Positioning for an Emerging Market Rebound

• Consumer Focus Helping: By design, WT Consumer Growth will have 60% of its weight split between the Consumer Discretionary and Consumer Staples sectors, thereby positioning with significant over-weights in these sectors compared to both EM Equities and WT EM Equity Income. Critically though, this WT Consumer Growth Index is not a “sector index”; it is broadly inclusive of companies from eight of ten sectors. It is just designed to remove companies that are most globally sensitive and not reflective of growth trends within emerging market economies.

o Special Note on Valuation: Despite focusing on a theme of growth and quality and reflecting growth trends within emerging market consumers, the WT Consumer Growth had a price-to-earnings (P/E) ratio of approximately 11.5x, compared with 10.8x for EM Equities. By contrast, the Consumer Staples in EM Equities has a P/E ratio over 20.0x.8 This is a testament to WisdomTree’s proprietary methodology while mitigating the risk of an expensive valuation.

• Complements WT Equity Income: WT Equity Income’s strategy, focusing on stocks with high dividend yields, has significant weights in state-owned enterprises—most notably Chinese financials and Russian energy firms. WT Consumer Growth, by virtue of its design, actually avoids these sectors:

o Energy Sector: Since we believe the Energy sector to be more globally sensitive and less a play on a growing emerging market consumer, it is excluded from WT Consumer Growth—meaning no exposure to Russian or Brazilian Energy stocks. The Materials sector is excluded for much the same reason.

o Large Banks: Large banks tend to be global economic actors rather than focusing on their local markets, and the largest Chinese banks are prime examples. WT EM Consumer excludes banks with more than $10 billion in market capitalization.

Conclusion: An Interesting Portfolio Approach

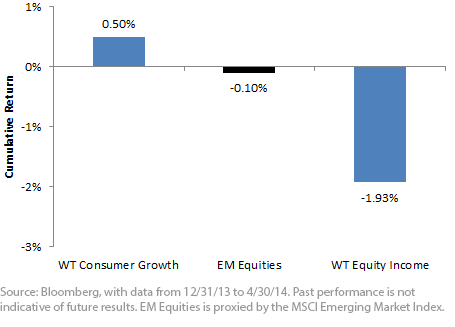

The reality is that, as India and Indonesia have been recovering to start 2014, Russian Energy stocks and Chinese Financials may lead an emerging market rebound in the future. It is hard to envision EM Equities rebounding without China turning the corner and performing more positively. But we think it’s interesting to consider just how complementary WT Consumer Growth and WT EM Equity Income actually are. As of April 30:

• Low Overlap in Common Constituents: There were 53 common constituents, with an 11.6% weight in WT EM Equity Income and a 21.8% weight in WT Consumer Growth. That is approximately 80% of the WT Consumer Growth is uniquely positioned in different stocks and sectors.9

• Energy & Materials: WT EM Equity Income’s two largest sector over-weights compared to EM Equities were Energy and Materials. WT Consumer Growth avoids these sectors, making a good pair in obtaining exposure to EM generally.

The emerging markets have been among the most battered of asset classes over last three to four years, especially when compared with the performance in the United States. As investors begin to look for unique opportunities to position for a rebound in EM equities, the WT Consumer Growth Index is one such set of unique exposure. 2014 is off to a relatively good start, and this could be the year when emerging markets begin to shine among the regional counterparts.

1Source:Bloomberg, as of 4/30/14

2Specific period:8/9/13 to 8/30/13

3Source:MSCI, with data from 12/31/13 to 4/30/14

4Source:Bloomberg, with data from 12/31/13 to 4/30/14

5Source:(whole bullet point): "Optimism about the Performance of the Indonesian Rupiah Rate in 2014," Indonesia Investments, 2/24/14

6Sources:Bloomberg for rupee's performance and MSCI for performance of India's equities. Period 12/31/13 to 4/30/14

7Source:Unni Krishnan, "India's Shrinking Current-Account Gap Reduces Risks to Rupee," Bloomberg, 12/3/13

8Source:for P/E ratio data: Bloomberg, as of 4/30/14

9Sources:WisdomTree, Standard & Poor's, as of 4/30/14

• Consumer Focus Helping: By design, WT Consumer Growth will have 60% of its weight split between the Consumer Discretionary and Consumer Staples sectors, thereby positioning with significant over-weights in these sectors compared to both EM Equities and WT EM Equity Income. Critically though, this WT Consumer Growth Index is not a “sector index”; it is broadly inclusive of companies from eight of ten sectors. It is just designed to remove companies that are most globally sensitive and not reflective of growth trends within emerging market economies.

o Special Note on Valuation: Despite focusing on a theme of growth and quality and reflecting growth trends within emerging market consumers, the WT Consumer Growth had a price-to-earnings (P/E) ratio of approximately 11.5x, compared with 10.8x for EM Equities. By contrast, the Consumer Staples in EM Equities has a P/E ratio over 20.0x.8 This is a testament to WisdomTree’s proprietary methodology while mitigating the risk of an expensive valuation.

• Complements WT Equity Income: WT Equity Income’s strategy, focusing on stocks with high dividend yields, has significant weights in state-owned enterprises—most notably Chinese financials and Russian energy firms. WT Consumer Growth, by virtue of its design, actually avoids these sectors:

o Energy Sector: Since we believe the Energy sector to be more globally sensitive and less a play on a growing emerging market consumer, it is excluded from WT Consumer Growth—meaning no exposure to Russian or Brazilian Energy stocks. The Materials sector is excluded for much the same reason.

o Large Banks: Large banks tend to be global economic actors rather than focusing on their local markets, and the largest Chinese banks are prime examples. WT EM Consumer excludes banks with more than $10 billion in market capitalization.

Conclusion: An Interesting Portfolio Approach

The reality is that, as India and Indonesia have been recovering to start 2014, Russian Energy stocks and Chinese Financials may lead an emerging market rebound in the future. It is hard to envision EM Equities rebounding without China turning the corner and performing more positively. But we think it’s interesting to consider just how complementary WT Consumer Growth and WT EM Equity Income actually are. As of April 30:

• Low Overlap in Common Constituents: There were 53 common constituents, with an 11.6% weight in WT EM Equity Income and a 21.8% weight in WT Consumer Growth. That is approximately 80% of the WT Consumer Growth is uniquely positioned in different stocks and sectors.9

• Energy & Materials: WT EM Equity Income’s two largest sector over-weights compared to EM Equities were Energy and Materials. WT Consumer Growth avoids these sectors, making a good pair in obtaining exposure to EM generally.

The emerging markets have been among the most battered of asset classes over last three to four years, especially when compared with the performance in the United States. As investors begin to look for unique opportunities to position for a rebound in EM equities, the WT Consumer Growth Index is one such set of unique exposure. 2014 is off to a relatively good start, and this could be the year when emerging markets begin to shine among the regional counterparts.

1Source:Bloomberg, as of 4/30/14

2Specific period:8/9/13 to 8/30/13

3Source:MSCI, with data from 12/31/13 to 4/30/14

4Source:Bloomberg, with data from 12/31/13 to 4/30/14

5Source:(whole bullet point): "Optimism about the Performance of the Indonesian Rupiah Rate in 2014," Indonesia Investments, 2/24/14

6Sources:Bloomberg for rupee's performance and MSCI for performance of India's equities. Period 12/31/13 to 4/30/14

7Source:Unni Krishnan, "India's Shrinking Current-Account Gap Reduces Risks to Rupee," Bloomberg, 12/3/13

8Source:for P/E ratio data: Bloomberg, as of 4/30/14

9Sources:WisdomTree, Standard & Poor's, as of 4/30/14Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. The recent growth in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.