Time to Dive Deep into Value

2023 is off to a cautious start, heralded by the International Monetary Fund (IMF). It has warned that the upcoming recession will likely leave the global economy fundamentally damaged—with a recession in the U.S., a deeper slowdown in Europe and a drawn-out recession in the United Kingdom. This is quite possible; however, the current downturn may not look like downturns of the past as it’s supported by a more resilient labor market. As we transition to 2023, three questions from 2022 remain unanswered:

1. How sticky will the underlying inflation be?

2. How intense will the recession be?

3. Will we find a solution to Europe’s energy crisis?

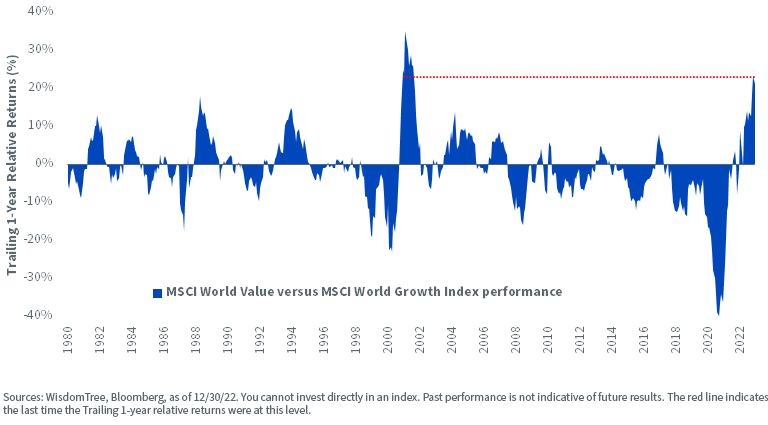

2022 was a tough year for equities, as evident by the 20% decline in the global stock market capitalization to $96.6 trillion1. Expensive growth stocks that had driven markets higher over the past decade began to correct sharply as the interest rate regime changed. In contrast, value stocks, while down for the year, were relative outperformers. The MSCI World Value Index outperformed its growth counterpart by 21% this year.1 The rising rate environment had a strong role to play in the higher relative performance.

Rotation from Growth into Value Stocks

Central Banks Turn up the Hawkish Rhetoric

While inflation has begun showing signs of easing globally, central banks in the U.S., Europe and the UK continue to remain hawkish. The Federal Open Market Committee’s (FOMC) new forecasts for the economy and policy showed few signs that the inflation picture is improving meaningfully. Federal Reserve (Fed) Chair Powell made clear in the December meeting that he wanted to see “substantially” more progress on inflation before the hiking would stop. The Fed is pointing out that there is no Fed put left while markets continue to misprice what the Fed is going to do.

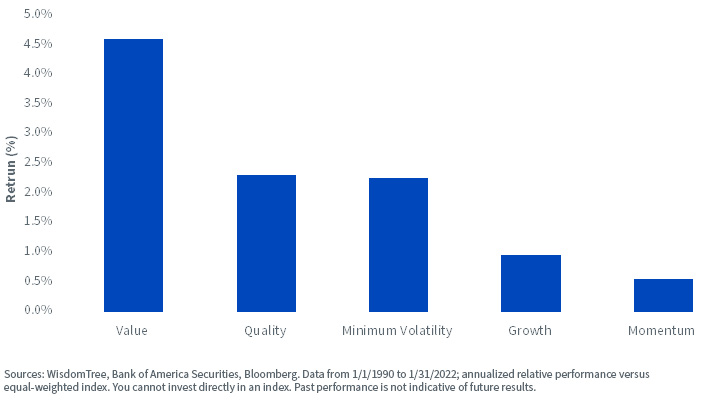

The latest European Central Bank (ECB) projections show inflation is unlikely to reach the 2% target until late 2025. At its December meeting, the ECB took a hawkish turn, and we think it is likely to hike by 50 basis points (bps) at least twice more, in February and March 2023. Similarly, in the UK, the Monetary Policy Committee (MPC) will need to see core consumer price index (CPI) inflation slow materially before the MPC stops its rate hike cycle. The key question in 2023 remains how sticky inflation will be on the upside (how soon it will approach the central bank’s targets), as it will determine the likelihood of central banks maintaining their hawkish stance on monetary policy. Historically, the value factor has demonstrated resilience during periods of interest rate volatility.

Factor Performance during Periods of Above-Average Interest Rate Volatility

De-risking Your Equity Portfolio with the High-Dividend and Value Factors

As interest rate volatility is poised to remain high, value-oriented stocks such as Financials, Energy, Utilities, Health Care and Industrials may be in better shape to withstand a slowdown. This is because value companies tend to make their money in the near term, owing to which earnings for these companies are less discounted than for growth companies whose significant profits and cash flow are expected to occur far in the future. Value stocks also have a better chance of defending and/or growing their operating margins than growth stocks.

The high-dividend factor is synonymous with an investment strategy that gains exposure to companies that appear undervalued and have demonstrated stable and increasing dividends. The strong performance of the dividend factor in 2022 has been a function of its close relationship with stocks with more stable fundamentals alongside the rising rate environment.

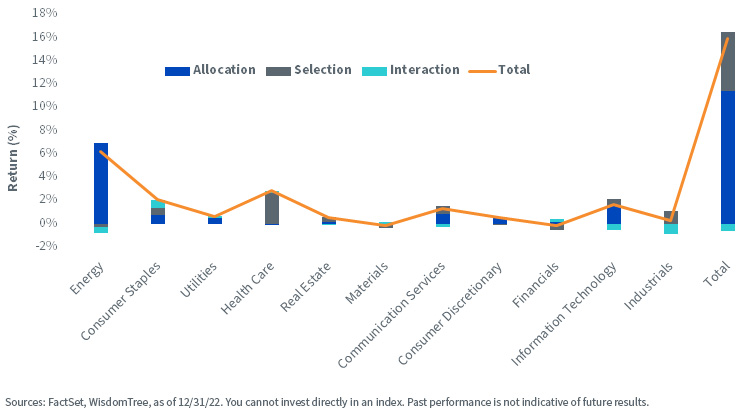

What Worked in 2022?

Our approach to blending the high-dividend factor alongside the value factor helped the WisdomTree U.S. High Dividend Index (WTHYE) outperform the Russell 1000 Value Index (RLV Index) by 15.9% in 2022. As illustrated in the sector attribution (below), the allocation has been positive, contributing to the tracking difference by +11%. The over-weight in Energy, Information Technology and Consumer Staples benefited performance by +7%, 2% and 1%, respectively, last year.

Sector Attribution – 2022

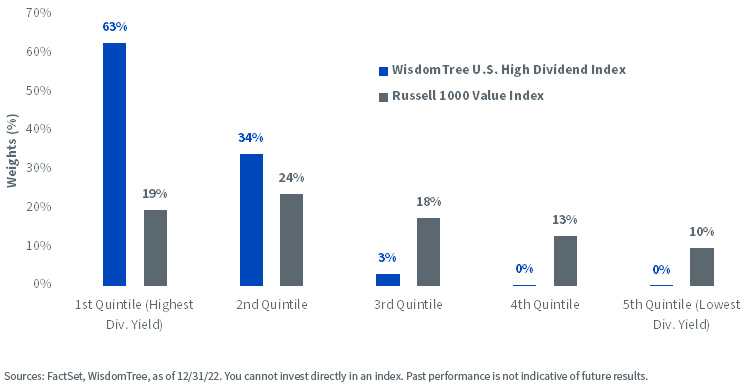

More importantly, the higher allocation of the WisdomTree U.S. High Dividend Index to the higher-yielding dividend quintiles also contributed to the higher relative performance versus the Russell 1000 Value Index.

Allocation within Dividend Yield Quintiles

1 Source: Bloomberg, as of 12/30/22.

For definitions of terms/indexes in the charts above, please visit the glossary.

Aneeka Gupta is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

Aneeka Gupta is Director of Research at WisdomTree. Prior to the acquisition of ETF Securities in April 2018, Aneeka worked as an Equity & Commodities Strategist at the company. Aneeka has 17 years of experience working as a Research Analyst across a wide range of asset classes. In her current role she is responsible for conducting analysis for all in-house equity, commodity and macro publications and assisting the sales team with client queries around products and markets.

Prior to WisdomTree, Aneeka began her career as an equity analyst at Bear Stearns International Ltd in London. She also worked as an Equity Sales Trader at Sunrise Brokers across US and Pan European Exchanges. Before that she worked as an Equity Derivatives Sales Manager at Mashreq Bank in Dubai.

Aneeka holds a Masters in Mathematics from Oxford University and a BSc in Mathematics from the University of Delhi, India. She is also a CFA Charterholder.