Blockchain Technology, Real World Asset Tokenization and Smart Contracts: Today’s IRL Use Cases—The Power of Smart Contracts

Overview

Blockchain technology, real world asset tokenization and smart contracts are concepts and buzzwords talked about frequently in financial services today. But what are some of the real life use cases, and how can this technology be applied?

This is the second blog post in a series where we’ll discuss some of the actual use cases of how we believe this technology can and will impact financial services and the potential improvements that investors can expect.

Use Case #2: Using smart contracts to establish standardized identity credentials for cross-chain transactions and collateralized lending

Blockchain technology has the potential to reshape capital markets and improve the end-investor experience by solving for infrastructural challenges in traditional models, unlocking opportunities to access new investment products, streamline workflows and improve settlement times. Many of these potential solutions can be realized through smart contracts.

But what are smart contracts? And why are they important to the evolution of financial services on-chain?

What Is a Smart Contract?

Smart contracts are self-executing rules or operations that run on a blockchain network—software that essentially uses “if, then” statements to execute operations. These contracts are used to facilitate, verify and enforce transactions among two or multiple parties without intermediaries and do so, automatically, when defined terms are met.

What Are the Potential Implications of Using Smart Contracts in Financial Transactions?

Smart contracts are computer code. They are a predefined set of instructions that automatically execute when their conditions are met. They record their actions on a distributed database, a “blockchain,” that is transparent in that anyone can monitor past activity. To give an example of how this technology can be used, imagine that you want to sell your fund shares to someone else, the smart contract could automatically—and instantaneously—execute the recipient’s payment to you (if payment received…) and your transfer of the fund shares to them (…then deliver fund shares).

How Could Smart Contracts Be Used IRL? A Proof of Concept

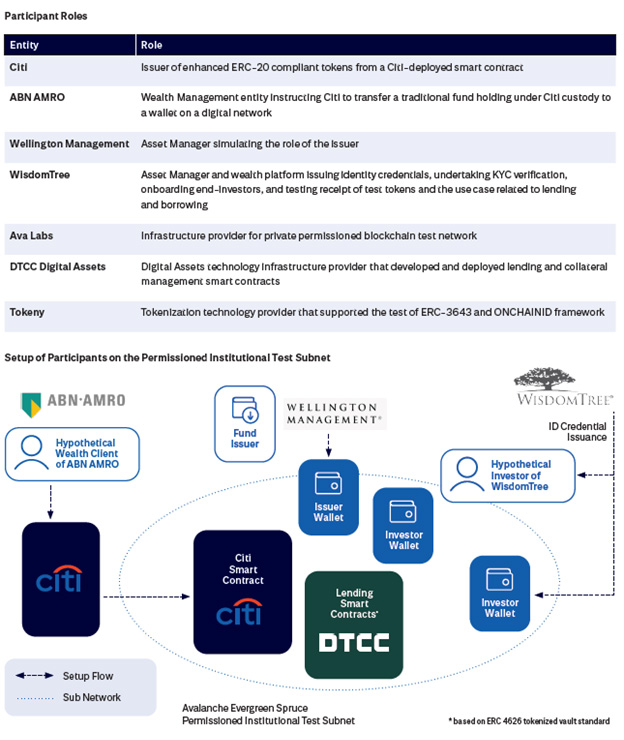

In collaboration with Citi, Wellington and DTCC Digital Assets (formerly Securrency) on the Avalanche Spruce Subnet, we simulated workflows using a private equity fund and a money market fund, showcasing how tokenization and smart contracts could automate operations, improve efficiency, eliminate errors and create standardized identity credentials. This proof of concept also demonstrated the potential of smart contracts to automate the workflow of securities lending.1

Use Cases Tested

1. Tokenizing a traditional private fund with embedded smart contract-based distribution rules, such as jurisdiction or investor status requirements, that could be sent cross-chain to a WisdomTree client/investor.

2. Testing identity/credential-based transfers using various implementation models including through smart contracts with WisdomTree issuing credentials, as a wealth management platform, to investors’ wallets as well as between investors’ wallets (peer-to-peer transfers).

3. Through smart contracts, use of a tokenized private fund as collateral in an automated lending contract to borrow WisdomTree money market Fund tokens.

Key Takeaway

Smart contracts offer opportunities to streamline and systematize many transactions that are multi-step or manual in today’s traditional financial markets. They can be used for sharing of identity and use credentials across financial firms, to eliminate counterparty risk and to validate whether an investor can hold a specific private equity fund based on their location or investor status. Smart contracts have applications in many areas where repeatable, consistent logic is deployed to finalize a transaction. These contracts automatically and instantaneously execute when defined conditions are met, potentially reducing overall error rates related to financial transactions as long as the conditions are accurately defined and coded into the contract. This could mean reduced counterparty risk, lower capital requirements and fewer trading errors. All of these mean results in overall improved efficiency.

Challenges and Considerations

The transition from traditional to digital infrastructure presents operational challenges and costs. Legal considerations, identity standards, data flow, privacy concerns and compatibility with existing standards need to be further evaluated in collaboration with regulators. We believe that the financial services industry should work collaboratively to build an identity infrastructure to facilitate wider tokenization adoption, addressing jurisdictional complexities and ensuring data security in digital networks. While smart contracts are only as efficient and accurate based on the code written, can be prone to security breaches if not coded correctly or subject to operational risk if not interacted with securely.

Conclusion

While the usage of blockchain technology in financial services is still nascent, there are many real life use cases today that demonstrate how this technology could improve the ways end-investors buy, sell, receive and interact overall with their investments over time. Streamlined workflows, increased accessibility and increased reliability showcase the transformative potential power of blockchain technology and specifically smart contracts. Collaborative efforts among market participants, especially with standardization of identity credentials, could improve the efficiency and transparency of the entire financial services ecosystem.

1 "Solution Spotlight: Citi Token Services for Trade", Citi. https://www.citigroup.com/global/businesses/digital-assets#tokenization

Important Risks Related to this Article

There are risks associated with investing, including the the possible loss of principal. Blockchain technology is a relatively new and untested technology, with little regulation. Blockchain systems could be vulnerable to fraud, particularly if a significant minority of participants colluded to defraud the rest. Potential risks also include vulnerability to theft, or inaccessibility, and future regulatory developments could affect its viability. Using an asset allocation strategy does not assure a profit or protect against loss.This proof of concept was a series of tests and utilized test tokens that have no monetary value.

Maredith Hannon Sapp joined WisdomTree in May 2022 as Director of Business Development for Digital Assets. In this role, she is responsible for leading business development and partnerships for WisdomTree’s digital assets division, including WisdomTree Prime.

Prior to joining WisdomTree, Maredith was an Executive Director at Morgan Stanley, Head of Business Development and Strategy for the Outsourced Chief Investment Office (OCIO). In this role, she was responsible for sales and operations across business development, marketing, strategic initiatives, and business management. OCIO’s client base included institutional clients, including family offices, ultra-high net worth clients, defined contribution and defined benefit plans, nonprofits, and corporations, both domestic and international. Maredith began her career at Bank of America Merrill Lynch where she worked across product, sales, and strategy roles before becoming Director, Head of Sales Performance and Strategy for their Workplace Financial Solutions business, which focused on delivering wealth management solutions to institutional clients and their employees.

Maredith graduated cum laude with a Bachelor of Arts degree from Georgetown University.