Looking back at Equity Factors in Q1 2023 with WisdomTree

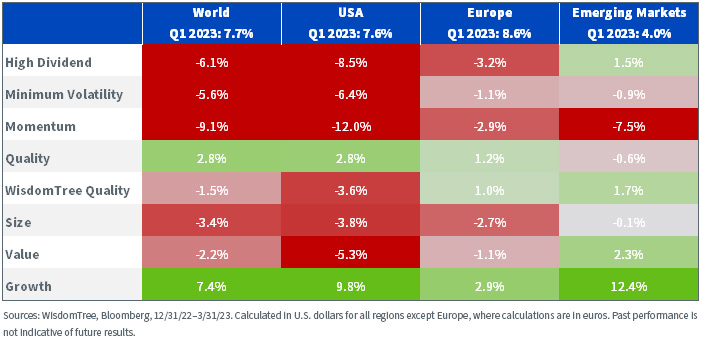

Equity markets started 2023 as they closed 2022, with positive performance across regions. However, it was anything but plain sailing for investors as tighter monetary policies started to bite and the most vulnerable banks started to fall. The MSCI World Index gained 7.7% over the quarter, but Europe performed the best with +8.6%. Emerging markets trailed other regions with +4%.

This installment of the WisdomTree Quarterly Equity Factor Review aims to shed some light on how equity factors behaved in this complicated quarter and how this may have impacted investors’ portfolios.

- As if compensating for 2022, growth stocks performed the best in Q1.

- Quality was the second-best factor for the quarter, benefiting from its resilience in uncertain periods.

While central banks in the U.S., Europe and the UK continued on their hawkish path, the evolving banking crisis could alter monetary policies ahead. Chair Powell conceded that tightening financial conditions could have the same impact as another quarter-point rate hike or more from the Federal Reserve (the “Fed”). Markets are now pricing in rate pauses and cuts for later in 2023. However, uncertainty is very high, with inflation worries warring with recession fears. Given the rising concerns about the risk of banking industry contagion, shrinking corporate profits and central bank policies ahead, positioning equity exposure toward the quality factor could be prudent.

Performance in Focus: Growth Rebounds and Quality Outperforms

In the first quarter of 2023, equity markets posted the second positive quarter in a row across regions. In January, markets performed very strongly, anticipating a central bank pivot and easing monetary conditions. February’s performance was more muted in reaction to hawkish rhetoric from central bankers. March opened with the bankruptcies of Silicon Valley Bank and Signature Bank, as well as the takeover of Credit Suisse by UBS. While increasing volatility, this “banking crisis” turned rate expectations significantly more dovish, leading to another month of positive performance.

Overall, it was a relatively difficult period for factor investing in developed markets:

- Growth stocks performed the best in Q1 across all geographies, rebounding from a challenging 2022.

- Quality was the second-best factor for the quarter in developed markets, benefiting from its resilience in periods of high volatility and uncertainty.

- In developed markets, other factors like value, high dividend and min volatility all suffered from the change in regimes.

- In emerging markets, value and high dividend continued to deliver some outperformance.

Figure 1: Equity Factor Outperformance in Q1 2023 across Regions

The Impact of Central Banks’ Pivots on Factor Performance

Looking forward to the rest of 2023, the timing of the Fed pivot will be one of the main factors driving equity performance. As economies decelerate, recession fear grows and inflation decelerates, central banks will need to start planning for some landing (soft or not). Such periods of monetary policy changes are always quite difficult for equity investors, and it is always good to look back at similar periods in the past to inform our current positioning. Using the performance of U.S. factors in the 12 months following the end of the last seven Fed rate hike cycles, we observe that:

- High-quality companies behaved the best, outperforming in six out of seven periods (as illustrated in figure 2) and posting an average 3.57% outperformance versus the market.1

- Growth companies also tend to benefit from easier monetary conditions, leading to outperformance in five out of seven of those periods and an average outperformance of 3.08%.

- Small-cap companies and value companies’ performance was mixed, outperforming in three and four periods respectively (out of seven) but posting double-digit underperformance in others.

Figure 2: Outperformance of the Quality Factor in U.S. Markets in the 12 Months following Fed Rates Peaking

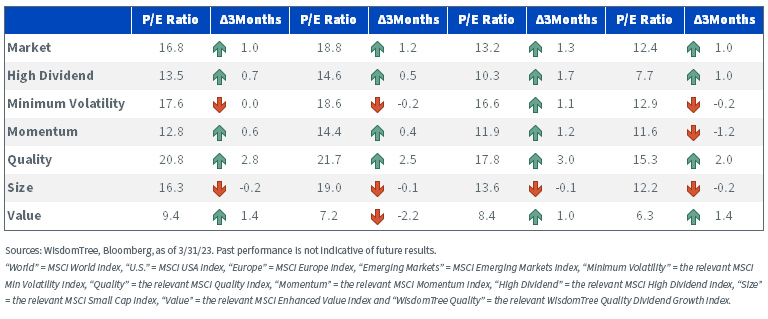

Valuations Continued to Increase in Q1

In Q1 2023, market valuations continued to increase across regions on the back of the positive performance. However, in developed markets, while quality and value got more expensive faster than the markets, small caps and min volatility got cheaper. In the U.S., the value factors got even cheaper, with a current P/E of only 7.2. In emerging markets, momentum also got significantly cheaper. Overall, the most defensive factors, min volatility and quality, are currently the most expensive on a relative basis.

Figure 3: Historical Evolution of the Price-to-Earnings Ratios of Equity Factors

For definitions of terms and indexes in the table, please visit our glossary.

Looking forward to 2023, two questions remain unanswered: (1) How sticky is underlying inflation, and (2) How intense will the recession be? However, the balance of risk is slowly shifting from inflation to recession across developed economies.

Our Senior Investment Strategy Advisor, Jeremy Siegel, suggested the Fed pause and pivot should happen sooner than anticipated, and markets are starting to price that in. But uncertainty remains very high, and interest rate volatility is very elevated.

We see rising risks from banks tightening lending standards, shrinking corporate profits and central bank policies ahead, with market expectations continuing to shift very rapidly. In such an environment, defensive investments such as high-quality and low-volatility companies benefit and receive high interest from investors.

Pierre Debru is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree, Inc.

1 Source: Kenneth French data library. Data is calculated at a daily frequency, as of February 2023. Stocks are selected to be above the median market cap, with “High Quality” representing the top 30% by operating profitability. The portfolios are rebalanced yearly at the end of June. The market represents the portfolio of all available publicly listed stocks in the United States. All returns are in USD. Operating profitability for year t is annual revenues minus cost of goods sold, interest expense, and selling, general and administrative expenses divided by book equity for the last fiscal year end in t-1. Past performance is not indicative of future results.