Semiconductors Are off to a HOT Start in 2023…after a COLD 2022

As we begin 2023 looking at technology-oriented investments, a “consumer slowdown” and related macroeconomic factors are front and center in investor considerations:

• Worldwide shipments in personal computers (PCs) totaled 286.2 million units in 2022, a 16% decline from 2021.1

• Global Information Technology spending contracted 0.2% in 2022, dropping to a total figure of $4.38 trillion. It is rare to see this figure, which represents spending in many different categories of things, contract. PCs, smartphones and other devices are seeing the biggest cuts. Devices spending dropped more than 10% in 2022.2

• Taiwan Semiconductor Manufacturing Co. (TSMC) has indicated that its revenue may drop as much as roughly 5% in the current quarter, and it expects lower capital expenditures when measured against the 2022 figures. TSMC is the world’s largest contract chip maker, and it has set its capital expenditure budget at $32 billion to $36 billion, which compares to $36.3 billion in 2022.3

However, the fact that semiconductor companies behave in a cyclical fashion, sensitive to the ups and downs of supply and demand, is not new. There was a deluge of negative news and a downplaying of forward-looking expectations in the second half of 2022. During earnings calls, the CEOs of semiconductor companies put on a masterclass in seeking to lower forward-looking expectations.

Therefore, we could be in a position where, at the start of 2023, any news that does not represent the most bearish of possible outcomes is viewed positively.

Semiconductor Companies Have Rallied Strongly to Start 2023

When many investors think about “growth” or “tech,” they first think of the Nasdaq 100 Index. This Index functions as a baseline, where the top holdings are some of the world’s largest companies driving what we think of as “information technology” forward.

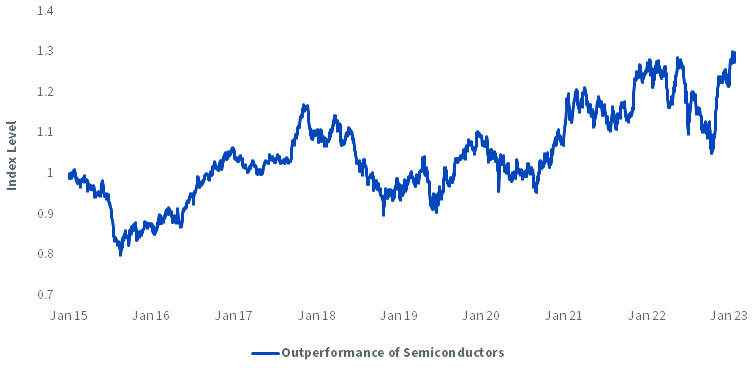

In figure 1a, we created a ratio chart where, as the line moves from the left to the right of the page:4

• An upward or positive slope represents the outperformance of semiconductor companies relative to the Nasdaq 100 Index.

• A downward or negative slope represents the underperformance of semiconductor companies relative to the Nasdaq 100 Index.

When we see the overall trend going back to 2015, we know that semiconductor companies have generally performed strongly—since the line is higher at the right of the chart than the left, we know that Semiconductors outperformed the Nasdaq 100 Index. However, the line is not stable or smooth, and it is characterized by sweeping upward and downward trends. We show those figures specifically in figure 1b.

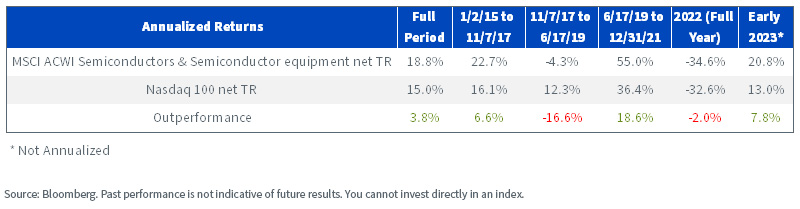

• This full period was strong from “tech stocks.” The Nasdaq 100 Index was up 15.0% annualized, whereas Semiconductors was up 18.8% annualized.

• Our “recent memory” is coloring our perception, so what we likely closely remember is how it felt to watch Semiconductors drop -34.6%, but at the same time, the Nasdaq 100 Index dropped -32.6%. 2022, as we all well know, was a rough year for the returns of technology-oriented stocks.

• We would say that the 2022 experience was largely a result of what had come directly before—a massive expansion in near-term demand as many people shifted their working practices and purchased different types of hardware to allow them to work from anywhere. From June 17, 2019, to December 31, 2021, Semiconductors returned 55.0%, annualized, while the broader Nasdaq 100 Index returned 36.4%.

• We find it interesting that even with all the same headwinds, like higher interest rates, a higher cost of capital and a lowered expectation of global economic growth, semiconductor stocks have risen 20.8% in early 2023, through 1 February 2023, compared to the Nasdaq 100 Index rising 13.0%. Roughly 1-month is not a significant length of time, but it’s notable that this period immediately precedes most of the companies reporting their earnings results from the period ending December 31, 2022. Maybe there is an implicit assumption in these returns that the results could be “less bad” than what the CEOs of the semiconductor companies had guided toward in prior quarters. So far, it has been resilient to Intel’s rather challenging results.

Figure 1a: Ratio of Cumulative Performance—Semiconductors vs. Nasdaq 100 Index (January 2, 2015, to February 1, 2023

Figure 1b: Table of Returns over Selected Periods within Figure 1a.

Conclusion: The Two Forces of 2023 That Determine the Semiconductor Return Experience

No one knows how the performance of semiconductor companies will evolve over 2023, but we are watching two critical areas of the space.

1. Even if 2022 was poor from a direct share price performance perspective, there was an enormous array of announcements of planned new plants to be built in different states in the U.S. There was also the passage of the “Chips Act.” Even if it will take years before these plants will be making physical chips that can be sold, the signal that these companies are adjusting their supply chains to be less geographically reliant on Taiwan is an important one.

2. As we stated, the general CEO of a semiconductor company was focused on lowering guidance for the upcoming quarterly earnings results. When this happens, the future reports become less about the number on the page and more about whether the number on the page is “less bad” than the guidance. If there is a perception that things are “less bad,” it’s possible that share prices can rally even if the results in isolation do not look great.

As we write these words, we recognize that the earnings season is ongoing and new results are coming out all the time. If one story has dominated so far, it has been Intel’s rather negative picture. CEO Pat Gelsinger has noted that he, along with other managers, will be taking pay cuts to help in containing costs5. Even if the slowdown in PC sales has been well-documented, as has the slowdown in smartphone demand, we did find one bit of news interesting—the fact that AMD is picking up market share in data centers relative to Intel6. This is still early, in that Intel’s lead is rather large, but it is one trend we are intently watching.

If Semiconductors can continue to outperform the Nasdaq 100 Index through the upcoming earnings season, this would lend strength to the concept that they may be able to hold onto this for the year, as opposed to us remembering that quick three-week period of strong performance before the market gave it all back.

At WisdomTree, we write a lot about semiconductors, largely because the global economy, as we have come to know it, cannot function without them. Investors seeking specific exposure to semiconductors designed to power artificial intelligence applications may see these companies within the broader WisdomTree Artificial Intelligence and Innovation Fund (WTAI). Where sometimes artificial intelligence is viewed as software, we felt it important to recognize that semiconductors provide a crucial foundation for these applications and calculations.

1 Source: Denny Jacob, “PC Shipments Drop Sharply in a Slump Expected to Last Until 2024,” Wall Street Journal, 1/11/23.

2 Source: Angus Loten, “Global IT Spending Decreased in 2022,” Wall Street Journal, 1/18/23.

3 Source: Yang Jie, “TSMC Warns of Possible Revenue Drop, Spending Cut,” Wall Street Journal, 1/12/23.

4 When referencing figures 1a and 1b, “Semiconductors” is defined as the universe of companies within the MSCI ACWI Semiconductor and Semiconductor Equipment Index. A positive slope therefore indicates a trend of outperformance of the MSCI ACWI Semiconductor and Semiconductor Index against the Nasdaq 100 Index, and a negative slope represents the opposite.

5 Source: Wall, Robert. “Intel CEO Takes Pay Cut as Chip Maker Targets Cost Reductions.” Wall Street Journal. 2/1/23.

6 Source: Clark, Adam. “AMD Stock is Climbing. Its Success is Buoyed by Intel’s Weakness.” Barron’s. 2/1/23.

Important Risks and Disclosure Related to This Article

There are risks associated with investing, including the possible loss of principal. The Fund invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.Click here for a full list of WTAI’s Fund holdings. Holdings are subject to change and risk.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.