With Nvidia at $2 Trillion, Where Is the Risk Concentrated?

No stock has been hotter in this artificial intelligence (AI) cycle than Nvidia, which recently eclipsed a market capitalization of $2 trillion.

Whether it can continue at this pace is a much more difficult question. We scoured a universe of thematic equity exchange-traded funds (ETFs) listed in the U.S. market and found a number with more than 10% exposure to this single name.1

If you’re evaluating these ETFs, which tend to be theme-based, there may be some options for exposure to those themes with more diversification.

Three Strategies with Weight of 10% or More in Nvidia

We found three strategies with greater than 10% weight to Nvidia as of March 1, 2024:

- The VanEck Semiconductor ETF (SMH) is a strategy that seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS US Listed Semiconductor 25 Index, which is intended to track the overall performance of companies involved in semiconductor production and equipment.

- The iShares Semiconductor ETF (SOXX) seeks to track the investment results of the NYSE Semiconductor Index, which is composed of U.S.-listed equities in the semiconductor sector.

- The Global X Robotics & Artificial Intelligence ETF (BOTZ) seeks to invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and AI, including those involved with industrial robotics and automation, non-industrial robots and autonomous vehicles. The ETF seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global Robotics & Artificial Intelligence Thematic Index.

We compare these strategies—associated with AI as a catalyst—to the WisdomTree Artificial Intelligence and Innovation Fund (WTAI).

WTAI is tracking an index designed to consider a more full-ecosystem exposure to AI as opposed to concentrating on a specific area. Sometimes the market’s performance will favor concentrating on a particular position, like Nvidia, and sometimes it favors diversifying more broadly.

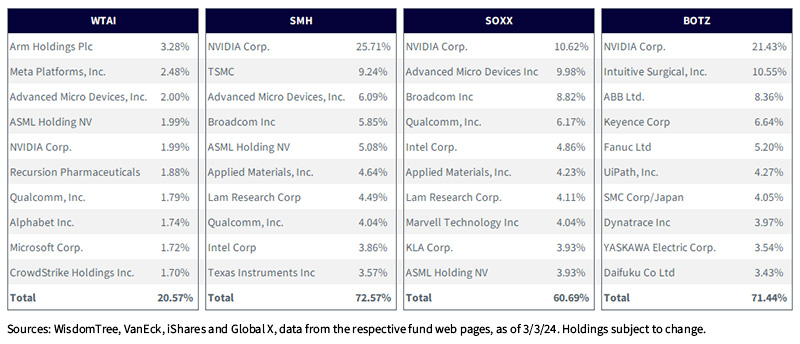

Figure 1 provides, by showing the top 10 positions in each fund, a sense of the concentration in the single Nvidia position as well as within the overall top 10.

A higher figure indicates that more of the overall strategy performance is being driven by the names seen in this figure as opposed to the rest of the strategy’s holdings.

Figure 1: Comparison of Top 10 Holdings

For current WTAI Fund holdings, please click here. Holdings are subject to risk and change.

Quantifying the Performance Wave

Nvidia’s share price after the launch of ChatGPT in November 2022 has been historic. Investors that we speak to are often nervous because they are simply not sure how long it can continue, particularly if they are initiating positions at present in 2024. We all recognize that a stock with a $2 trillion market capitalization can drop by 25% and still be worth $1.5 trillion—a very big number.

WTAI, SMH, SOXX and BOTZ all had different exposures to Nvidia in figure 1—figures 2a, b and c showcase differences in performance across these four strategies.

- In figure 2a, we see the standardized performance as of year-end 2023, where it is clear that SMH and SOXX had the stronger returns in 2023, at least relative to WTAI and BOTZ. Recall that SMH and SOXX can be thought of as “semiconductors,” whereas WTAI and BOTZ—in their own distinct ways—are seeking to be “broader AI.”

- In figure 2b, we see that WTAI and BOTZ had a downdraft from roughly the end of June 2023 through the end of October 2023, and it was this downturn that was the primary driver of their underperformance relative to SMH and SOXX. All four of the strategies rallied during November and December 2023.

- In figure 2c, we can see that the reign of Nvidia continued, and it continued to be better to simply focus on semiconductors as opposed to broader AI, at least if we are using performance to judge the result. SMH had the biggest exposure to Nvidia and it did the best. It is notable that BOTZ had the second-biggest exposure to Nvidia, but due to the broader exposure across robotics it was pulled down below the return of SOXX over this period, roughly the first two months of 2024. WTAI, with the broadest focus of the four funds, lagged.

Figure 2a: Standardized Returns

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: WTAI, SMH, SOXX and BOTZ.

Figure 2b: The 2023 Year (12/31/22–12/31/23)

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: WTAI, SMH, SOXX and BOTZ.

Figure 2c: The First Two Months of 2024 (12/31/23–3/1/24)

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: WTAI, SMH, SOXX and BOTZ.

Conclusion: $2 Trillion Is a Rather Big Number for a Firm’s Market Capitalization

While we can agree there is not necessarily an upper limit that defines how big any firm can be by way of market capitalization, execution takes time. Even if Nvidia’s revenues and profits march upwards, the share price incorporates a mix of those fundamentals alongside the hopes and dreams and aspirations of the broader crowd.

Those aspirations and ultimately expectations can get ahead of reality, and it’s possible the share price will have to pause and let the execution and fundamentals catch up. The environment of the continual upward adjustments to the size of the AI accelerator chip market will eventually change, and the growth will eventually slow.

We remind investors that AI, the theme, has been marching forward for decades, even if the combination of social media and smartphones put the headlines into the palms of our hands every minute of every day today, and the advent of processing power and cheap data storage allow for greater and greater breakthroughs.

If you cannot predict where the hype might go next, we advocate a more holistic, broad ecosystem approach, like WTAI, such that there is a greater chance of capturing that next big AI topic.

Figure 3: Important Further Information about the Funds Mentioned

If you are interested in diving more into the comparison of these Funds, please check out our Fund Comparison Tool.

1 Source: WisdomTree’s thematic universe is a monthly report available here that includes measures of all U.S. listed thematic equity funds.

Important Risks Related to this Article

For current Fund holdings, please click here. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal. The Fund invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.