An Update on Emerging Market Local Debt Positioning

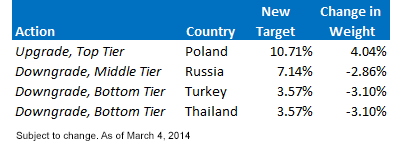

The Rationale Behind Allocation Changes

Poland: Upgraded to Top Tier

With nearly 43% of its export volume going to Germany, the United Kingdom, France and Italy, we believe Poland can directly benefit from a greater integration with Europe and a stronger Eurozone. Even though we have seen significant revisions to economic forecasts in the region, most analysts currently agree Poland will grow at the fastest rate of any emerging European economy (3.0%).2 Debt to Gross Domestic Product (GDP) continues to decline, while fiscal balances appear stable. With geopolitical risk in the region an ongoing concern, further integration into the European economy appears to be a key priority for the government and could result in additional upside surprises.

Russia: Downgraded to Middle Tier

Prolonged tensions with Ukraine and uncertainty around President Vladimir Putin’s political calculus are clear negatives for the Russian economy and foreign capital flows. However, while these political concerns may have tipped the balance, Russia’s economy was showing signs of slowing even before the current crisis developed. Russia’s once healthy current account surplus has faded from view and now represents a headwind deterring growth. Additionally, the emergency 1.5% rate hike by the Russian central bank to stem outflows will apply additional restraint on an economy already forecasted to grow at a less than 1% in 2014.3 However, as emerging market investors, we feel Russia is, in many respects, too large to ignore. With an economy of over $2 trillion—the sixth largest in the world—completely eliminating exposure to the ruble and its comparatively attractive level of carry can introduce its own element of risk.4 While a political solution remains in flux, we believe an underweight position to Russia appears prudent.

Turkey: Downgraded to Bottom Tier

While the central bank’s dramatic tightening in January provided some near-term relief, the Turkish economy continues to face significant external vulnerability from sticky inflation, a large current account deficit, dwindling foreign exchange (FX) reserves, and a sizable percentage of local debt held by foreign investors.5 This weak foundation is likely to be exacerbated by a volatile Turkish political climate. Favorable results for the ruling party in local elections on March 30 diffused some near-term tensions, but we fear that these tensions are likely to re-emerge before the presidential election in August. In fact, Prime Minister Recep Tayyip Erdoğan could feel emboldened by the results, and double down on policies that have materially weakened Turkey’s economy in recent years and distanced it from the capital markets. Additionally, while the move by the Turkish central bank did much to bolster its credibility, the highest borrowing rates across the emerging markets should have a direct impact on economic growth for Turkey.

Thailand: Downgraded to Bottom Tier

Thailand is in a fundamentally better position than Turkey, but cracks in a once vibrant economy are showing. The current account has been negative for the past two years and the gap between GDP growth and potential now ranks among the largest in Asia, excluding Japan.6 A challenging political situation could lead to further deterioration. On March 23, 2014, Thailand’s Constitutional Court ruled that the elections from February 2 were not valid. While active protests have largely subsided in Bangkok, previous protests have had a significant impact on the country’s tourism industry, which accounts for 9% – 15% of GDP.7 Even though protesters have limited their activities in the streets in the past few weeks, Thai Prime Minister Yingluck Shinawatra is now being forced to answer corruption and abuse-of-power charges from the country’s highest court, which could further cloud its outlook.

Brazil: No Tier Change

Standard & Poor’s decision to downgrade the sovereign rating of Brazil to BBB- on March 24, 2014, represents the first S&P downgrade experienced in ELD since its inception. However, we remain comfortable with the economic risks in Brazil (such as difficult growth environment and persistent inflation pressures) when balanced against its currency and income potential (12.7% for five year government debt).8 In fact, the market actually rallied on the announcement—on account of S&P’s stable outlook. While Brazil continues to face many economic headwinds, we remain somewhat positive that a rebound in growth could have a significant impact on asset levels.

Increasing Differentiation

In addition to the moves discussed, we remain comfortable with an underweight to South Africa in comparison to the performance benchmark. Over the past several months, we have been somewhat heartened that many of the potentially more vulnerable economies (Brazil, India and Indonesia) have taken proactive steps to stabilize their currencies, reduce their vulnerabilities and lay a foundation for future growth. Consequently, within the broader theme of differentiation among EM issuers, we are seeing an increased variety in those countries once categorized as vulnerable. We believe that investors will continue to look to Asia as well as Latin America over the next several months as ways to access opportunities in emerging markets. Absent a significant catalyst, we believe that the fundamental story in Asian growth and attractive carry in Latin America will attract a greater percentage of assets compared to slowing growth and geopolitical uncertainty in the Eastern Europe.

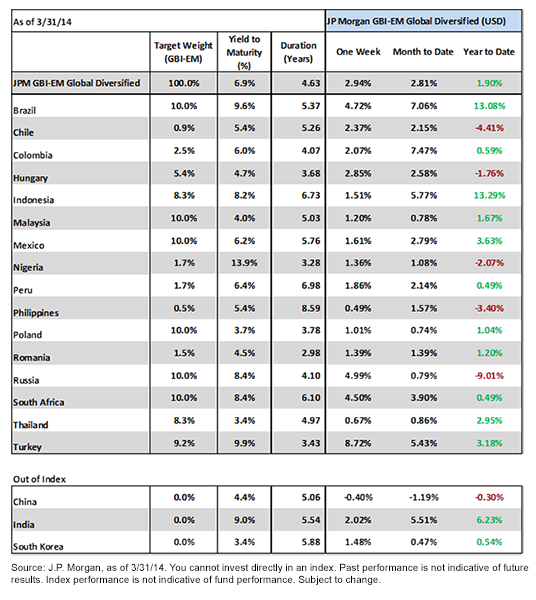

A Look at ELD’s Position Compared to the J.P. Morgan GBI-EM Global Diversified Index

• Overweight: Brazil, Chile, Colombia, Malaysia, Mexico, Peru, Philippines, Poland, Romania

• Underweight: Hungary, Nigeria, Russia, South Africa, Thailand, Turkey

• Out-of-Index Allocations: China, South Korea, India

Year-to-Date Performance Snapshot

The Rationale Behind Allocation Changes

Poland: Upgraded to Top Tier

With nearly 43% of its export volume going to Germany, the United Kingdom, France and Italy, we believe Poland can directly benefit from a greater integration with Europe and a stronger Eurozone. Even though we have seen significant revisions to economic forecasts in the region, most analysts currently agree Poland will grow at the fastest rate of any emerging European economy (3.0%).2 Debt to Gross Domestic Product (GDP) continues to decline, while fiscal balances appear stable. With geopolitical risk in the region an ongoing concern, further integration into the European economy appears to be a key priority for the government and could result in additional upside surprises.

Russia: Downgraded to Middle Tier

Prolonged tensions with Ukraine and uncertainty around President Vladimir Putin’s political calculus are clear negatives for the Russian economy and foreign capital flows. However, while these political concerns may have tipped the balance, Russia’s economy was showing signs of slowing even before the current crisis developed. Russia’s once healthy current account surplus has faded from view and now represents a headwind deterring growth. Additionally, the emergency 1.5% rate hike by the Russian central bank to stem outflows will apply additional restraint on an economy already forecasted to grow at a less than 1% in 2014.3 However, as emerging market investors, we feel Russia is, in many respects, too large to ignore. With an economy of over $2 trillion—the sixth largest in the world—completely eliminating exposure to the ruble and its comparatively attractive level of carry can introduce its own element of risk.4 While a political solution remains in flux, we believe an underweight position to Russia appears prudent.

Turkey: Downgraded to Bottom Tier

While the central bank’s dramatic tightening in January provided some near-term relief, the Turkish economy continues to face significant external vulnerability from sticky inflation, a large current account deficit, dwindling foreign exchange (FX) reserves, and a sizable percentage of local debt held by foreign investors.5 This weak foundation is likely to be exacerbated by a volatile Turkish political climate. Favorable results for the ruling party in local elections on March 30 diffused some near-term tensions, but we fear that these tensions are likely to re-emerge before the presidential election in August. In fact, Prime Minister Recep Tayyip Erdoğan could feel emboldened by the results, and double down on policies that have materially weakened Turkey’s economy in recent years and distanced it from the capital markets. Additionally, while the move by the Turkish central bank did much to bolster its credibility, the highest borrowing rates across the emerging markets should have a direct impact on economic growth for Turkey.

Thailand: Downgraded to Bottom Tier

Thailand is in a fundamentally better position than Turkey, but cracks in a once vibrant economy are showing. The current account has been negative for the past two years and the gap between GDP growth and potential now ranks among the largest in Asia, excluding Japan.6 A challenging political situation could lead to further deterioration. On March 23, 2014, Thailand’s Constitutional Court ruled that the elections from February 2 were not valid. While active protests have largely subsided in Bangkok, previous protests have had a significant impact on the country’s tourism industry, which accounts for 9% – 15% of GDP.7 Even though protesters have limited their activities in the streets in the past few weeks, Thai Prime Minister Yingluck Shinawatra is now being forced to answer corruption and abuse-of-power charges from the country’s highest court, which could further cloud its outlook.

Brazil: No Tier Change

Standard & Poor’s decision to downgrade the sovereign rating of Brazil to BBB- on March 24, 2014, represents the first S&P downgrade experienced in ELD since its inception. However, we remain comfortable with the economic risks in Brazil (such as difficult growth environment and persistent inflation pressures) when balanced against its currency and income potential (12.7% for five year government debt).8 In fact, the market actually rallied on the announcement—on account of S&P’s stable outlook. While Brazil continues to face many economic headwinds, we remain somewhat positive that a rebound in growth could have a significant impact on asset levels.

Increasing Differentiation

In addition to the moves discussed, we remain comfortable with an underweight to South Africa in comparison to the performance benchmark. Over the past several months, we have been somewhat heartened that many of the potentially more vulnerable economies (Brazil, India and Indonesia) have taken proactive steps to stabilize their currencies, reduce their vulnerabilities and lay a foundation for future growth. Consequently, within the broader theme of differentiation among EM issuers, we are seeing an increased variety in those countries once categorized as vulnerable. We believe that investors will continue to look to Asia as well as Latin America over the next several months as ways to access opportunities in emerging markets. Absent a significant catalyst, we believe that the fundamental story in Asian growth and attractive carry in Latin America will attract a greater percentage of assets compared to slowing growth and geopolitical uncertainty in the Eastern Europe.

A Look at ELD’s Position Compared to the J.P. Morgan GBI-EM Global Diversified Index

• Overweight: Brazil, Chile, Colombia, Malaysia, Mexico, Peru, Philippines, Poland, Romania

• Underweight: Hungary, Nigeria, Russia, South Africa, Thailand, Turkey

• Out-of-Index Allocations: China, South Korea, India

Year-to-Date Performance Snapshot

The Market Outlook

After strong performances for most emerging markets in February and March, analysts were concerned that—absent a catalyst or material pickup in EM growth—markets would not be able to sustain their recent rally. We believe that investors have been slowly moving back into emerging markets, as valuations appear cheap on an absolute and a relative basis. This resulted in a strong rally across emerging markets during the last week of March, pushing EM local debt into positive territory one of the only times this year. The rally in EM currencies (after a massive hike by the Turkish central bank on January 28) has also been encouraging.

However, there has been continued uneasiness concerning U.S. rates ticking higher once investors stop focusing on disappointing Q1 data and geopolitical risk. That said, there has been an interesting response from EM currencies since the hawkish tone of Janet Yellen’s first Federal Open Market Committee (FOMC) meeting. With a majority of EM currencies weaker over the last six months, markets were concerned the FOMC meeting could lead to inflationary pressures. However, inflation has been largely contained (notably in Brazil and India), providing strong support for currency and asset performance. More traders are starting to view the negative carry costs of shorting EM currencies as an increasingly difficult hurdle. This hasn’t necessarily translated into robust, sustained inflows back into EM assets, but less selling pressure has dampened headwinds, allowing for markets to rise.

Ultimately, after a rough patch of market volatility and headline risk, our outlook for EM assets remains much more positive than it does for many opportunities in developed markets. While volatility may reappear at any time, we believe that these fluctuations may ultimately lead to opportunity for intermediate and long-term investors.

1Source: J.P. Morgan, as of 3/31/14.

2Source: Bloomberg, as of 3/31/14.

3Source: Bloomberg, as of 3/31/14.

4Source: World Bank data (purchasing power parity terms), 07/13.

5Source: J.P. Morgan.

6Source: J.P. Morgan, 02/14.

7Source: Barclays.

8Source: WisdomTree, Bloomberg as of 3/31/14.

The Market Outlook

After strong performances for most emerging markets in February and March, analysts were concerned that—absent a catalyst or material pickup in EM growth—markets would not be able to sustain their recent rally. We believe that investors have been slowly moving back into emerging markets, as valuations appear cheap on an absolute and a relative basis. This resulted in a strong rally across emerging markets during the last week of March, pushing EM local debt into positive territory one of the only times this year. The rally in EM currencies (after a massive hike by the Turkish central bank on January 28) has also been encouraging.

However, there has been continued uneasiness concerning U.S. rates ticking higher once investors stop focusing on disappointing Q1 data and geopolitical risk. That said, there has been an interesting response from EM currencies since the hawkish tone of Janet Yellen’s first Federal Open Market Committee (FOMC) meeting. With a majority of EM currencies weaker over the last six months, markets were concerned the FOMC meeting could lead to inflationary pressures. However, inflation has been largely contained (notably in Brazil and India), providing strong support for currency and asset performance. More traders are starting to view the negative carry costs of shorting EM currencies as an increasingly difficult hurdle. This hasn’t necessarily translated into robust, sustained inflows back into EM assets, but less selling pressure has dampened headwinds, allowing for markets to rise.

Ultimately, after a rough patch of market volatility and headline risk, our outlook for EM assets remains much more positive than it does for many opportunities in developed markets. While volatility may reappear at any time, we believe that these fluctuations may ultimately lead to opportunity for intermediate and long-term investors.

1Source: J.P. Morgan, as of 3/31/14.

2Source: Bloomberg, as of 3/31/14.

3Source: Bloomberg, as of 3/31/14.

4Source: World Bank data (purchasing power parity terms), 07/13.

5Source: J.P. Morgan.

6Source: J.P. Morgan, 02/14.

7Source: Barclays.

8Source: WisdomTree, Bloomberg as of 3/31/14.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Unlike typical exchange-traded funds, there are no indexes that these Funds attempts to track or replicate. Thus, the ability of the Funds to achieve their objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see the Funds’ prospectus for specific details regarding the Funds’ risk profile. Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.