Introducing the International Hedged Dividend Growth Index

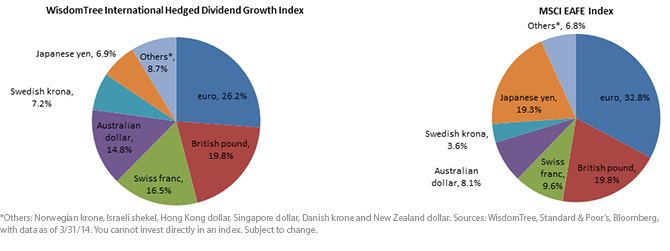

• Most Notable Difference—Yen Under-weight: When measured against the MSCI EAFE Index, the largest under-weight is the Japanese yen. Japanese firms, compared to the rest of the developed international equity landscape, tend to have lower ROE and ROA figures. A number of currency-hedged Japan strategies can blend in with this International Hedged Dividend Growth exposure to increase exposure to Japan if one has a more favorable outlook on Japan. As the ROE and ROA metrics improve, or earnings growth expectations rise, Japan’s weight can also increase in this index during subsequent annual index screenings over time.

• Cost of Hedging: An important element to consider is the ultimate cost of hedging, which can be estimated as the weighted average difference in short-term interest rates relative to the United States. For the WisdomTree International Hedged Dividend Growth Index, this figure is 0.51%, whereas for the MSCI EAFE Index it would be 0.25%. Both are relatively small numbers to remove a large source of additional volatility. Importantly, as central bank policies change, we believe this cost is likely to keep decreasing and may actually turn into a small positive in the near future if the U.S. raises short-term interest rates ahead of foreign central banks.

• The differentials in the cost to hedge the WisdomTree Index and the MSCI Index can be explained by the MSCI EAFE Index weight containing three times the exposure to the yen, a currency with a minimal cost to hedge.The other notable difference is the higher weight within the WisdomTree International Hedged Dividend Growth Index to Australia, which has a higher cost to hedge than some of the other developed markets.

Sector Allocation Differentials

The growth and quality selection factors emphasize companies that are employing less leverage to achieve their return on equity. This often results in an under-weight in financials and utilities, and this is true of this new WisdomTree dividend growth Index. Health Care, Consumer Discretionary and Consumer Staples stocks receive greater weights in this Index, as these sectors typically have higher return-on-equity and return-on-assets metrics.

Conclusion: Growth and Quality at a Reasonable Price

WisdomTree believes currency-hedged investment strategies are growing in prominence due to shifting policy winds among global central banks. We believe the new International Hedged Dividend Growth Index represents a potential marriage of growth and quality characteristics with this added currency-hedged feature. This type of exposure represents to us an attractive holding for core allocations to developed international stocks.

• Most Notable Difference—Yen Under-weight: When measured against the MSCI EAFE Index, the largest under-weight is the Japanese yen. Japanese firms, compared to the rest of the developed international equity landscape, tend to have lower ROE and ROA figures. A number of currency-hedged Japan strategies can blend in with this International Hedged Dividend Growth exposure to increase exposure to Japan if one has a more favorable outlook on Japan. As the ROE and ROA metrics improve, or earnings growth expectations rise, Japan’s weight can also increase in this index during subsequent annual index screenings over time.

• Cost of Hedging: An important element to consider is the ultimate cost of hedging, which can be estimated as the weighted average difference in short-term interest rates relative to the United States. For the WisdomTree International Hedged Dividend Growth Index, this figure is 0.51%, whereas for the MSCI EAFE Index it would be 0.25%. Both are relatively small numbers to remove a large source of additional volatility. Importantly, as central bank policies change, we believe this cost is likely to keep decreasing and may actually turn into a small positive in the near future if the U.S. raises short-term interest rates ahead of foreign central banks.

• The differentials in the cost to hedge the WisdomTree Index and the MSCI Index can be explained by the MSCI EAFE Index weight containing three times the exposure to the yen, a currency with a minimal cost to hedge.The other notable difference is the higher weight within the WisdomTree International Hedged Dividend Growth Index to Australia, which has a higher cost to hedge than some of the other developed markets.

Sector Allocation Differentials

The growth and quality selection factors emphasize companies that are employing less leverage to achieve their return on equity. This often results in an under-weight in financials and utilities, and this is true of this new WisdomTree dividend growth Index. Health Care, Consumer Discretionary and Consumer Staples stocks receive greater weights in this Index, as these sectors typically have higher return-on-equity and return-on-assets metrics.

Conclusion: Growth and Quality at a Reasonable Price

WisdomTree believes currency-hedged investment strategies are growing in prominence due to shifting policy winds among global central banks. We believe the new International Hedged Dividend Growth Index represents a potential marriage of growth and quality characteristics with this added currency-hedged feature. This type of exposure represents to us an attractive holding for core allocations to developed international stocks.

Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments focused in Europe or Japan may increase the impact of events and developments associated with those regions, which can adversely affect performance. Diversification does not eliminate the risk of experiencing investment losses.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.