How ETFs Work

Exchange-traded funds (ETFs) offer investors many exciting benefits, including lower fees, tax efficiency, no minimums and transparency. The creation process for ETFs—the way they work and are maintained—is an important part of the mechanism that allows for these benefits.

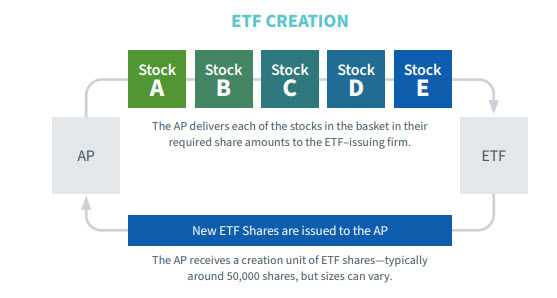

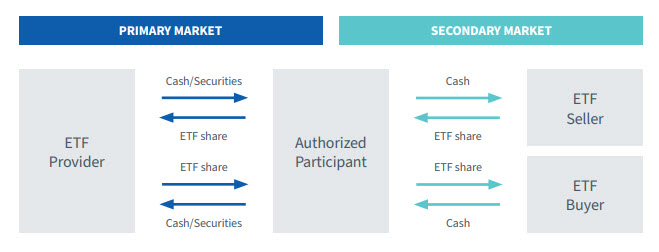

Before investors can trade shares of an ETF on the market, the shares are first created through an arrangement between the ETF sponsor and a party known as an authorized participant (AP). The AP is simply a large financial institution that has the ability to create and redeem shares with the ETF provider. Here’s how this works:

- An ETF sponsor decides to create a new fund.

- An authorized participant (AP) purchases the underlying securities then exchanges them for a large block of ETF shares of equal value in what is called an “in-kind” transfer. It is an “in-kind” transaction because the AP is exchanging the same exact securities with the same value; rather than exchanging for cash.

+ The block of shares is called a “creation unit” and usually equals between 25,000 and 200,000 shares.

- The AP sells those ETF shares to investors or market makers on an exchange.

- Investors buy and sell ETF shares on the market from other investors, the AP or market makers.

It is worth noting that an AP can also redeem ETF shares by executing this process in reverse. The AP does this by purchasing enough ETF shares to form a creation unit and redeeming them for the same value of underlying securities, thereby removing those ETF shares from the market. This can be an important mechanism for keeping share prices in line with value (learn more about arbitrage below).

Because of the way ETF shares are created, bought and sold, they have the potential for lower costs and fewer capital gains than mutual funds.

As mentioned above, an AP can sometimes create or redeem ETF shares in order to keep prices in line with NAV in a process called “arbitrage.” Why is this necessary?

Consider that if investor demand were to drive up the price of ETF shares to the point where the price exceeds the value of the underlying securities, an AP can flood the market with additional shares through a creation unit. In this way, the price per share could fall back in line with the fund’s net asset value (NAV). Of course, if the ETF shares are selling at a great discount, an AP can buy up shares and remove them from the market to help push the share price back up.

This process of arbitrage helps balance out supply and demand pressures over time and generally keeps the ETF’s market price at or near NAV.

The efficiency of the creation mechanism can benefit ETF investors in other ways as well. In a mutual fund, when investors purchase or redeem shares from the fund, the mutual fund is forced to buy or sell securities on the market to meet investor demands. This can result in:

+ Trading fees and commissions

+ Capital gains and other tax consequences for all shareholders

And these can both affect returns. With ETFs, however, when an investor purchases or sells shares:

+ The fund does not necessarily have to sell underlying securities.

+ You do not pay costs associated with their trade.

+ There are generally no capital gains tax consequences for you.

It is also worth noting that mutual funds often hold cash in reserves to meet fund redemptions. Because ETFs do not need to do this, all fund assets can be fully invested. This may help enhance returns—giving ETFs another advantage over mutual funds.

Contact Us

For general inquiries including questions about our website and online registration.

For U.S. investors only, call 1-866-909-WISE (9473) to speak to a representative. Representatives are available from 9 a.m.—5:30 p.m. ET, Monday—Friday.

Please forward correspondence to:

WisdomTree, Inc.250 West 34th St, 3rd Floor

New York, NY 10119

Note: Investors can obtain fund information, including a prospectus, by visiting the Resource Library.