Two Strategies for One Emerging Markets Approach

We recently discussed the benefits of a dividend-weighted approach to investing in small-cap equities in emerging markets, relative to exposure weighted by market capitalization. These benefits include potential for:

- Higher long-term historical returns

- Lower volatility than large caps

- Higher current dividend income and lower valuations

We believe the WisdomTree Emerging Markets SmallCap Dividend Fund (DGS) can serve as one end of a barbell strategy for emerging markets that provides all these same characteristics.

The other end of the barbell would be a large-cap, higher-dividend strategy like the WisdomTree Emerging Markets High Dividend Fund (DEM).

We think this barbell approach can incorporate the best of both worlds among attractive factors.

Let’s dig in.

The Role of Dividends in Emerging Markets

We believe our emerging markets dividend approach offers a distinct advantage in terms of yield relative to the MSCI Emerging Markets Index. Both DGS and DEM have eclipsed the average dividend yield of the index by over 180 and 280 basis points (bps) over the last 10 years.

And this is a meaningful space for dividends. Both the MSCI Emerging Markets Mid Cap and MSCI Emerging Markets Small Cap Indexes have average payout ratios higher than any size segment of the U.S. equity market over the past 10 years, except for U.S. small caps (which have been magnified by high price-to-earnings multiples). They have even exceeded the ratios of the overall value segment of the U.S. market, which should naturally have a greater tilt toward dividend payers.

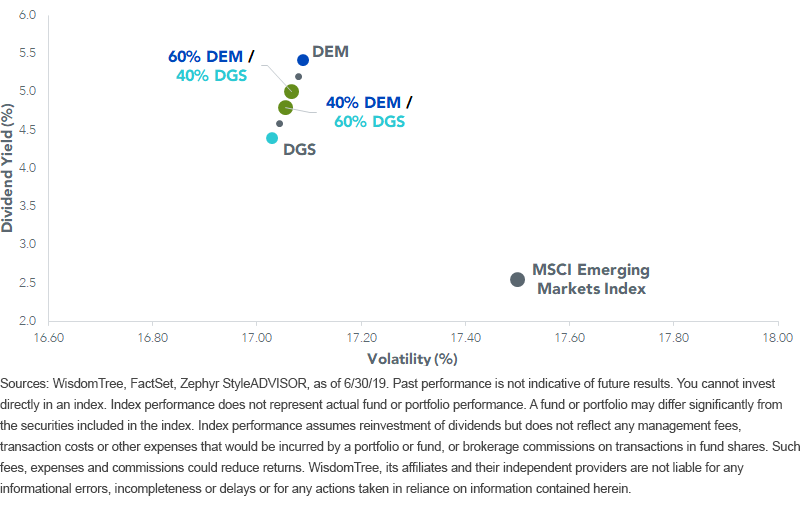

To understand the advantage of WisdomTree’s approach, let’s examine an efficient frontier. In modern portfolio theory (MPT), an efficient frontier is a method of illustrating the expected risk and return profile of different portfolios. Typically, investors would want a portfolio offering the highest possible return for a given level of risk.

A Modified Efficient Frontier—The DEM & DGS Barbell

Dividend Yield & Volatility Comparison: DEM & DGS vs. MSCI Emerging Markets Index

For standardized performance of the Funds in the chart, please click their respective tickers: DEM, DGS.

In the chart above, we modify the efficient frontier slightly, by replacing return on the Y-axis with 10-year average dividend yield in order to illustrate WisdomTree’s yield advantage over the MSCI Emerging Markets Index. The X-axis uses the 10-year standard deviation of returns as our measure of volatility.

The results are striking.

Not only did DGS and DEM offer more dividend yield historically, but they did so with considerably less volatility.

The riskiest portfolio (100% allocated to DEM) retained a 41 bps volatility cushion compared to the MSCI Emerging Markets Index, while the lowest-yielding portfolio (100% allocated to DGS) exhibited a 184 bps dividend yield advantage. Between these two extremes, the blended DEM/DGS portfolios also maintained the advantage in terms of volatility mitigation and yield potential.

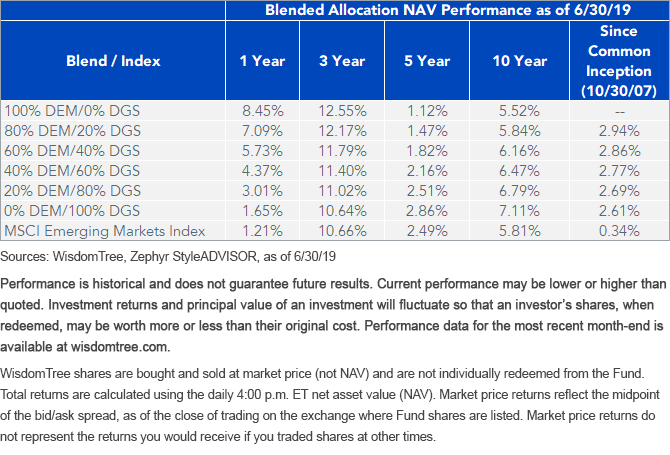

There were also fairly consistent return advantages over most periods. Below is a standard return combination of the blended portfolios. Most added over 200 bps per year over the longest common period.

Investing in emerging markets can have daunting levels of risk. Yet many investors continue putting their emerging markets allocation into one cap-weighted product, hoping it pays off without much damage.

At WisdomTree we do things differently. And we believe the method of putting all your eggs in one cap-weighted basket can often have painful consequences. Instead, we suggest that a diversified barbell blend of the WisdomTree Emerging Markets High Dividend Fund and WisdomTree Emerging Markets SmallCap Dividend Fund has the potential to give investors the yield, volatility mitigation and returns they are looking for.

Unless otherwise stated, data source is WisdomTree, FactSet, as of June 30, 2019.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of these Funds they may make higher capital gain distributions than other ETFs. Please read each Funds’ prospectus for specific details regarding the Funds’ risk profiles.

Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time.

Diversification does not eliminate the risk of experiencing investment losses.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.