A Three-Year Journey Back to the Same Place…

On December 18, 2022, Jason Lemkin posted a blog piece titled “Right Back to Where We Were 3 Years Ago.” It caught my attention because he was looking at an earlier version of the following:

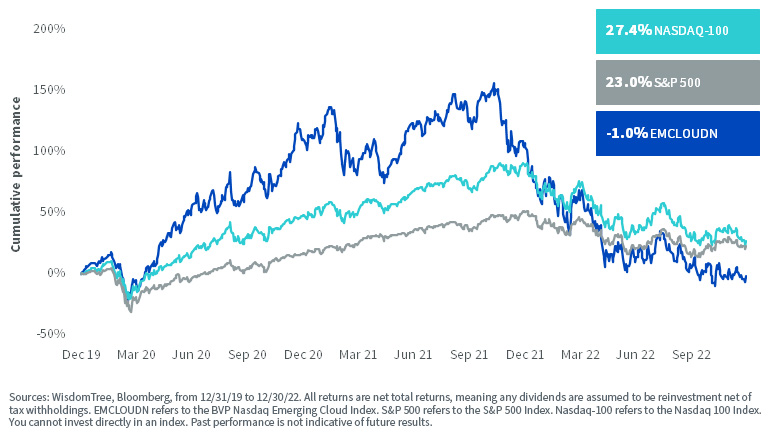

Figure 1: Cumulative Performance of Select Equity Indexes over Three Years Ended December 30, 2022

This is a staggering illustration for those of us who have been following the performance of Software-as-a-Service (SaaS) cloud computing companies. It is telling us, quite clearly, that the impact of the “pandemic pull-forward” of demand for software consumption is completely removed from the three-year performance number.

To us, it means that it is time to ask a simple question: Is the market giving us a “do-over,” meaning that we can now access companies at something similar to “pre-pandemic” levels, or is the jig up and the cloud business model doomed to fade away into the sunset?

SaaS Companies Have Evolved Significantly since 2019

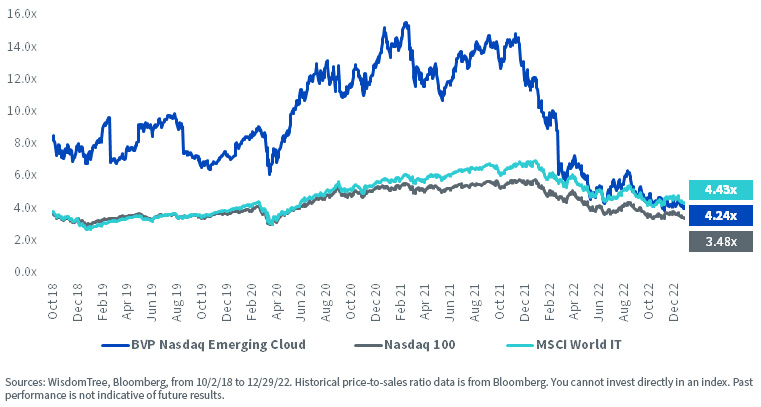

In figure 2, we wanted to look at valuation over the same period. Even if the share price performances of the underlying companies have run up and then fallen back in most cases—leading to the observed performance of the BVP Nasdaq Emerging Cloud Index—we have not been seeing companies reporting widespread negative year-over-year revenue growth. Instead, we’ve tended to see the revenue growth ranges shifting downward, with the median figure for the Index now closer to the 30% level. In contrast, it was higher than 40% for a period ending roughly one year ago.

If prices have dropped but sales have continued to grow, it’s possible to see that the valuation opportunity at present is better than it was in December 2019, three years ago. In figure 2, we see that the price-to-sales ratio was 7.0–8.0x during this period, whereas presently, it is below 4.5x. We agree that these stocks should be less expensive today in that the risk today is higher, and the cost of capital is also higher. We can’t know with certainty if the current price levels perfectly encapsulate this risk, but it is simply important to know that the risk does look like it is, to some effect, being accounted for.

Figure 2: Historical Price-to-Sales Ratio since Live Inception of the BVP Nasdaq Emerging Cloud Index

Now, in our opinion, within Software-as-a-Service companies, one must always marry looking at valuation to looking at revenue growth. Many of these firms, as yet, do not carry through positive net income to the bottom lines of their income statements, so if one can look at a reasonable fundamental, sales seems to make the most sense at this point in the development of the megatrend. We do view this as a megatrend, which means the time horizon we are thinking about is not the next 12 months or couple of years, but something that should unfold over a decade.

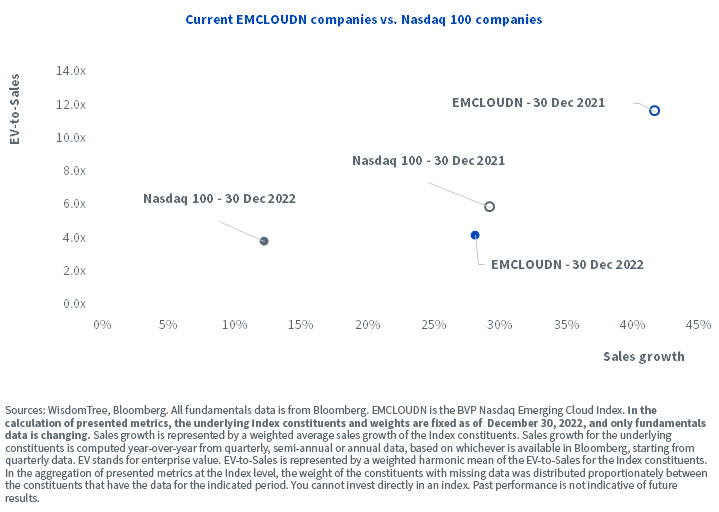

Figure 3 shows a notable evolution in that, in December 2021, companies currently held (meaning those companies in the Index as of December 2022) in the BVP Nasdaq Emerging Cloud Index were 2x as expensive on an enterprise-value-to-sales basis than the companies in the Nasdaq 100. Looking at the same multiple in December 2022, the Index comprised of Software-as-a-Service stocks costs almost the same as the broad technology benchmark.

Growth, on the other hand, has come down more slowly than valuation. Now, this is “revenue growth,” not earnings growth or cash flow growth, but we note that companies are still growing, and some are still delivering results ahead of Wall Street’s expectations. If the Nasdaq 100 is growing something close to 10%, and the BVP Nasdaq Emerging Cloud Index is growing something close to 30%, is this a worthwhile trade-off? The Nasdaq Index predominantly represents proven, established businesses, with some of the world’s most valuable companies, measured by their market capitalizations, getting the top weights. The risk profiles of these groups of stocks should be quite different, but if we are able to think not of the next 12 months but rather the next 10 years, does the difference in risk potentially make sense?

We do feel comfortable concluding there is a better chance of it making sense at the present valuation trade-off than it did at the near-term market high observed in November 2021, even if it’s impossible to know the future with certainty.

Figure 3: SaaS Companies Showcase Higher Growth at Similar Aggregate Multiple to the Nasdaq 100 Index

Where the Rubber Meets the Road: What Do SaaS Companies Do?

In our opinion, no discussion of cloud computing or SaaS companies is complete without at least giving some treatment to what the companies do. SaaS is just a business model—a way to provide/consume software that competes with other ways to provide/consume software. Do people prefer subscription models, or would they want to go back to a world where they need to buy a DVD and physically hold and use their own copy? If the software is necessary and valuable and the company can execute its strategy, we have confidence in the long term. If, on the other hand, the software is discretionary and more “nice to have” than needed, then there could be more risks. We see the following functional groupings as a starting point:

- Cybersecurity: Companies like CrowdStrike, SentinelOne, Cloudflare, Zscaler and Darktrace focus on cybersecurity. Subscribing to cybersecurity protection makes sense because we know that attackers are always evolving. Stagnant protection would eventually lead to limited protection. Many SaaS cybersecurity firms are not necessarily trading at single-digit price-to-sales multiples, but it’s also the case that cybersecurity has received massive attention from investors in 2022, largely due to the Russia/Ukraine conflict.

- Software Development: Companies like Twilio, Atlassian and New Relic are involved with running platforms useful to software development. Twilio and Atlassian have faced challenges in their share price performance during their most recent quarterly earnings reporting periods. However, we believe that the service they provide for software development remains critical.

- Business Services: A company like Bill.com is very interesting in that it is an example of a service that helps small and mid-sized firms manage their expenses. It’s a good case to remember because companies will tend to employ services like this to create efficiencies and save costs and time. We couldn’t ever say this company (or others like it) would be immune to recessionary pressures, but we find it important to note that it also may not be the first subscription to cut, either.

Cloud computing and Software-as-a-Service companies do not have long histories of operation where we can look back at their performance during the global financial crisis of 2008–2009, and we’d have to assume that, if they were around in 2001 and 2002, their performance as the “tech bubble” burst would have been significantly negative. To say these companies are completely resilient to recession is not a thesis that was proven in 2022. However, we’d note that their revenues are still growing, so it’s not the case either that these companies immediately reverted to negative revenue growth and collapsing fundamentals. If people view this as a megatrend, as we do at WisdomTree, the coming months could be a much more interesting entry point than anything we have seen recently, even if near-term performance could still be challenging.

The WisdomTree Cloud Computing Fund (Ticker WCLD) is designed to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index, which is another reason why Jason Lemkin’s blog post on December 18, 2022, caught our eye.

As of January 6, 2022, WCLD held 0.87%, 0.88%, 0.99%, 1.10%, 0%, 1.15%, 0.78%, 1.51% and 0.97% in CrowdStrike, SentinelOne, Cloudflare, Zscaler, Darktrace, Twilio, Atlassian, New Relic and Bill.com, respectively. Click here for a full list of Fund holdings. Holdings are subject to change.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the internet and utilizing a distributed network of servers over the internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

THE INFORMATION SET FORTH IN THE BVP NASDAQ EMERGING CLOUD INDEX IS NOT INTENDED TO BE, AND SHALL NOT BE REGARDED OR CONSTRUED AS, A RECOMMENDATION FOR A TRANSACTION OR INVESTMENT OR FINANCIAL, TAX, INVESTMENT OR OTHER ADVICE OF ANY KIND BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS DOES NOT PROVIDE INVESTMENT ADVICE TO WISDOMTREE OR THE FUND, IS NOT AN INVESTMENT ADVISER TO THE FUND AND IS NOT RESPONSIBLE FOR THE PERFORMANCE OF THE FUND. THE FUND IS NOT ISSUED, SPONSORED, ENDORSED OR PROMOTED BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS MAKES NO WARRANTY OR REPRESENTATION REGARDING THE QUALITY, ACCURACY OR COMPLETENESS OF THE BVP NASDAQ EMERGING CLOUD INDEX, INDEX VALUES OR ANY INDEX RELATED DATA INCLUDED HEREIN, PROVIDED HEREWITH OR DERIVED THEREFROM AND ASSUMES NO LIABILITY IN CONNECTION WITH ITS USE. BESSEMER VENTURE PARTNERS AND/OR POOLED INVESTMENT VEHICLES WHICH IT MANAGES, AND INDIVIDUALS AND ENTITIES AFFILIATED WITH SUCH VEHICLES, MAY PURCHASE, SELL OR HOLD SECURITIES OF ISSUERS THAT ARE CONSTITUENTS OF THE BVP NASDAQ EMERGING CLOUD INDEX FROM TIME TO TIME AND AT ANY TIME, INCLUDING IN ADVANCE OF OR FOLLOWING AN ISSUER BEING ADDED TO OR REMOVED FROM THE BVP NASDAQ EMERGING CLOUD INDEX.

Nasdaq® and the BVP Nasdaq Emerging Cloud Index are registered trademarks and service marks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by WisdomTree. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.