The WisdomTree Q4 2023 Asset Allocation and Portfolio Positioning Summary

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

We recently posted a blog summarizing our general economic and market outlook as we move through to the end of 2023. You can also find a more comprehensive review in our Q4 2023 Economic & Markets Chart Deck.

In this blog post, we take those outlooks and translate them to our current Model Portfolio allocations and positions. Before we get to that, a quick reminder of our general framework with respect to our asset allocation and portfolio construction:

Now let’s summarize our current economic and market outlook:

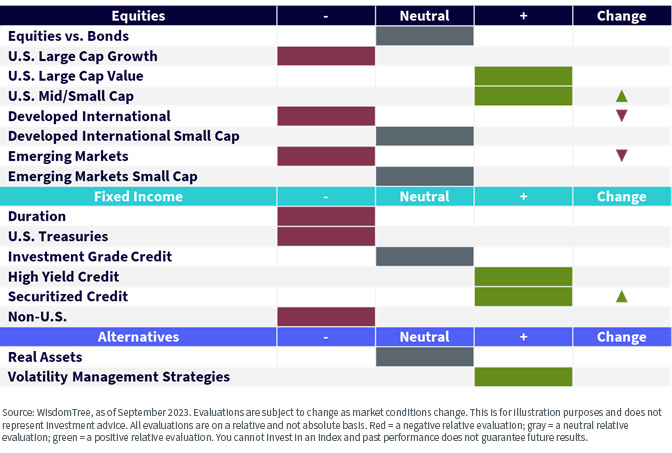

Finally, let’s summarize our general asset class outlook:

Equities

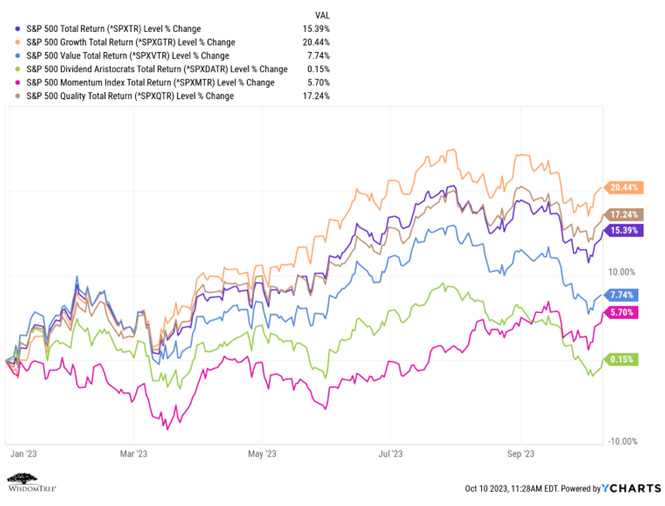

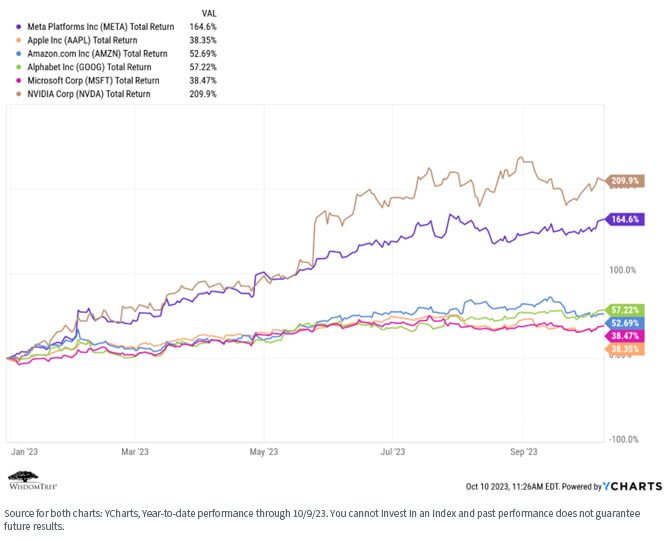

Many of WisdomTree’s ETF strategies (and, therefore, our Model Portfolios) have explicit factor tilts toward dividends, value, size and quality. These factors underperformed through the first three-quarters of 2023 as large-cap, growth and mega-cap tech stocks rallied strongly on the back of investor fascination with artificial intelligence (AI). Most companies believed to be positively influenced by the evolution of AI have benefitted so far this year, with Nvidia Corporation being the poster child (two charts).

For definitions of terms in the graphs above, please visit the glossary.

Despite this challenge for our overweighted factors, the rising rate environment in the third quarter resulted in a slight rollover of the growth factor and a possible re-rotation back into value stocks. Small caps and dividend stocks continue to trail, while quality, as usual, has proven to be the most consistent risk factor. This is why it remains the anchor factor in most of our Model Portfolios.

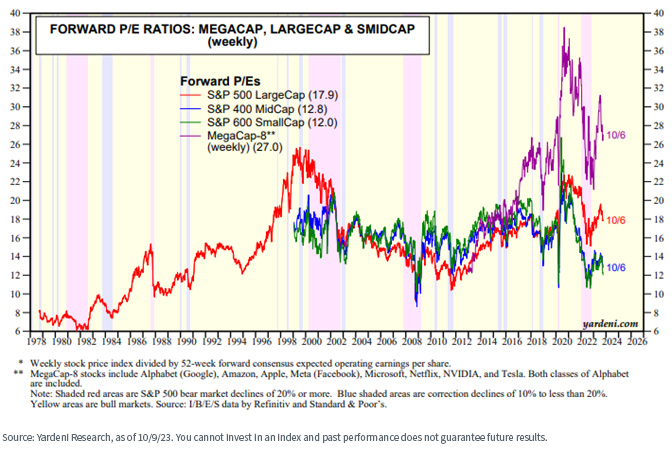

The valuation dispersion between large cap and small-cap stocks has become historically wide, and we believe mean reversion will set in at some point. We maintain our overweight allocations in small-cap stocks relative to our benchmarks.

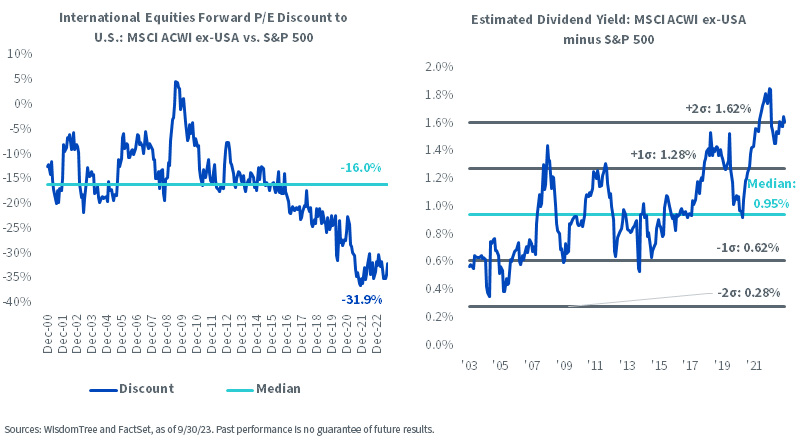

Finally, let’s examine current valuations between U.S. and non-U.S. stocks. Combined with the higher dividend yield typically available outside the U.S., there appears to be an interesting relative value trade outside the U.S.

That said, we are uncomfortable with the economic growth environment outside the U.S., especially in Europe and China. This, combined with the strong dollar rally since midyear, led us recently to reduce our allocations to both EAFE (Europe, Australasia and Far East) and EM and to go overweight the U.S., relative to the MSCI ACWI index.

Bottom Line: Our Model Portfolios maintain factor tilts toward value, dividends, size and quality, but have moved to an overweight allocation in the U.S. Despite our Portfolio underweights to the mega-cap tech stocks through the first three quarters, our equity Models have largely matched or beaten their respective benchmarks. We attribute this to both our asset allocation and security selection decisions.

If we are correct in our view that the value trade is rebounding and that small caps present a relative value opportunity, our Portfolios are positioned to take advantage of that.

Fixed Income

Our primary narratives for 2023 are, “Higher for longer” and “There is income back in fixed income.”

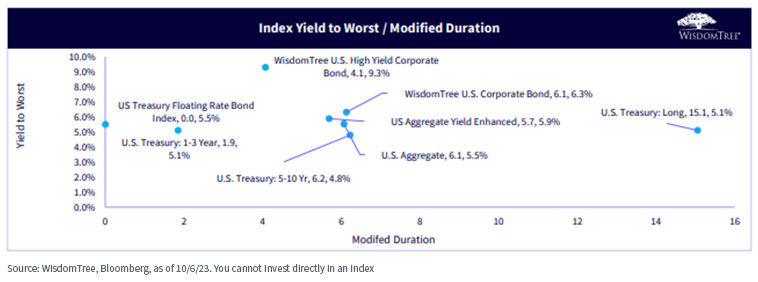

While we increased the duration of our fixed income allocations several months ago, we remain short duration relative to the Bloomberg Aggregate index. The market simply is not paying investors to take on duration risk.

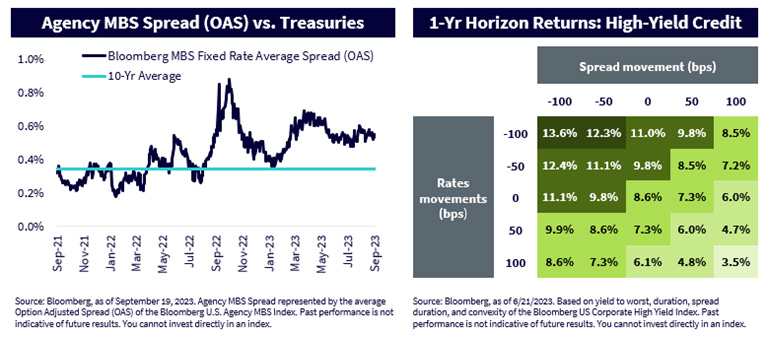

While we remain constructive on high yield, we did recently move to lower our overweight allocations there in favor of adding to mortgage-backed securities.

At current rate and spread levels, high yield continues to offer elevated yield levels to investors, while maintaining a comfortable “buffer” against both a further rise in rates and/or a rise in spreads (right-hand chart below).

Meanwhile, on a relative value basis, agency-backed mortgages are exhibiting attractive spreads to Treasuries in comparison to their historical average (left-hand chart below).

Real Asset and Alternatives

Finally, for those advisors and investors for whom it made sense, we have advocated considering allocations to real assets and alternatives for most of the past two years.

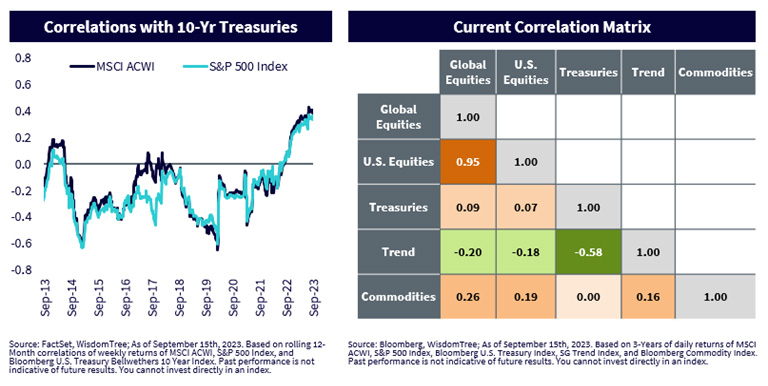

Certainly, the inclusion of these types of strategies, depending on the strategies and exposures, benefited many investors as they provided excellent diversification to the abysmal stock and bond performances of 2022.

Most commodities have been range-bound for the past 12 months (and we maintain a neutral stance in our asset allocation positioning), but we still believe in the potential benefits of diversification within our Portfolios that have that investment objective.

Meanwhile, the correlation between stocks and bonds has risen to levels not seen in more than 10 years (left-hand chart). In this type of environment, the potential diversification benefits of both real assets and alternatives (focusing on managed futures or trend-following strategies) becomes even more important (right-hand chart).

Conclusion

Trying to predict future market performance is a fool’s errand and a loser’s game. But, given historical performances and trends, we like how our Portfolios are positioned. But it is also why we continue to favor longer-term time horizons and appropriate diversification at both the asset class and risk factor levels.

Contact Us