent spell of outperformance. This backdrop has led many investors—WisdomTree included—to call for a mean-reversion period of outperformance for U.S. large-cap value. Valuations of foreign equities are more modest, but growth has similarly outperformed value for an extended period.

WisdomTree’s quality dividend growth methodology strikes a unique balance between screening for companies with premium profitability and growth, while also having a valuation discipline with dividend weighting.

While this methodology may cause these strategies to lag in a global reflationary environment, it also may strike a balance for investors—mitigating exposure to distressed European and Japanese banks that dominate most value funds, while also having discounted valuations relative to the largest foreign large growth funds.

1Time period chosen per standard look-back periods.

2All data points are at NAV

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent the Funds invest a significant portion of their assets in the securities of companies of a single country or region, they are likely to be impacted by the events or conditions affecting that country or region. Dividends are not guaranteed and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As these Funds can have a high concentration in some issuers, the Funds can be adversely impacted by changes affecting those issuers. The Funds invest in the securities included in, or representative of, their Indexes regardless of their investment merit and the Funds do not attempt to outperform their Indexes or take defensive positions in declining markets. Heightened sector exposure increases the Funds’ vulnerability to any single economic, regulatory or other development impacting that sector. This may result in greater share price volatility. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.