Get the Most out of Emerging Markets

We’re halfway through 2019, but the past six months have probably felt more like a lifetime for investors amid the flurry of geopolitical headlines. While global equities largely recovered 2018’s losses to begin the year, the latter half of 2019 may prolong the existing uncertainty. Trade disputes, global economic growth concerns, central bank activity and whatever else the president can tweet in 280 characters or fewer will likely continue to fuel market activity in the near term.

Through the first six months of the year, emerging markets have lagged most developed markets. The MSCI Emerging Markets Index has gained about 10.5% through the end of June, but a large portion of these returns were front-loaded.

On one hand, the region entered the year with price-to-earnings and forward price-to-earnings valuations near three-year lows, suggesting the region was likely to have an enduring rally. On the other, we’ve seen emerging markets broadly up over 14% year-to-date in April, only to fall to just over 2% during May’s sell-off.

In light of this volatility, we believe a dividend-weighted approach to emerging market small-cap equities strikes an intriguing balance between return potential and volatility mitigation.

Why Emerging Market Small Caps?

The WisdomTree Emerging Markets SmallCap Dividend Index was introduced in 2007 to target some of the most generous dividend payers within emerging markets. Over the past 10 years, the MSCI Emerging Markets Small Cap Index had an average dividend payout ratio of nearly 45%,1 eclipsing the broader MSCI Emerging Markets Index by over 10%.

This suggests that small-cap companies in emerging markets, despite their growth profiles, are inclined to return their profits to investors in the form of dividends.

Additionally, when an index is weighted by a fundamental metric such as dividends, the result is a tilt toward value-oriented equities, which can double as a form of volatility management. For example, during the market sell-off this past May, WisdomTree’s Index provided nearly 160 basis points (bps) of downside protection versus broad emerging markets.

The Value of Value

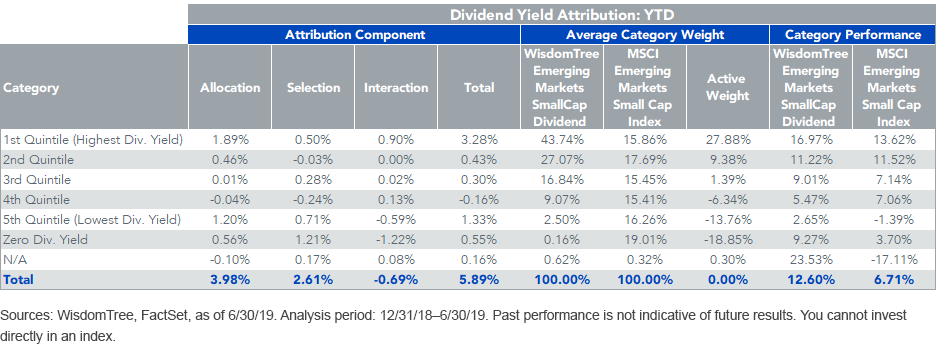

The returns from our approach speak for themselves. Year-to-date, the WisdomTree Index has amassed nearly 600 bps of outperformance relative to its MSCI small-cap counterpart, with 328 bps attributed to being 28% over-weight in the highest dividend-yielding equities. Remember, the higher-yielding companies simultaneously provide extra income at attractive prices, which helps magnify returns.

Looking deeper, we show that nearly 90% of the WisdomTree Index’s weight is consolidated into the top three quintiles ranked by dividend yield, and this allocation has resulted in two-thirds of the total year-to-date outperformance.

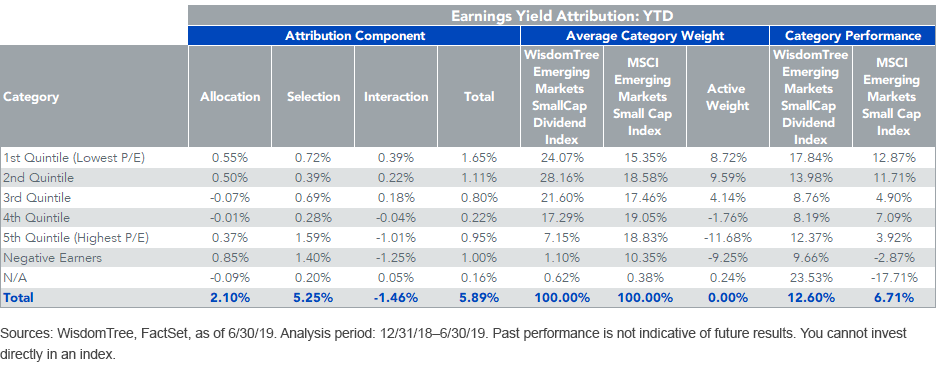

Dissecting outperformance further, the tilt to value is apparent if we analyze returns by earnings yield quintiles. In this framework, WisdomTree’s Index is almost 75% consolidated into the top three quintiles corresponding to low price-to-earnings (P/E) ratios, implying attractive valuations. This results in an over-weight greater than 20% to the MSCI Emerging Markets Small Cap Index, and the results are evident. Being over-weight in these top three quintiles explains 60% of the outperformance year-to-date.

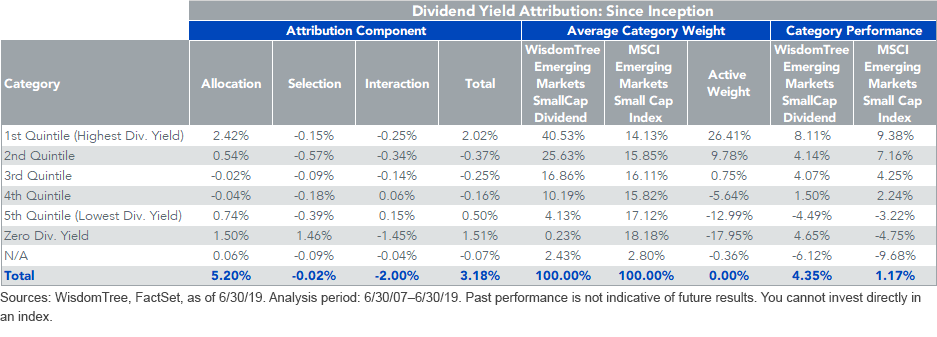

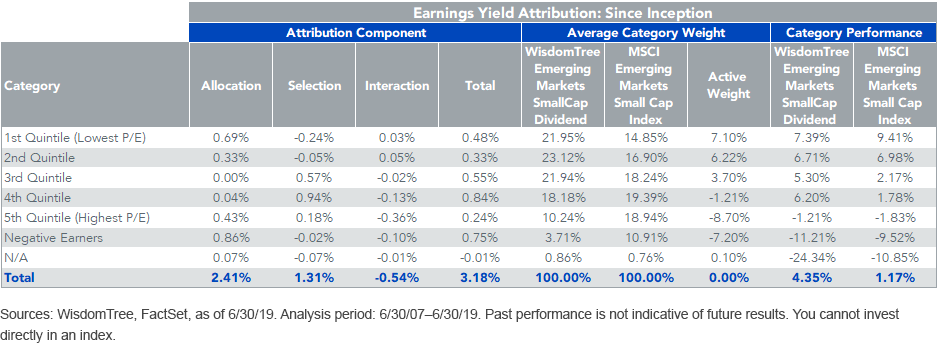

While the market environment over the past year has exhibited significant bouts of volatility, the success of the WisdomTree Emerging Markets SmallCap Dividend Index is not just a short-term anomaly. Extending our analysis back to the Index’s inception in 2007 shows that being over-weight in the highest dividend-yielding quintile of equities explains nearly half of the 318 bps of outperformance.

Similarly, being 17% over-weight in the top quintiles (exhibiting the lowest P/E multiples) explains a large portion of the outperformance. Likewise, being 17% under-weight in the bottom quintiles (exhibiting the highest P/E multiples, plus those with negative earnings) explains the rest.

How to Capitalize on the Emerging Markets Small-Cap Opportunity

While the success of a dividend-weighted approach to small-cap equities is apparent, the benefits also apply to broader emerging markets as well, where there’s naturally more exposure to larger companies along the size spectrum. WisdomTree’s Index has outpaced the conventional MSCI Emerging Markets Index over the past 3-, 5-, and 10-year periods as well, giving credence to dividend-oriented strategies in the developing world.

Emerging markets have the potential to offer investors much more than just diversified global exposure, including additional dividend income, volatility management and attractive valuations. While it is often difficult to find a comprehensive strategy that can help maximize this potential for investors, the WisdomTree Emerging Markets SmallCap Dividend Fund (DGS) may prove to be a favorable opportunity.

Unless otherwise stated, all data comes from Bloomberg as of June 30, 2019.

1Source: WisdomTree, FactSet, as of 6/30/19.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector and/or smaller companies generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.