WisdomTree And Currency Hedging

WHAT IS CURRENCY HEDGING?

International investing can provide many exciting opportunities for investors:

- The potential to go up when the U.S. market is down

- Exposure to different macro trends, opportunities—and risks

- The potential for higher returns given relative valuations

But these opportunities come with additional risks—one of the most significant of which can be fluctuations from currency risk. While currency can sometimes push equity returns higher, it can often pull returns down introducing a challenging source of uncertainty.

Currency hedging is a strategy designed to mitigate the impact of currency or foreign exchange (FX) risk on international investments returns. Popular methods for managing currency risk are forward contracts or FX options.

These tools enable investors to isolate local equity returns by mitigating the impact of FX.

WHY HEDGE CURRENCIES?

The ABCs of Currencies

Currency can be a headwind—or a tailwind

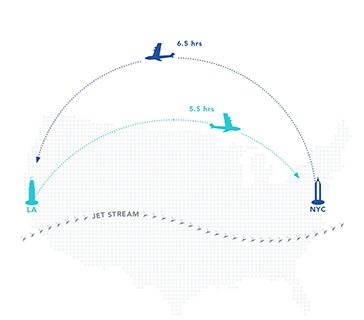

Imagine you’re on an airplane heading from New York to Los Angeles. The jet stream, which flows from west to east, is creating a headwind that slows down the airplane and makes the flight take about 6½ hours. Your return trip, however, will only take about 5½ hours, because the jet stream now acts as a tailwind that helps propel the plane forward. Currencies are exactly the same. Sometimes they are the tailwind helping push the security forward, and sometimes they are the headwind holding it back. But either way, they always make the ride more turbulent.

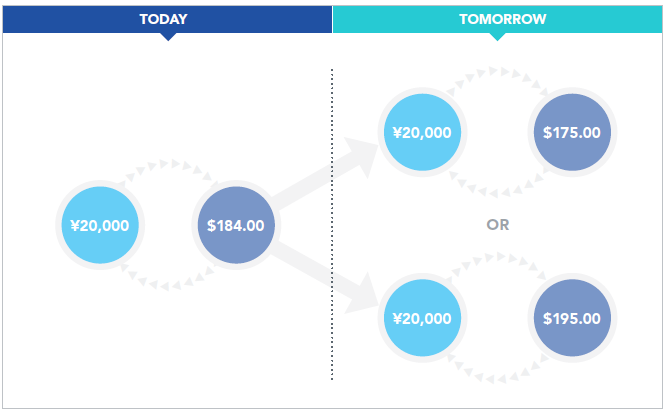

CURRENCY IMPACTS YOUR U.S. DOLLAR INVESTMENT

Even the most sophisticated investors can overlook how currency is affecting them if their investment is in U.S. dollars. If you’ve ever traveled abroad, you know that sometimes your dollar buys more, and the goods you purchase seem inexpensive—and sometimes the opposite is true. This is because of fluctuations in the strength of the dollar compared to the currency of the country where you are purchasing goods or making investments. These types of currency differences can impact the value of your investment over time.

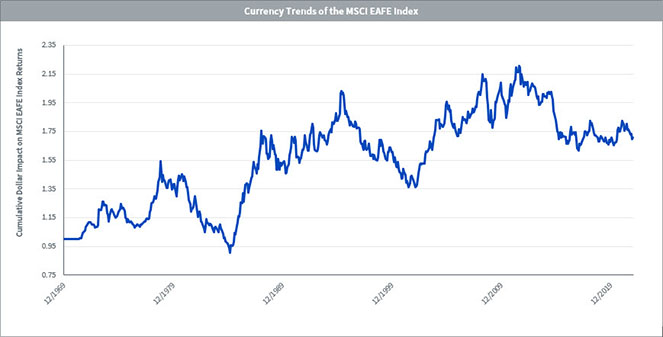

CURRENCY CAN BE HARD TO PREDICT

Because currency may move in waves, trending one way or the other, it can significantly impact your investments over certain periods. Predicting which way it will go, especially in the short term, is particularly challenging.

Sources: MSCI, WisdomTree, as of 12/31/22

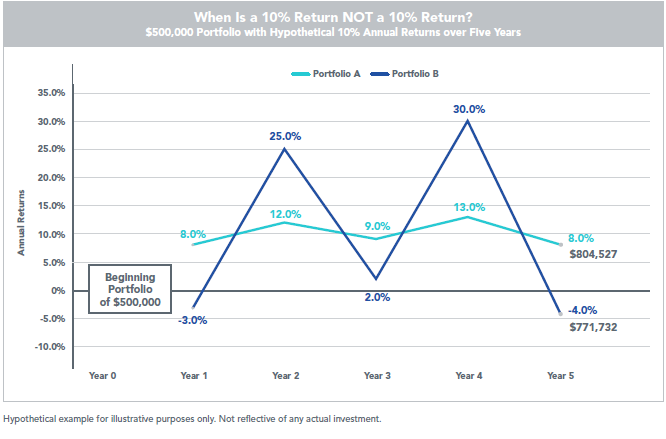

CURRENCY ADDS VOLATILITY — AND THAT CAN BE COSTLY

A portfolio's average annual returns are important—but they do not tell the full story. In the example below, portfolios A and B both start out with $500,000. Although it may not look like it, they both have average annual returns of 10%. After five years, however, portfolio A is worth just over $804,000, while portfolio B is worth less than $772,000. Why? Volatility.

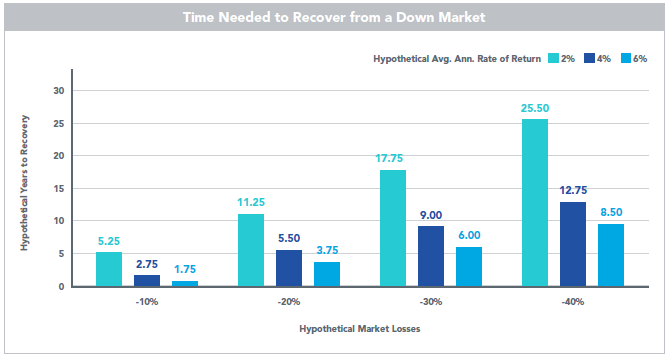

VOLATILITY CAN COST YOU TIME

Volatility can cost you not only money, but time as well. In fact, the more your portfolio drops, the higher a return you will need and the longer it could take to get you back to where you were. For example, a drop of 30% will take six years to recover from at 6% per year, nine years at 4%, or nearly 18 years at 2%. And that is simply to break even.

FULLY HEDGED EXPOSURE

Fully hedged ETFs are designed to mitigate the currency exposure from an investment, regardless of market conditions. While this may impact returns positively or negatively, it can reduce overall volatility—and that can be critical for portfolio values.

At WisdomTree, we have been implementing currency-hedging strategies in a way that may be simpler and more cost-effective than many investors expect.

Our full currency hedge works like this:

The WisdomTree currency-hedged equity family of Funds implements WisdomTree’s currency-hedging strategies by entering into one-month forward contracts each month and rebalancing at month-end.

WisdomTree CURRENCY HEDGED EQUITY FAMILY

EUROPE

Not only are many of the world's leading companies—and familiar brands—headquartered in Europe, but they are truly global companies that generate the bulk of their revenue from exporting to countries outside Europe. Our family of European hedged equity Funds seeks to offer investors a way to more fully access the return potential of European equities while hedging the effects of the currencies.

JAPAN

Asian investments can be a smart addition to a portfolio, and now may be an opportune time to consider Japan, as this country is undergoing exciting changes.

However, history has shown that in export-driven economies, the equities typically go up when the currency is going down. That can erode investors’ returns. Hedging the yen can help offset losses when the dollar appreciates.

DEVELOPED INTERNATIONAL

We believe international investments should have a place in every portfolio, and now may be an opportune time to consider them.

However, while valuations may look attractive outside the U.S., there is no guarantee that the U.S. dollar will depreciate. By hedging exposure to foreign currencies, investors are able to isolate the returns of foreign equity markets.

TODAY'S INVESTORS HAVE CHOICES

Today’s investors can offset currency risk with fully hedged ETFs, or they can attempt to opportunistically capitalize on it with dynamically hedged ETFs.

Full currency hedging is designed to mitigate currency exposure, helping reduce volatility and provide the equivalent of local returns. But what if you are interested in capitalizing on currency when it can help your returns? It can be very challenging for investors to determine when and how much to hedge.

Dynamic hedging seeks to address these challenges—using rules-based processes based on sophisticated signals to help determine the right time to hedge and how much to hedge.

DYNAMIC HEDGING

Dynamically hedged ETFs attempt to determine the best times for a portfolio to be hedged. Depending on market conditions and specific quantitative indicators, these strategies automatically dial the currency exposure up or down. This may provide investors with the potential to opportunistically capitalize on currencies when they may help returns—and to avoid them when they may not.

The WisdomTree dynamically hedged ETFs use rules-based methodologies and a proprietary signal overlay to determine the potentially best times (and amounts) to be hedged, or not to be hedged, automatically dialing the currency exposure up or down given specific signals.

FIVE SIGNALS WE BELIEVE CONTRIBUTE TO EXPLAINING CURRENCY TRENDS

| Indicator | Description | Hedges Currency If |

| Momentum | Similar to equity markets, currencies may be impacted by technical factors that lead them to appreciate or depreciate in the short-run | The foreign currency is experiencing a downward trend |

| Interest Rate Differential (aka "Carry") | The difference between the one-month forward interest rate of a foreign currency and the U.S. dollar | The interest rate of the foreign currency is lower than that of the U.S. dollar |

| Low Currency Risk | Lower volatility currencies tend to appreciate vs. the U.S. dollar | Hedge when currencies are very volatile |

| Cross Asset | Stock market returns of a country has some predictive power for currency movement | Hedge when expected currency returns are negative based on our cross asset model |

| Trend | Broad-based, regional factors in developed or emerging markets can impact the value of individual currencies | Hedge individual currency risk if a particular region (developed or emerging markets) are experiencing a downward trend |

When constructing a composite signal for hedging, the Trend signal has half the weight, while the other half were distributed equally among the rest of signals. For emerging markets, the Carry signal is not used.