We Believe Equity Investing Is Alive and Well, Depending on Where You Look

Conventional wisdom says we are living in a fixed income world. Fear and uncertainty in the markets have crowded investors into areas of perceived safety, such as money market funds, U.S. Treasuries, investment-grade bonds and even cash.1 Despite an aging population’s need for income and capital appreciation, many say there is simply no appetite for stocks.

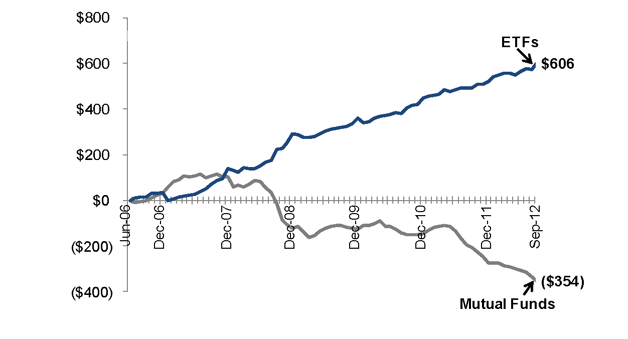

To be fair, these have been challenging and volatile markets for investors. And they have been lean years for the mutual fund industry. Over the last six years, mutual funds haven’t seen one net new dollar in equities. To the contrary, they have experienced $354 billion in equity outflows since 2006.2 No wonder the traditional mutual fund firms are hoping for brighter days.

Don’t call it a comeback.

Equity inflows may have slowed on a historical basis, but they never went away. Market prognosticators have been using an incomplete data set: While mutual funds saw outflows, the exchange-traded fund (ETF) industry saw $606 billion in equity inflows over this same period.3 From our inception as an ETF sponsor in June 2006 and in every year since, WisdomTree, and the ETF industry as a whole, has gathered net new assets in equities. Turns out, equity investing is alive and well, depending on where you look.

Tale of the tape: Cumulative Equity Net Inflows since June 2006

Sources: Investment Company Institute, Bloomberg, WisdomTree. Data as of September 30, 2012. Excludes exchange-traded notes, money market and hybrid funds4.

1Source: Popper, Nathaniel, “Investors Seek Out Safer Shores,” The New York Times, August 6, 2012. 2Sources: Investment Company Institute, Bloomberg, WisdomTree. 3Sources: Investment Company Institute, Bloomberg, WisdomTree.4Hybrid funds: A category of mutual fund that is characterized by portfolios that are made up of a mix of stocks and bonds, which can vary proportionally over time or remain fixed.