Year End Currency Performance and a Look Forward to 2013

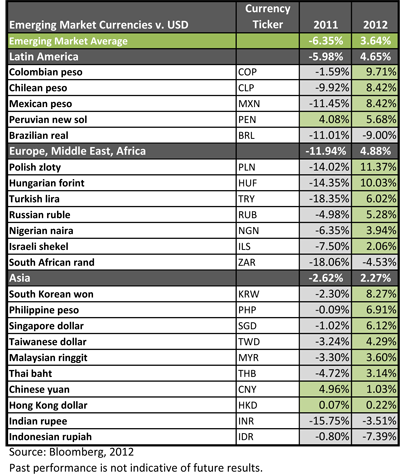

On average, investors with exposure to EM currencies were rewarded for taking more risk in 2012. In many instances, currencies that sold off the most in 2011 seemed to rally back at the fastest pace in 2012. Emerging markets in Europe, such as Hungary, rallied strongly after experiencing steep losses in 2011. While concerns about Europe are still in the back of investors’ minds, positive surprises in Europe in 2012 provided a constructive backdrop for currency appreciation in countries such as Poland, Turkey and Russia.

As a region, Asia saw its currencies appreciate at the slowest pace on average. However, a more subdued depreciation in 2011 meant that most Asian currencies have bounced back to levels seen at the end of 2010. Historically, Asian currencies have been less volatile than their Latin American or European counterparts. In uncertain market environments, this has been a benefit for investors. Many economists predict that Asian economies ex-Japan will grow at faster rates in 2013 than Latin America or Europe. Faster growth rates and increased economic output could provide a boost for their currencies in 2013.

Latin American currencies performed well in 2012, with the notable exception of the Brazilian real. After a series of interest rate cuts from 12.50% in September 2011 down to 7.25% in November 2012, the stimulus of the previous year could finally begin to have an effect on the Brazilian economy. Better-than-forecast economic growth could see the Brazilian real appreciate against the U.S. dollar in 2013. In Latin America, another currency poised to continue its upward trend in 2013 could be the Mexican peso. In an environment where the U.S. economy continues to grow at faster rates than developed economies in Europe, Mexico could continue to be a net beneficiary.

While currency movements can be the primary driver of investor returns in non-deliverable forward currency contracts, it is also worth highlighting that even though many emerging market central banks have cut interest rates to stimulate their economies, local interest rates still remain four times higher on average than in the United States. After an active 2012, we believe that the bulk of interest rate cuts in emerging markets have already occurred. For investors in locally denominated debt funds (WisdomTree Emerging Markets Local Debt Fund – ELD or WisdomTree Asia Local Debt Fund – ALD) or EM currency funds (WisdomTree Emerging Currency Fund – CEW)1, we expect returns from currency appreciation and interest income to be more balanced than in 2012.

In light of explicit pledges from developed market central banks to continue accommodative monetary policy, faster-growing economies such as emerging markets could be the net beneficiary in 2013, as investors shift to into higher-yielding, riskier assets. With EM central banks largely on hold, the absence of stimulus from them could remove a potential cause of currency weakness that dampened returns in 2012. For investors that are still underexposed to international currency and fixed income, 2013 could prove to be a great year for gaining exposure to faster-growing economies around the world.

1Although CEW invests in very short-term, investment grade instruments, the Fund is not a "money market" Fund and it is not the objective of the Fund to maintain a constant share price.

On average, investors with exposure to EM currencies were rewarded for taking more risk in 2012. In many instances, currencies that sold off the most in 2011 seemed to rally back at the fastest pace in 2012. Emerging markets in Europe, such as Hungary, rallied strongly after experiencing steep losses in 2011. While concerns about Europe are still in the back of investors’ minds, positive surprises in Europe in 2012 provided a constructive backdrop for currency appreciation in countries such as Poland, Turkey and Russia.

As a region, Asia saw its currencies appreciate at the slowest pace on average. However, a more subdued depreciation in 2011 meant that most Asian currencies have bounced back to levels seen at the end of 2010. Historically, Asian currencies have been less volatile than their Latin American or European counterparts. In uncertain market environments, this has been a benefit for investors. Many economists predict that Asian economies ex-Japan will grow at faster rates in 2013 than Latin America or Europe. Faster growth rates and increased economic output could provide a boost for their currencies in 2013.

Latin American currencies performed well in 2012, with the notable exception of the Brazilian real. After a series of interest rate cuts from 12.50% in September 2011 down to 7.25% in November 2012, the stimulus of the previous year could finally begin to have an effect on the Brazilian economy. Better-than-forecast economic growth could see the Brazilian real appreciate against the U.S. dollar in 2013. In Latin America, another currency poised to continue its upward trend in 2013 could be the Mexican peso. In an environment where the U.S. economy continues to grow at faster rates than developed economies in Europe, Mexico could continue to be a net beneficiary.

While currency movements can be the primary driver of investor returns in non-deliverable forward currency contracts, it is also worth highlighting that even though many emerging market central banks have cut interest rates to stimulate their economies, local interest rates still remain four times higher on average than in the United States. After an active 2012, we believe that the bulk of interest rate cuts in emerging markets have already occurred. For investors in locally denominated debt funds (WisdomTree Emerging Markets Local Debt Fund – ELD or WisdomTree Asia Local Debt Fund – ALD) or EM currency funds (WisdomTree Emerging Currency Fund – CEW)1, we expect returns from currency appreciation and interest income to be more balanced than in 2012.

In light of explicit pledges from developed market central banks to continue accommodative monetary policy, faster-growing economies such as emerging markets could be the net beneficiary in 2013, as investors shift to into higher-yielding, riskier assets. With EM central banks largely on hold, the absence of stimulus from them could remove a potential cause of currency weakness that dampened returns in 2012. For investors that are still underexposed to international currency and fixed income, 2013 could prove to be a great year for gaining exposure to faster-growing economies around the world.

1Although CEW invests in very short-term, investment grade instruments, the Fund is not a "money market" Fund and it is not the objective of the Fund to maintain a constant share price.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Funds focus their investments in specific regions or countries, thereby increasing the impact of events and developments associated with those regions or countries, which can adversely affect performance. Investments in emerging or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As these Funds can have a high concentration in some issuers, the Funds can be adversely impacted by changes affecting such issuers. Unlike typical exchange-traded funds, there are no indexes that the Funds attempt to track or replicate. Thus, the ability of the Funds to achieve their objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of these Funds, they may make higher capital gains distributions than other ETFs. Please read the Funds’ prospectuses for specific details regarding the Funds’ risk profiles.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.