Four Potential Benefits of Leveraging Crypto Indexes for Financial Advisors

The world of crypto assets can be overwhelming for financial advisors looking to understand and invest in this market.

With a variety of different tokens in the crypto market, it can be difficult to know where to start. Building the capabilities required to research, monitor and stay up to date with the crypto market can take a lot of time and money.

That’s where crypto indexes may come in.

Crypto indexes can serve as a helpful information resource for financial advisors in seeking to track an investment methodology in the crypto market.

Financial advisors may find the following as potential benefits of crypto indexes:

1. Leverage an index provider’s information

As a financial advisor or investment professional, how much time and money can you justify spending to build out a digital assets research team and digital asset capabilities?

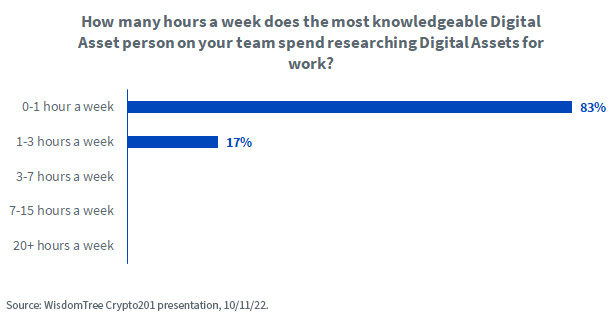

In a webinar last year, we polled a large audience of financial advisors and found that most advisors and their firms had their most knowledgeable digital asset person only spending between zero and one hour a week on digital assets.

No one in the audience spent more than three hours a week on digital assets.

When it comes to investing in the crypto market, it’s important to educate yourself and leverage a number of sources of information, including information made publicly available by index providers.

2. Potentially reduce risk through less reliance on active investments

Another key benefit of leveraging publicly available information provided through crypto indexes is that it may reduce risk by eliminating the need to make active investments in individual coins or tokens. Instead, you may use the information to implement a passive investing strategy to achieve greater diversification in the crypto sector. Although diversification does not eliminate risk, particularly in a highly volatile and speculative area such as crypto, diversification may help reduce the risk of a single cryptocurrency investment.

3. Add diversification for the long term

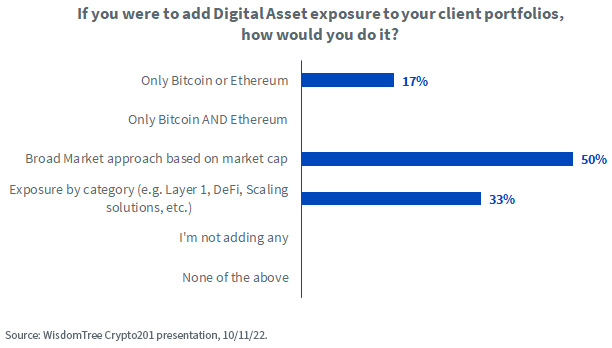

With so many cryptocurrencies widely available and a constantly shifting market, seeking to track a broad-based crypto index, whether based on the entire market or a particular segment of the market, may allow a financial advisor or investment professional to diversify their client’s holdings.

Whether a financial advisor or investment professional is interested in the whole market or subcategories such as layer 1 payment networks, layer 1 smart contract networks and decentralized finance (DeFi), they may be able to implement client strategies by leveraging an index that tracks those categories.

By leveraging the information associated with a crypto index and grounded in a methodology, the index can provide a level of information that may help a financial advisor or investment professional to focus on its clients long term goals and objectives.

4. Implementation through technology solutions

To track an index in client portfolios, it’s important to consider the efficiency that can potentially be added through a technology solution that integrates with an advisor’s tech stack and has a user experience that can work for you, as an advisor, in implementing client trades.

The Onramp Invest platform is one example of a technology solution used by financial advisors who have clients interested in getting exposure to crypto.

Onramp bridges the world of digital assets and traditional finance for financial professionals. Indexes are available through Onramp’s marketplace, which an adviser can leverage as an information and education resource in potentially investing for clients in seeking to pursue strategies that meet each client’s wealth management goals and objectives.

“One of the biggest things we consistently hear from financial advisors is that they believe in the benefits of digital asset investment, but they don’t have the time to properly learn about, allocate to and manage a client’s crypto investment that may amount to less than 5% of that client’s AUM,” stated Eric Ervin, CEO of Onramp Invest.

If you’re interested in attending one of our Digital Assets Office Hours, sign up and see past recordings here.

Important Information

This material is for informational purposes only and contains the opinions of the author, which are subject to change, and should not be considered or interpreted as a recommendation to participate in any particular trading strategy or deemed to be an offer or sale of any investment product, and it should not be relied on as such. This material is not intended to provide investment recommendations and is not an official statement of WisdomTree. This material represents an assessment of the environment discussed at a specific time and is not intended to be a forecast of future events or a guarantee of future results. Readers of this information should consult their own financial advisor, lawyer, accountant, or other advisor before making any financial decision.

This document and all information contained in it or otherwise related to this document and/or any WisdomTree crypto index should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. All information is impersonal and not tailored to the needs of any person, entity or group of persons. None of the Information constitutes an offer to sell or a solicitation of an offer to buy, any security or other asset, financial product or other investment vehicle or any trading strategy. It is not possible to invest directly in an index.

Information provided by WisdomTree regarding digital assets, crypto assets, blockchain networks or technology providers should not be considered or relied upon as investment or other advice, as a recommendation from WisdomTree, including regarding the use or suitability of any particular digital asset, crypto asset, blockchain network, technology provider or any particular strategy. WisdomTree is not acting and has not agreed to act in an investment advisory, sub-advisory, fiduciary or quasi-fiduciary capacity to any advisor, end client or investor, and has no responsibility in connection therewith, with respect to any digital assets, crypto assets, or blockchain networks or otherwise.

There are risks associated with investing, including the possible loss of principal. Crypto assets, such as bitcoin and ether, are complex, generally exhibit extreme price volatility and unpredictability, and should be viewed as highly speculative assets.

Crypto assets are frequently referred to as crypto “currencies,” but they typically operate without central authority or banks, are not backed by any government or issuing entity (i.e., no right of recourse), have no government or insurance protections, are not legal tender and have limited or no usability as compared to fiat currencies. Federal, state or foreign governments may restrict the use, transfer, exchange and value of crypto assets, and regulation in the U.S. and worldwide is still developing.

Crypto asset exchanges, liquidity providers, networks, protocols, settlement facilities, service providers and other participants in the digital asset ecosystem, and/or crypto assets related to the foregoing, may stop operating, permanently shut down or experience issues due to security breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your customer/Anti-Money Laundering) procedures, non-compliance with applicable rules and regulations, regulatory investigations or orders, technical glitches, hackers, malware or other reasons, which could negatively impact the price of any cryptocurrency traded on such exchanges or reliant on a digital asset ecosystem participant or otherwise may prevent access or use of the crypto asset.

Crypto assets can experience unique events, such as forks or airdrops, which can impact the value and functionality of the crypto asset. Crypto asset transactions are generally irreversible, which means that a crypto asset may be unrecoverable in instances where: (i) it is sent to an incorrect address, (ii) the incorrect amount is sent, or (iii) transactions are made fraudulently from an account. A crypto asset may decline in popularity, acceptance or use, thereby impairing its price, and the price of a crypto asset may also be impacted by the transactions of a small number of holders of such crypto asset. Crypto assets may be difficult to value and valuations, even for the same crypto asset, may differ significantly by pricing source or otherwise be suspect due to market fragmentation, illiquidity, volatility and the potential for manipulation.

Crypto assets generally rely on blockchain technology and blockchain technology is a relatively new and untested technology which operates as a distributed ledger. Blockchain systems could be subject to internet connectivity disruptions, consensus failures or cybersecurity attacks, and the date or time that you initiate a transaction may be different then when it is recorded on the blockchain. Access to a given blockchain requires an individualized key, which, if compromised, could result in loss due to theft, destruction or inaccessibility. In addition, different crypto assets exhibit different characteristics, use cases and risk profiles.

Onramp Invest, LLC (“Onramp”) is a technology company providing access to crypto assets for registered investment advisers, such as financial advisors. WisdomTree has licensed crypto indexes to Onramp for use by such advisors in managing separate accounts for their clients via Onramp. WisdomTree has a financial interest in Onramp.