ETFs FOR 401K PLANS

A Wise Way to 401(K)

ETFs offer a number of benefits that can make them effective for 401(k) investors. They provide diversification, low fees, intraday liquidity, transparency, and much more.* And, as WisdomTree ETFs are built differently, they also offer investors thoughtful innovation, smart engineering and redefined investments.

In fact, our ETF family covers everything from equities to fixed income, alternatives and currencies around the world.

CONTACT US

Our experienced 401(k) team can help you find a wise way to make ETFs part of your 401(k) business.

For more information, please call

1-866-909-WISE(9473).

Benefits of ETFs

As the 401(k) industry shifts its focus to cost and transparency, ETFs offer a number of benefits that can help address these needs.

Lower Fees

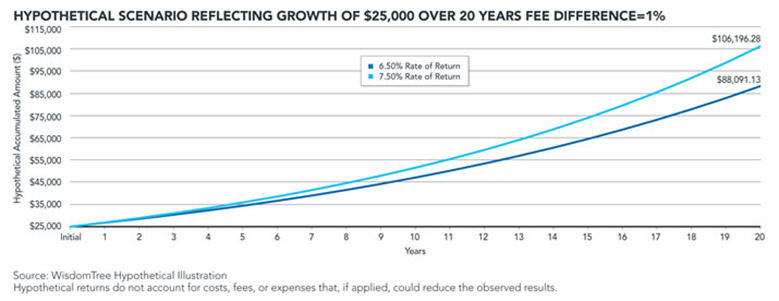

High fees may erode 401(k) plan performance. In fact, even a 1% difference in total fees can have a significant impact on participant savings—an effect that increases over time.

In the hypothetical illustration below, we show a higher fee versus a lower fee scenario, with average annual returns (avg. ann. returns) of 6.50% and 7.50% respectively on an initial investment of $25,000.

- Over the course of 20 years, a $25,000 investment with 6.5% returns will grow to about $88,091.13

- Over the course of 20 years, a $25,000 investment with 7.5% returns will grow to about $106,196.28

When you consider that retirement accounts can have a life of 30+ years, the impact of a seemingly small 1 percentage point difference in fees can truly be appreciated.

WisdomTree ETFs in a 401(k) Plan

ETFs when used within 401(k) portfolios offer several strengths that make them an effective long-term investment strategy. But not all ETFs are created equal. WisdomTree ETFs are built differently and offer benefits that may be attractive to retirement investors.

A Fundamental Difference

The vast majority of ETFs are market cap weighted1. So by design, they tend to hold more of a stock as its price is going up and less as it’s going down. We believe this has the potential to overweight overvalued stocks and underweight undervalued stocks, potentially exposing investors to higher risks and lower returns. WisdomTree weights securities in our equity Indexes by metrics of fundamental value like dividends or earnings, because we believe these are better indicators of a stock’s fiscal health than its price alone.

A Long-term Strategy

In addition, our dividend-based Funds offer the potential of lower volatility and income-generating yields. We believe our goal of capital preservation and reduced volatility makes WisdomTree ETFs a natural fit for most retirement investors.

*Ordinary brokerage commissions apply. Holdings are displayed daily on the website. Investors can buy - or sell - shares at any time throughout the day. Diversification does not eliminate the risk of experiencing investment losses.

1 12b-1 fee: An annual marketing or distribution fee on a mutual fund; this fee is considered an operational expense and is included in a fund’s expense ratio.

2 Omnibus basis: When transactions of two or more account holders are combined under one merchant account; the individual account holders' identities remain undisclosed.