India Poised to Sustain Growth despite the Global Slowdown

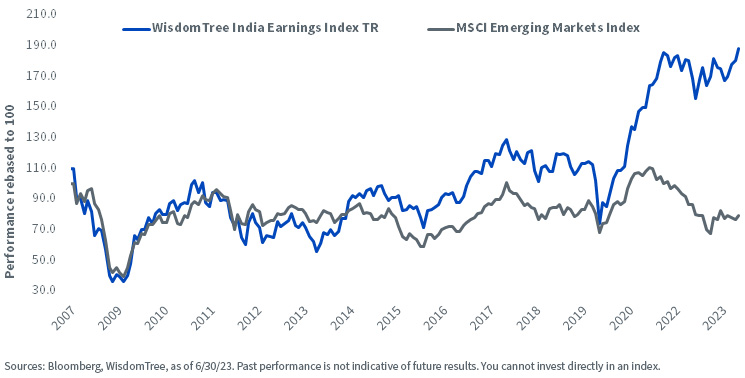

Indian equities1 are on a tear this year, outperforming the MSCI Emerging Markets Index by 6.2%. India has had a number of obstacles thrown at it—from the COVID-19 pandemic in 2021 to the Adani case raised by Hindenburg in 2023—yet improving corporate fundamentals have helped the economy power ahead. India is not just the world’s fifth-largest economy; it is also home to the world’s fifth-largest stock market. India’s stock market has surged more than 14% in the past three months, aided by strong net inflows of US$9.4Bn by foreign investors.2

India's Outperformance vs. Emerging Markets

India in an Advantageous Position Owing to Robust Domestic Demand

Clearly, what is working for India is the strength of its domestic demand. Post-pandemic quarterly trajectories of consumption and investment have already crossed their pre-pandemic paths.3 However, net exports still have some ground to cover as external demand remains weak. We believe when external demand begins to turn around, the pre- and post-pandemic trajectories of real GDP will also converge.

GDP growth in Q4 (ending March 2023) the full 2022–23 fiscal was ahead of expectations at 6.1% year over year (YOY), led by strong construction and financial services momentum. The economic recovery drove a pickup in credit growth in FY23. India’s purchasing managers’ indexes for manufacturing and services continue to remain in expansionary mode, well ahead of peers. While growth is likely to moderate in the coming quarters from the fading re-opening gains, India is less vulnerable to slowing global demand as exports currently make up less than a quarter of GDP. The decline in global oil and commodity prices since their 2022 peaks has eased pressure on India’s current account (CA) balance and inflation.

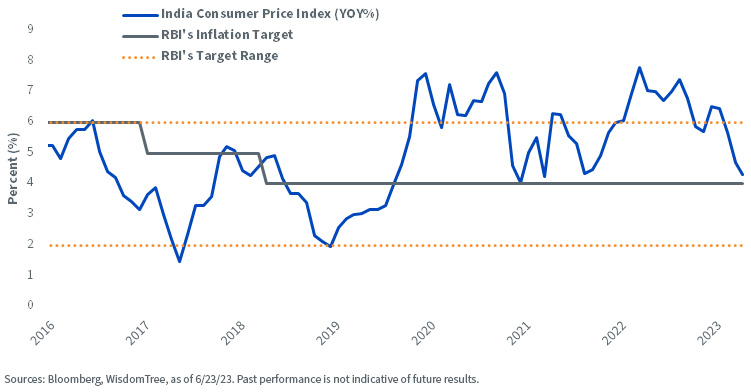

The End of Monetary Tightening in Sight as Inflation Moderates

Since May 2022, the Reserve Bank of India (RBI) has hiked the policy repo rate in every Monetary Policy Committee (MPC) meeting, barring the meetings of April 6 and June 8, 2023, in which it unexpectedly decided to pause. After 250 basis points (bps) of rate increases in the past year, the policy rate was kept unchanged at 6.50%. Headline inflation has fallen sharply from 6.50% at the start of 2023 to 4.25% in May 2023. A gradual moderation in the pace of inflation will provide the RBI with room to focus more on domestic growth and stability considerations. We expect a policy pause to continue over the next few months, with the potential for rate cuts in H2FY24.

Inflation Is Approaching the RBI’s Target

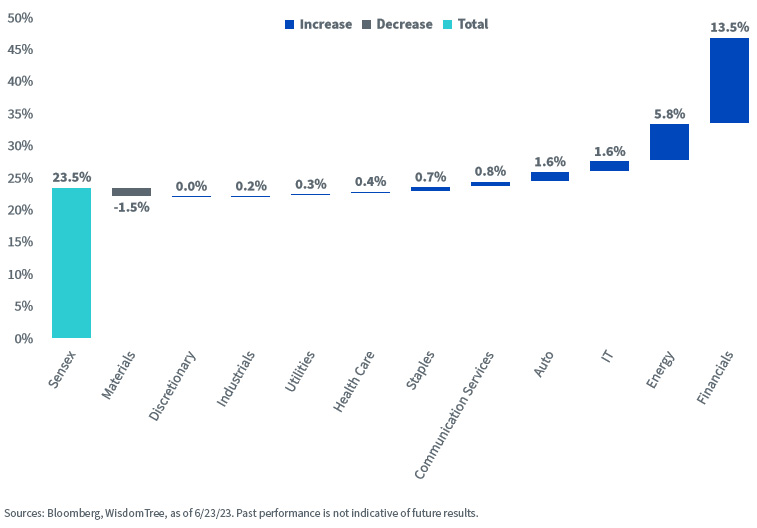

Earnings Beat on Margin Expansion

Foreign investors have been impressed by the strong earnings results in Q4FY23. The Sensex Index delivered a 24% YOY earnings growth in Q4FY23 (free float-weighted). While topline growth slowed, margin expansion was the primary driver of earnings growth. Sector-wise, earnings growth was led by Financials and Energy, while Materials dragged earnings growth lower.

Sector-Wise Earnings Growth for Sensex Q4FY23

Materials continued to face sharp margin compression. Despite strong domestic demand, a weak revival in China post-COVID-19 has impacted confidence in its steel industry and weighed on steel prices. Looking ahead, current expectations are for a 15% earnings growth for FY24/25. The auto sector is expected to see the highest upgrades, while Materials and Communication Services are expected to face downgrades.

Adopting an Earnings Bias to Tap into Indian Equities

For investors looking to tap into India’s buoyant earnings growth at a discount, the WisdomTree India Earnings Fund, which seeks to track the WisdomTree India Earnings Index, offers a unique opportunity. Over the past year, the WisdomTree India Earnings Index has outperformed the MSCI India Index by 7.79% owing to its earnings-focused methodology. WisdomTree’s earnings-focused methodologies tilt the portfolio toward lower-valuation companies.

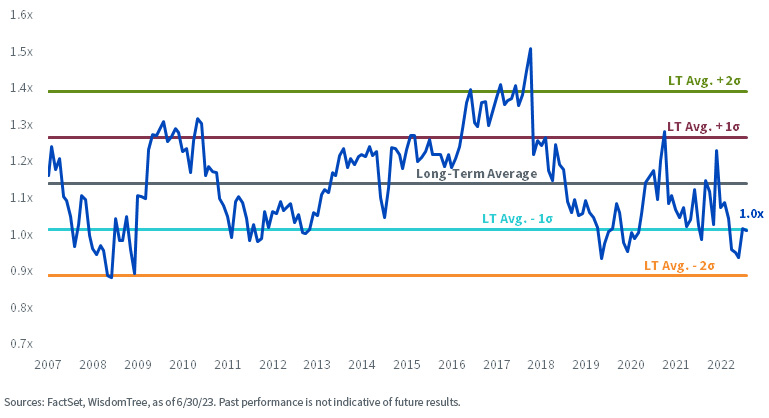

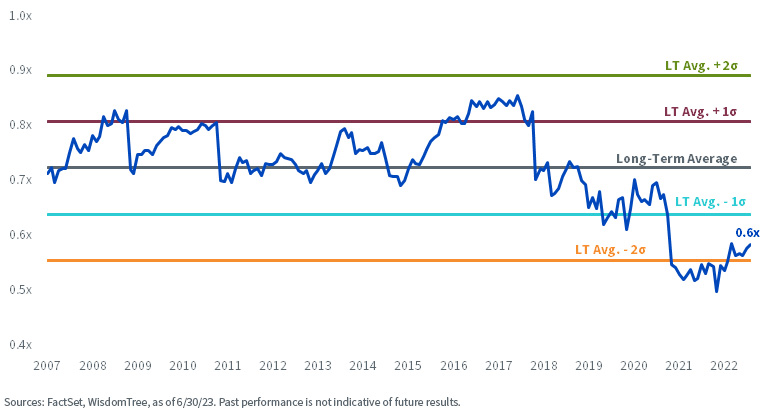

Indian equities are often touted as expensive. However, the WisdomTree India Earnings Index is trading at a significant discount to the MSCI India Index at a price-to-earnings ratio of 14.8x versus 24.8x, respectively, without sacrificing earnings growth and quality characteristics. This highlights the impact that earnings weighting has had on valuations, enabling valuations to be consistently cheaper on a relative basis versus the broad MSCI Emerging Markets Index and the MSCI India Index, as illustrated below.

Relative P/E - WisdomTree India Earnings Index vs. MSCI EM

Relative Forward P/E - WisdomTree India Earnings Index vs. MSCI EM

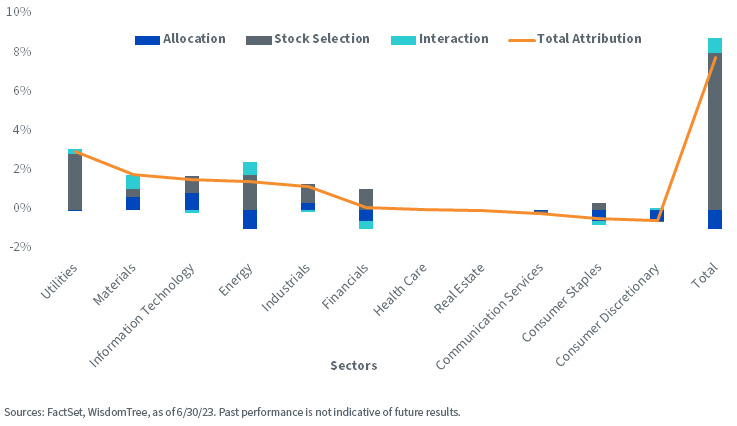

By earnings weighting our strategy, the portfolio takes on some unique sector tilts compared to a market cap-weighted approach. Over the past year, Utilities, Materials, Information Technology and Energy provided the highest contributions across sectors, enabling the WisdomTree India Earnings Index to outperform the MSCI India Index by 7.79%.

Sector Attribution - 1 Year

1 WisdomTree India Earnings Index TR, as of 7/11/23.

2 Bloomberg, as of 6/30/23.

3 Finance Ministry, latest assessment of the annual Economic Review for 2022–23.

Important Risks Related to this Article

Aneeka Gupta is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree, Inc.

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Investments

in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Aneeka Gupta is Director of Research at WisdomTree. Prior to the acquisition of ETF Securities in April 2018, Aneeka worked as an Equity & Commodities Strategist at the company. Aneeka has 17 years of experience working as a Research Analyst across a wide range of asset classes. In her current role she is responsible for conducting analysis for all in-house equity, commodity and macro publications and assisting the sales team with client queries around products and markets.

Prior to WisdomTree, Aneeka began her career as an equity analyst at Bear Stearns International Ltd in London. She also worked as an Equity Sales Trader at Sunrise Brokers across US and Pan European Exchanges. Before that she worked as an Equity Derivatives Sales Manager at Mashreq Bank in Dubai.

Aneeka holds a Masters in Mathematics from Oxford University and a BSc in Mathematics from the University of Delhi, India. She is also a CFA Charterholder.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.