An Idea for Adding Treasuries via Efficient Core

From August to mid-October, long-term bond yields injected renewed fears of a repeat of 2022, when fixed income and equities both generated meaningfully negative returns.

WisdomTree launched the capital-efficient family of funds to allow investors to free up capital and add in portfolio diversifiers. While bonds did not diversify stocks in 2022 by generating positive returns, managed futures strategies that offer a “cash plus” type of investing payout did provide that diversification.

But if one replaced just traditional or even defensive equities with the Efficient Core strategy because bonds provided diversification in the past, that historical bond diversification did not work in 2022.

With the dramatic increase in both nominal and real yields in the bond market, we believe it has become a much more opportune time to consider our capital-efficient family to add more Treasury duration to portfolios.

A Longer-Term Perspective

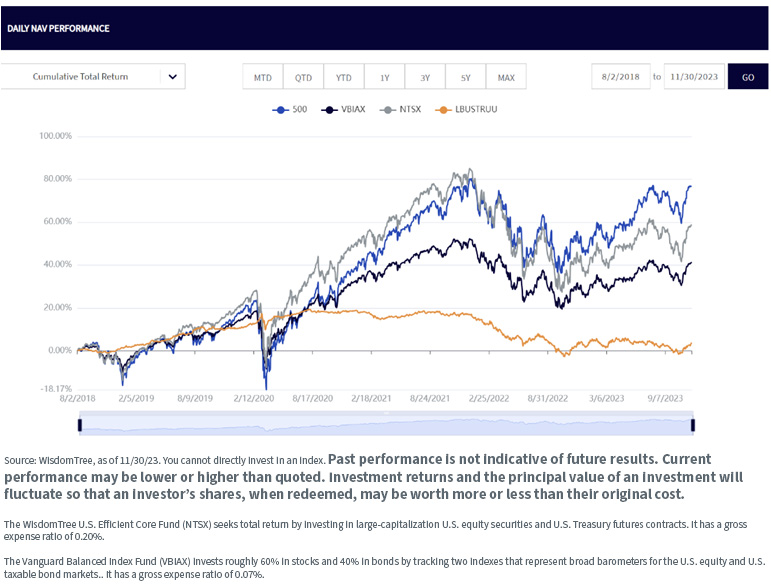

For the most recent month-end and standardized performance, click the respective ticker: NTSX, VBIAX.

For definitions of the indices in the chart above, please visit the glossary.

Since we launched NTSX in August 2018, core fixed income returns (as measured by the Bloomberg U.S. Aggregate Index—LBUSTRUU) have been effectively zero. Despite this headwind for the strategy, NTSX has delivered on its mandate of generating the leveraged returns of a 60/40 portfolio (60% S&P 500 Index, 40% Bloomberg U.S. Aggregate Index). Ignoring the differences in volatility, an investor may have replicated the returns of 60/40 by owning 60% in equities and stuffing the remaining 40% under their mattress.

2022 and 2023

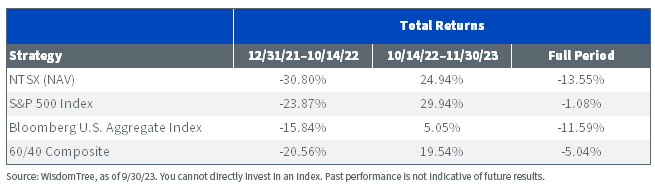

Unfortunately, leverage cuts both ways. Returns in 2022 were disappointing in pretty much every market except for the U.S. dollar and managed futures. Rising rates and falling equities resulted in the worst-case scenario for a standalone strategy like NTSX. However, we think it’s instructive to separate the period into two sections: the drawdown and the aftermath.

Looking first at the drawdown period, while extremely rare, negative total returns for stocks and bonds meant a 60/40 portfolio down in line with a 100% equity portfolio. This contrasts with more normal periods when fixed income acts as a shock absorber for stocks. For a levered strategy like NTSX, this meant a drawdown in excess of equities, which was painful.

During the rebound, equities led the way, whereas bond returns were more muted. In this scenario, NTSX generated returns that exceeded the 60/40 portfolio on account of leverage. For the full period, NTSX remains below levels seen at the end of 2021, as fixed income returns have been the primary driver of negative total returns.

Reasons for Optimism on Bonds’ Diversifying Potential

The challenges for 60/40 over this period were largely attributable to fixed income returns. While nothing in markets is impossible, the odds that fixed income returns continue to generate these levels of losses are now lower than they were in 2021. This is primarily a function of the starting levels of yields.

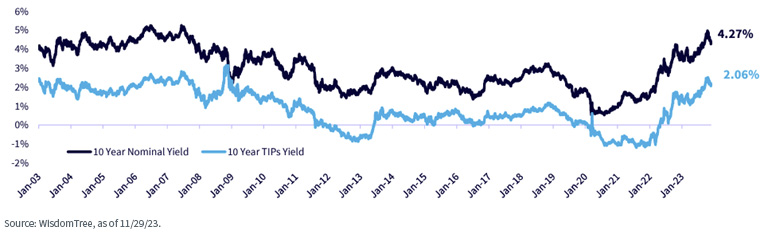

Today, with the 10-Year Treasury near 4.3%, rates would need to rise by another 2.57% to 6.87% over the next year to generate the same losses in fixed income experienced in 2022. While not impossible, we view this as extremely unlikely.

Real Yields

Our house view is that inflation will recede over the next 12–24 months, and in general, we think investors can focus on real yields as an important indicator for adding to fixed income allocations. We have some of the highest real yields available in the last 20 years after TIPS surged more than 350 basis points from a strongly negative yield to around 2.1%. These yields will attract some level of buyer support and hedge the downside in the economy better from here, in our view.

10-Year Nominal vs. Real Yields, 1/2/03–11/29/23

Packaging It All Together

After one of the worst sustained periods for fixed income returns in recent memory, we believe the primary risk for 60/40 allocations may come from equities. However, the timing of this risk is problematic, with many investors seeking to stay invested. In response, investors can gain exposure to Treasuries via Efficient Core while at the same time maintaining exposure to the market. Yes, the risk that equities fall with yields rising would result in negative total returns; however, we believe the prospect of significant drawdowns in fixed income may be behind us.

Should Treasuries begin to generate positive total returns over market cycles on account of higher starting yields, a strategy like NTSX could add value versus a 60/40 approach or versus a 100% equity allocation should equities start to become more volatile. Compared to simply owning a Treasury ETF, the fixed income portfolio in NTSX is diversified across the yield curve, making investors less sensitive to trying to figure out which segment of the curve appears most attractive. With rates around 4.5% across the curve, we believe this approach has the ability to outperform in the near term compared to solely investing at the long end.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models, and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Fund invests in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Fund’s use of derivatives will give rise to leverage, and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning, and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as perception of an issuer’s creditworthiness. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.