Gold Breaks New Highs. Will Miners Follow Suit?

Gold prices have reached new highs, with front-month futures hitting US$2,203/oz (March 8, 2024).1 The rally is supported by a sharp rise in speculative long positioning in gold futures markets, marking a positive shift in sentiment following months of decline. This rally has had a quick ascent. Neither Treasury Inflation-Protected Securities (TIPS) nor silver or gold miners have kept up over the past three months. These assets are usually strongly correlated with gold, but the speed of gold’s recent moves left these other related assets behind.

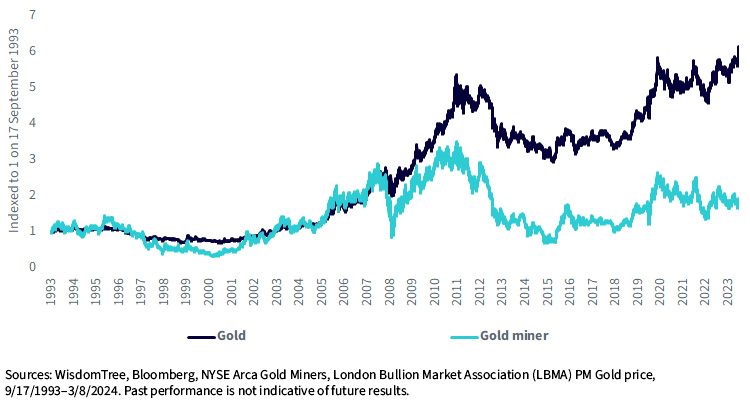

We believe there is catch-up potential. Gold miners have lagged behind gold bullion since their significant drawdown during the global financial crisis of 2008 and 2009 and have largely shown practically no gains over the last two decades. Yet, recently, they have shown signs of performing better: over one-month trailing returns to March 8, 2024, miners are up 8.8% versus 7.0% for gold.

Figure 1: Gold vs. Gold Miners Back to 1993

Hedge Funds Are Buying Gold Miners

Hedge funds have started to pay attention. Fund managers like Stanley Druckenmiller (of Duquesne Family Office) are reported in their latest 13F filings to have been buying gold miners like Barrick Gold and Newmont, moving away from technology firms like Amazon and Alibaba.2

Gold Rally Should Drive Miner Profitability Higher

Analysts have pointed to declining ore grades, more difficult operating conditions—including higher labor and energy costs—and less geopolitical stability as some of the reasons that miners have struggled in the recent past.

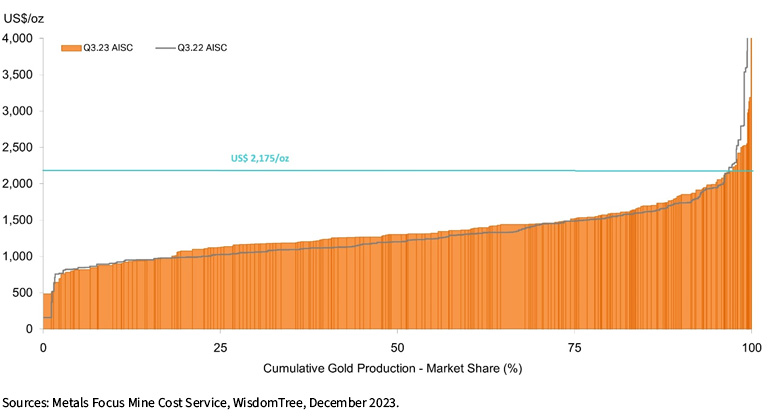

However, the profitability of gold miners will increase substantially. Using Metals Focus’s All-in-Sustaining Costs (AISC)3 curve, we estimate more than 95% of global gold production is profitable at current prices. And at the 50th percentile, we could have miners with greater than US$700/oz AISC margin. If current gold prices are sustained, we believe that gold miners could see substantial improvements to margins. Moreover, current prices should encourage mine expansion, adding volume to current operations.

Figure 2: Gold Miners’ All-in-Sustaining Costs Curve

Consolidation and Share Buybacks

The drift between gold prices and miners may also drive consolidation in the industry as miners seek to become more operationally efficient. Last year, Newmont announced the purchase of Newcrest.

Harmony Gold CEO Peter Steenkamp told Reuters, “I think it’s going to be inevitable that there will be some sort of consolidation, because exploration has been lacking for such a long time and for people to replace assets they will have to look at what their neighbors have and what the opportunities will be.”4

In January 2024, Perseus Mining announced a takeover bid for Silvercorp.5 Small- to medium-sized miners are likely to be deal-making targets.

Miners may also seek to make buybacks to use surplus cash. Kinross Gold, under pressure from activist investor Elliott Management, has done precisely that, and its stock has rallied 47% in the past year (March 13, 2013, to March 12, 2024).6

WisdomTree Solutions

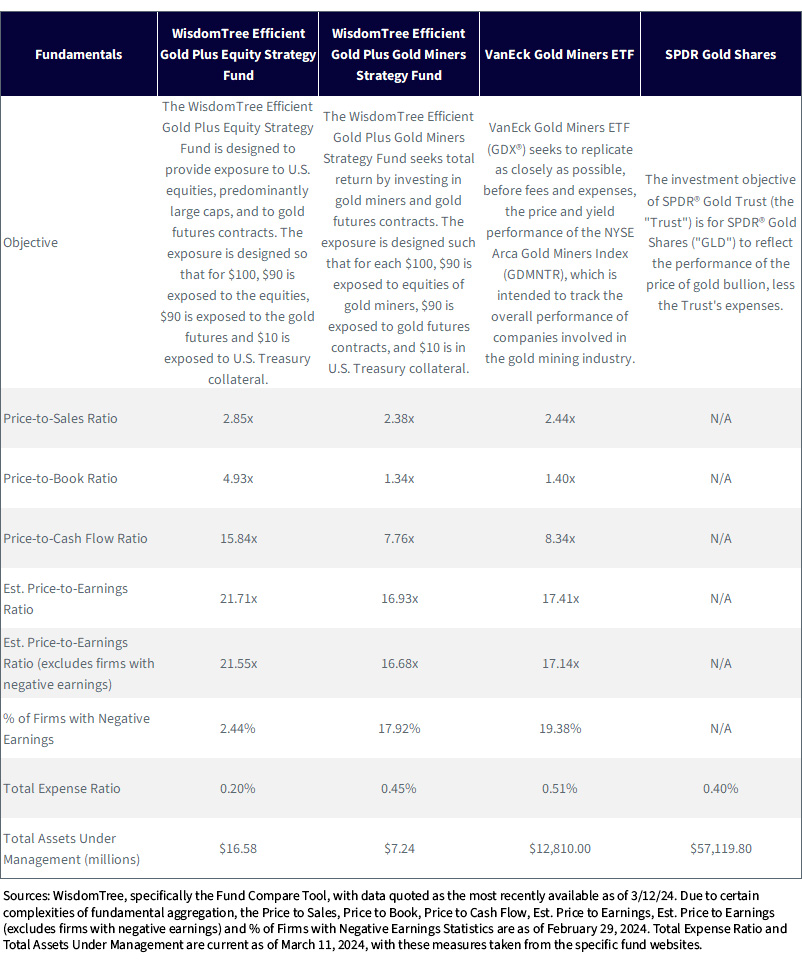

WisdomTree offers gold-related “efficient-core” solutions to help bring gold into a portfolio and provider greater portfolio diversification without sacrificing other slots in a total portfolio pie.

Efficient-core solutions tied to gold offer exposure to an equity benchmark and add gold futures on a leveraged basis. Because the gold exposure is leveraged, a $100 exposure to the strategy can give you $90 exposure to the specific equities, $90 exposure to gold futures and $10 cash collateral (earning rates comparable to U.S. Treasury bills).

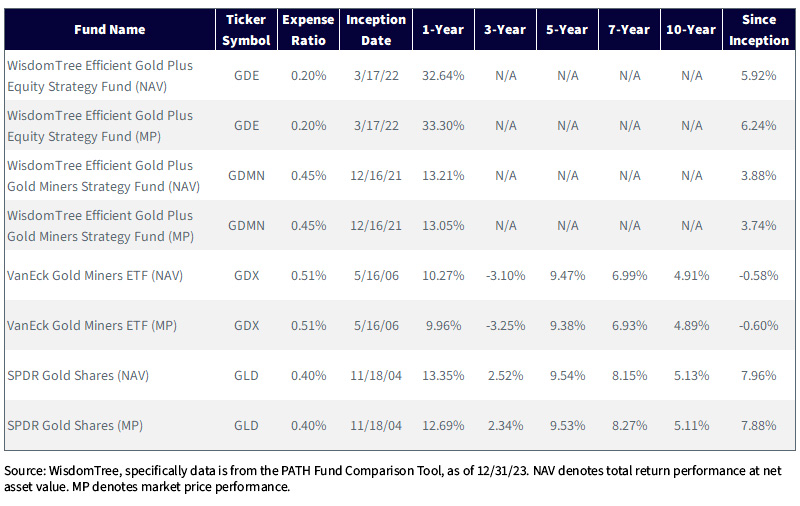

WisdomTree offers two efficient-core strategies with gold: one with an exposure to broad U.S. equities (WisdomTree Efficient Gold Plus Equity Strategy Fund, GDE) and the other with an exposure to gold miners (WisdomTree Efficient Gold Plus Gold Miners Strategy Fund, GDMN). With gold and broad equities both rallying, the case for GDE has been compelling for some time.

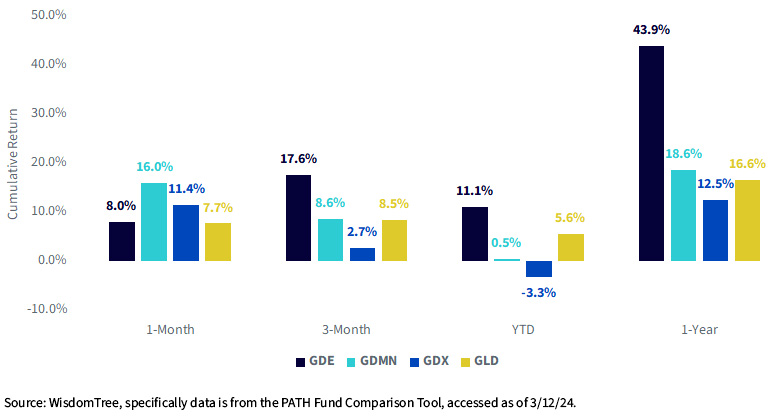

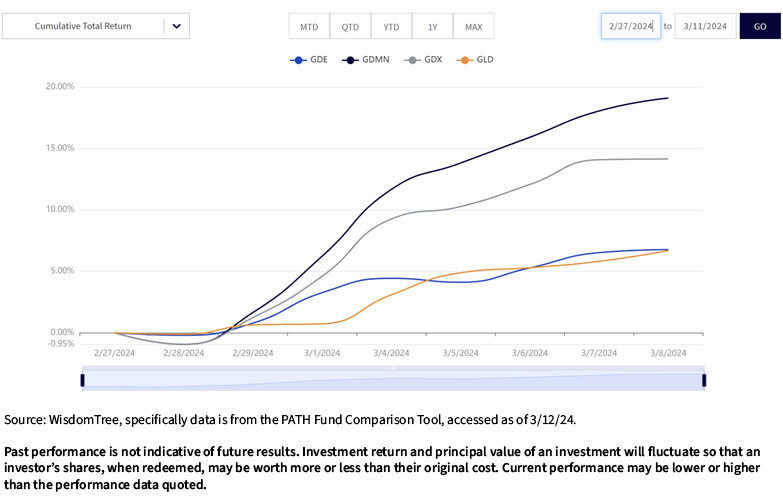

With miners now at an exciting inflection point, we believe it is time to think about GDMN. The Fund has risen almost 20% between February 27, 2024, and March 11, 2024, playing off both gold and gold miner rallies, which we will see in figure 3c.

Clearly, gold’s price has appreciated, but the metal has diverged from the miners for the last two decades. Many allocate to both individually, and GDMN allows an efficient package of both in one.

In figures 3a and 3b, we showcase some of the performance of both GDE and GDMN, compared to the following:

- VanEck Gold Miners ETF (GDX): This has been the largest ETF in the space. GDMN is a different exposure, as we explained, which has a .90 beta exposure to those related equities but adds the .90 beta to gold futures as well.

- SPDR Gold Shares (GLD): GLD is the largest strategy providing exposure to physical gold. This helps show how the straight equities and combo with gold futures compare to the physical metal.

When we are thinking about miners (GDX), capital-efficient gold plus miners (GDMN) and capital-efficient gold plus equities (GDE), it’s important to bring the discussion back to how these exposures compare to that of the price of gold.

Figure 3a: Standardized Performance Comparison

Figure 3b: Gauging the Recent Inflection, with Data as of 3/11/24

Figure 3c: The Recent Miner Rally from February 27, 2024, to March 11, 2024

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: GDE, GDMN, GDX, GLD

When Considering Equities, One Cannot Forget the Fundamentals

While short-term momentum can be nice and “confidence-inspiring,” it’s important to also look under the hood to note the fundamentals. A short-term rally supported by fundamentals has a better chance of sustaining into the medium or even longer term.

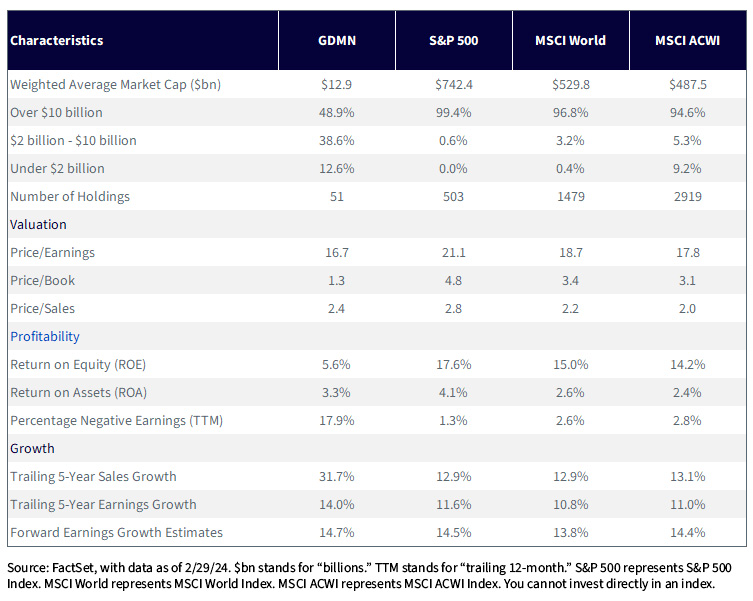

Looking at figure 4, we see:

- GDMN's gold mining stocks have a substantially lower price/earnings and price/book ratio, particularly gauged against the S&P 500 Index.

- GDMN's gold mining stocks will likely never look as strong on a return-on-equity or profitability basis. With the current exposures of the world’s largest companies in the S&P 500, MSCI World and MSCI ACWI Indexes, it would be tough to see mining stocks competing on a profitability basis.

- GDMN's trailing sales growth, trailing earnings growth and forward earnings growth estimates look very strong against even the tech-heavy S&P 500. The forward estimates may not even account for the record-high gold prices increasing the profitability of these companies. If share prices respond to these fundamentals, it could signal a noteworthy opportunity.

Figure 4: GDMN’s Gold Mining Stocks on a Fundamental Basis against Major Equity Benchmarks (as of 2/29/24)

Figure 5: Important Information Regarding Funds within This Report

If you are interested in diving more into the comparison of these Funds, please check out our Fund Comparison Tool.

1 Source: Bloomberg.

2 "DUQUESNE FAMILY OFFICE LLC", Whale Wisdom, https://whalewisdom.com/filer/duquesne-family-office-llc

3 All-in sustaining costs is a non-GAAP (generally accepted accounting principles) metric introduced in 2013 and adopted by most gold miners. It provides a comparable metric that reflects as closely as possible the full cost of producing and selling an ounce of gold. The “sustaining” nature of the metric includes both operating and capital expenditure. The cost curve recognizes that each mine has a different cost structure. The volume of gold production can be read across the horizontal axis, and production is ordered from lowest to highest cost producer.

4 Source: Nelson Banya, “Harmony Gold CEO says gold sector consolidation ‘inevitable,’” Reuters, 3/1/23.

5 Source: "Perseus Mining announces intention to make takeover bid for OreCorp Ltd", Globe Newswire, https://www.globenewswire.com/news-release/2024/01/22/2812645/0/en/Perseus-Mining-announces-intention-to-make-takeover-bid-for-OreCorp-Ltd.html

6 Source: Bloomberg.

Important Risks Related to this Article

Nitesh Shah is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

For current Fund holdings, please click the respective ticker: GDE, GDMN. Holdings are subject to risk and change.

GDE: There are risks associated with investing, including the possible loss of principal. The Fund is actively managed and invests in U.S.-listed gold futures and U.S. equity securities. The Fund’s use of U.S.-listed gold futures contracts will give rise to leverage, magnifying gains and losses and causing the Fund to be more volatile than if it had not been leveraged. Moreover, the price movements in gold and gold futures contracts may fluctuate quickly and dramatically and have a historically low correlation with the returns of the stock and bond markets. U.S. equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Fund’s investment strategy will also require it to redeem shares for cash or to otherwise include cash as part of its redemption proceeds, which may cause the Fund to recognize capital gains. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

GDMN: There are risks associated with investing, including the possible loss of principal. The Fund is actively managed and invests in U.S.-listed gold futures and global equity securities issued by companies that derive at least 50% of their revenue from the gold mining business (“gold miners”). The Fund’s use of U.S.-listed gold futures contracts will give rise to leverage, magnifying gains and losses and causing the Fund to be more volatile than if it had not been leveraged. Moreover, the price movements in gold and gold futures contracts may fluctuate quickly and dramatically and have a historically low correlation with the returns of the stock and bond markets. By investing in the equity securities of gold miners, the Fund may be susceptible to financial, economic, political or market events that impact the gold mining sub-industry, including commodity prices and the success of exploration projects. The Fund may invest a significant portion of its assets in the securities of companies of a single country or region, including emerging markets, and thus, the Fund is more likely to be impacted by events and political, economic or regulatory conditions affecting that country or region or emerging markets generally. The Fund’s investment strategy will also require it to redeem shares for cash or to otherwise include cash as part of its redemption proceeds, which may cause the Fund to recognize capital gains. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.