The Q3 2023 WisdomTree Economic Market Outlook in 10 Charts or Less

“I just dropped in to see what condition my condition was in.”

(Kenny Rogers & The First Edition, 1967)

The first half of 2023 was marked by a small handful of factors and issues, among them, (1) the overwhelming dominance of artificial intelligence (AI) meme stocks in driving domestic market performance; (2) U.S. and global economies that are slowing but proving to be more resilient than many expected; (3) continued uncertainty about Federal Reserve policy going forward; (4) the ongoing Russia-Ukraine war; and (5) simmering tensions between the U.S. and China.

As always, when reviewing the current state of the global economy and investment markets, we recommend focusing on market signals and weeding out market noise. We believe the five primary economic and market signals that provide perspective on where we go from here are GDP growth, earnings, interest rates, inflation and central bank policy.

We now believe that any U.S. recession will be pushed out to late in the year, and more probably into 2024—the proverbial economic “soft landing” is no longer dismissed by analysts. We continue to get mixed signals from the labor markets, consumers, the Fed, and the bond and stock markets. So, let’s dive in.

GDP, Inflation and Central Bank Policy

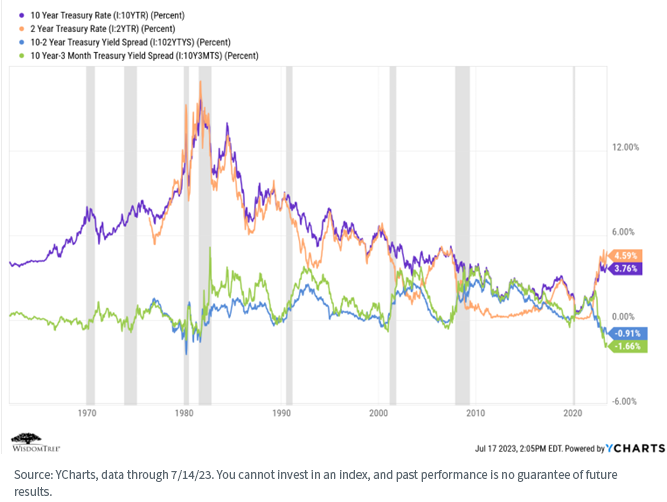

Let’s start with a look at the yield curve (i.e., interest rates), specifically two closely watched spreads: the 10 Year–2 Year and the 10 Year–3 Month. In some cases, what we see is a level of inversion we haven’t witnessed since the 1960s.

We see that the 10s/2s has been inverted since roughly July 2022, while the 10s/3Ms (historically the more accurate indicator of recessions—highlighted by the gray bars in the chart) inverted in October. Both are signaling a coming recession but, historically and importantly, with a time lag. Given how long and how steeply the curve has been inverted, we believe we are headed there, but perhaps not just yet, given the relative strength of the labor and retail sales indicators.

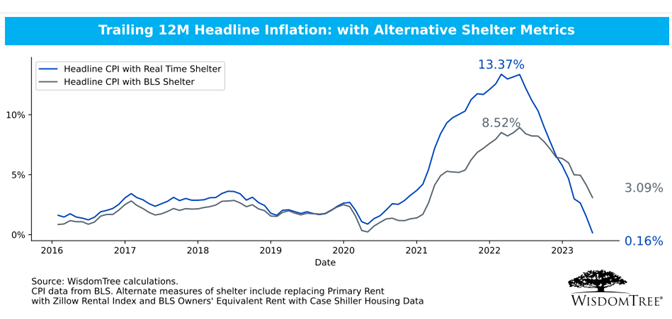

While some argue that elevated inflation remains a primary concern in 2023, we believe it has peaked and will continue to fall through the year, especially if the Fed maintains its hawkish tone and narrative. The market currently is pricing in a “raise and pause” approach, with perhaps one or two more hikes by year’s end. The market itself is not pricing in any rate cuts until March of next year—quite a reversal from just a few months ago when cuts were anticipated as early as this past June.

We note the headline CPI number is significantly impacted by housing and shelter data, which are subject to an approximately six-month reporting lag. CPI would look much lower if current or contemporaneous shelter data were used.

In fact, our belief in a possible recession later in 2023 or 2024 is at least partly based on the idea that the Fed will remain hawkish for too long, driving economic growth downward.

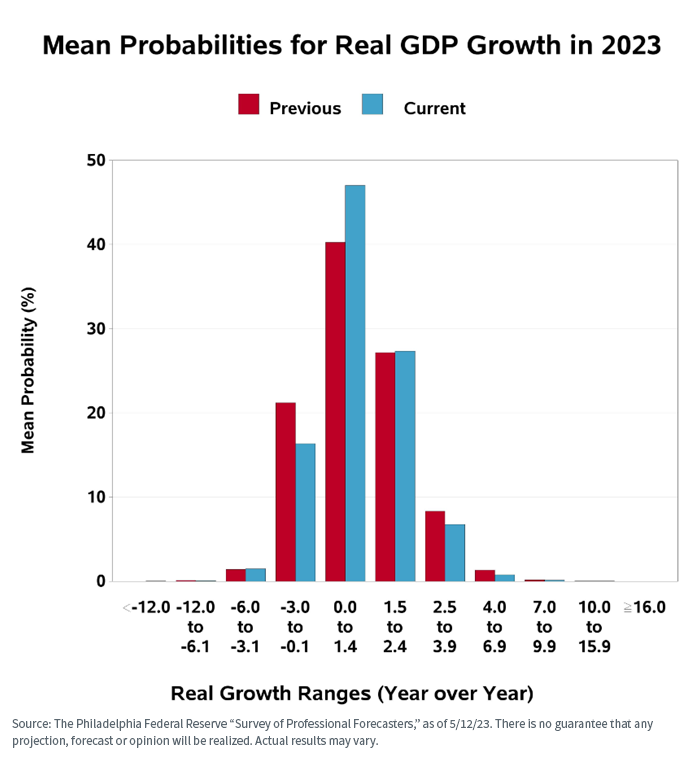

With that as a backdrop, it is not surprising that the consensus estimate for annual GDP growth in 2023 is muted, or that many analysts believe we will enter a recession later this year or early next year.

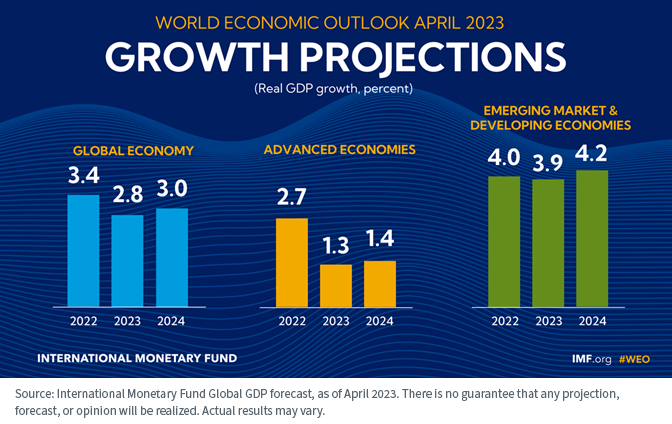

Outside the U.S., a slower-than-expected economic recovery in China following the end of its “Zero-COVID” policies, combined with the ongoing Russia-Ukraine conflict, have worked to lower global economic forecasts as well.

Translation: A recession seems to be on the horizon. There remains positive economic news, especially in consumption and labor, but some indicators—especially manufacturing—are declining.

While the Fed will be highly “data dependent” as we move through 2023, we believe we are at, or close to, the end of the rate hike cycle, with perhaps one or two more hikes in 2023. The market is no longer pricing in any rate cuts until early next year.

Our Senior Economist Professor Jeremy Siegel believes the Fed is misreading current economic data and is in danger of committing a policy mistake if it maintains its hawkish positioning.

Earnings and Valuations

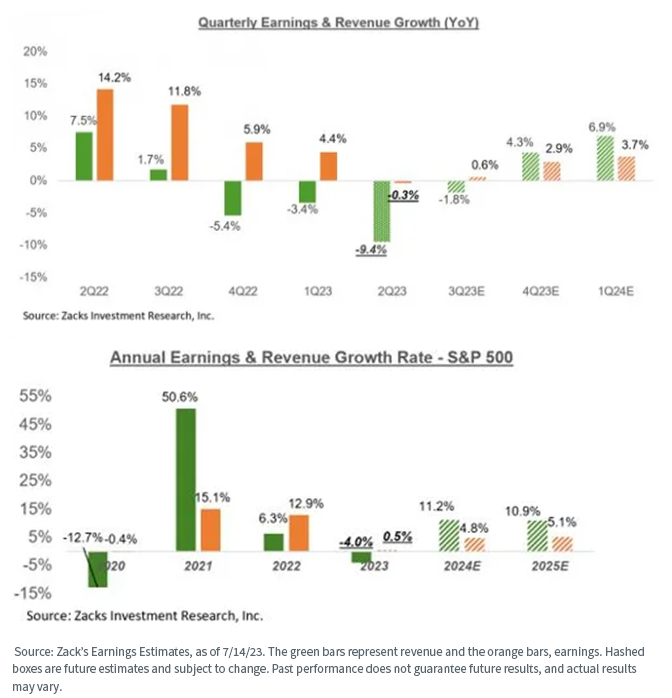

The Q2 earnings season is just getting started. The consensus is that 2023 will witness a decline in corporate earnings as economic activity slows and wages continue their upward trend, combining to put pressure on operating margins. This is a primary reason we believe the “quality tilt” in our products and Model Portfolios—which has not helped us so far in 2023, will eventually benefit us as we move through the year.

One question is whether the AI-themed stocks that have driven so much of market performance this year to date will be able to continue generating sufficient earnings to maintain their current frothy valuations. We think perhaps they are due for a mean reversion.

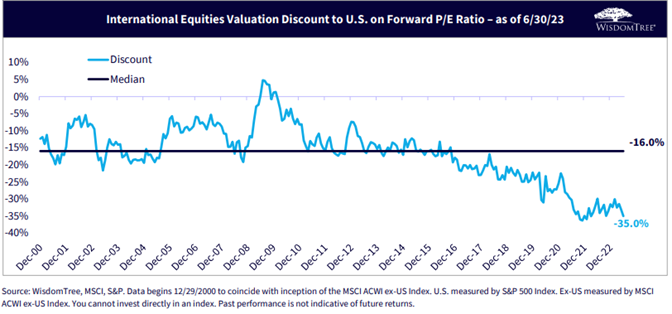

Outside the U.S., fundamental and dividend-driven investors may find relative valuations to be quite attractive, especially if the dollar continues its downward trend.

Translation: We have entered a period of uncertainty with respect to the equity markets. All eyes will be on earnings as we move through the year—many expect a global earnings recession. Excluding the mega-tech AI stocks, market valuations are in line with historical averages, with relative value perhaps available outside the U.S.

We saw a strong factor re-rotation toward large-cap growth and mega-tech stocks in Q1. If we are correct in our earnings and interest rate outlooks, we believe this trend will not continue.

In addition, given the outperformance of large caps in Q1, small-cap and value stocks continue to represent a relative value opportunity going forward. We also believe dividend stocks will continue to be attractive as we move into increased market uncertainty.

We believe quality (i.e., companies with strong balance sheets, earnings and cash flows) will become increasingly important as margins and earnings get squeezed. Firms that can maintain their pricing power and dividends should outperform.

Interest Rates and Spreads

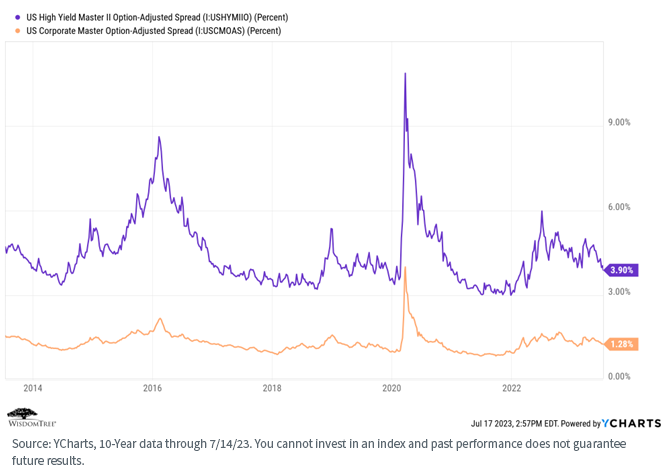

The yield curve remains an item of intense focus these days. We discussed the level and shape of the curve above, but what about credit spreads?

Credit spreads remain in line with historical levels. This, combined with positive real rates across the maturity spectrum translates into “there is income back in fixed income.”

Corporate balance sheets are in decent shape, so coupons should be safe. We increased the duration of our strategic fixed income Model several months ago but remain short duration relative to the Bloomberg Aggregate index and maintain an over-weight allocation to quality credit.

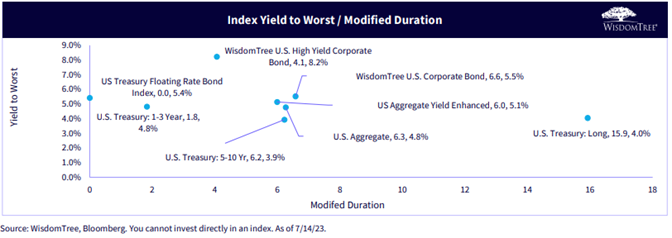

We believe there is relative value in high-yield bonds and, given the shape of the yield curve, we still like floating rate Treasuries.

Investors continue to be unrewarded for taking on duration risk. This chart illustrates why we favor floating rate Treasuries and U.S. corporate high yield.

Translation: We increased the duration within our fixed income a few months ago but remain short duration and maintain an over-weight allocation to quality credit relative to the Bloomberg Aggregate index. Floating rate Treasuries remain a high conviction trade for us, and we believe quality-oriented high yield is an attractive relative value trade.

Summary

When focusing on what we believe are the primary economic and market signals, the “condition our condition is in” is uncertain. Economic growth is slowing, and we are probably headed into a recession, but perhaps not until 2024. Earnings are expected to fall. The labor market and consumer spending remain solid, though both are perhaps showing signs of slowing down.

Combined with a still publicly hawkish Fed and heightened geopolitical tensions, these are uncertain times.

To summarize our primary investment themes and views for 2023:

- There is income back in fixed income. We believe there is relative value in high yield, and we continue to like U.S. floating rate Treasuries.

- Despite market performances this year to date, we maintain our conviction in value, small cap and dividend stocks.

- Quality should become an increasingly important risk factor as investors refocus on fundamentals during uncertain times.

- U.S. small-cap stocks are presenting attractive valuation plays.

- Higher dividends, lower valuations and the potential for a continued decline in the dollar suggest that U.S. investors should pay more attention to non-U.S. investment opportunities.

- Active management and intelligent risk factor tilts should be rewarded versus passive management (i.e., cap-weighted beta).

That said, as strategic investors, we continue to recommend focusing on a longer-term time horizon and the construction of “all weather” portfolios, diversified at both the asset class and risk factor levels.

Important Risks Related to this Article

For Financial Advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For definitions of Indexes/terms in the charts above, please visit the glossary.