Four Habits of Highly Successful Advisors: Part Three

My colleague Ryan Krystopowicz and I recently co-wrote and posted to the WisdomTree website a white paper “think piece” entitled, “Four Habits of Highly Successful Advisors.”1 We are now “serializing” that white paper into four blog posts. In part 1, we discussed how to appropriately evaluate and build enterprise value by focusing on scale, efficiency and profitability. In part 2, we focused on the importance of client segmentation and niche branding. Here in part 3, we focus on the importance of optimizing fees and taxes—the two things an advisor has the most control over.

Habit Three: Optimize Taxes and Active Management Fees

It is a well-known market adage that the only investment aspects advisors really have control over are fees and taxes—they cannot control market movements.

Well, it’s an adage because it’s true. Optimizing fees and taxes represents putting real money back into the pocket of your clients—ideally enough to cover your advisory fee and then some.

Optimizing Active Management Fees

Most advisors are familiar with the concept of “core/satellite” portfolio construction (sometimes referred to as “core and explore”), but let’s define terms so we are working from a similar framework.

The idea is to build an inexpensive and passive “core” portfolio, typically using ETFs, in an attempt to create a desired market exposure (or beta) portfolio in a cost- and tax-efficient manner. Then, that core portfolio is surrounded with actively managed “satellite” managers in an attempt to add net-of-fee outperformance (or alpha) to the overall portfolio. Historically, those active managers have come by way of mutual funds or, for larger clients, separately managed accounts (SMAs).

To understand the notion of adding alpha, we also need to remind ourselves of the concept of active risk.

Simplistically, active risk can be thought of as “bets” (over-weights, under-weights, factor tilts, etc.) an active manager takes away from the underlying benchmark to generate outperformance versus that benchmark.2

So, the goal of a core/satellite portfolio is to deliver cost- and tax-efficient outperformance relative to a defined benchmark (e.g., the S&P 500 index or the MSCI ACWI index for an equity portfolio).

Building a Better Mousetrap

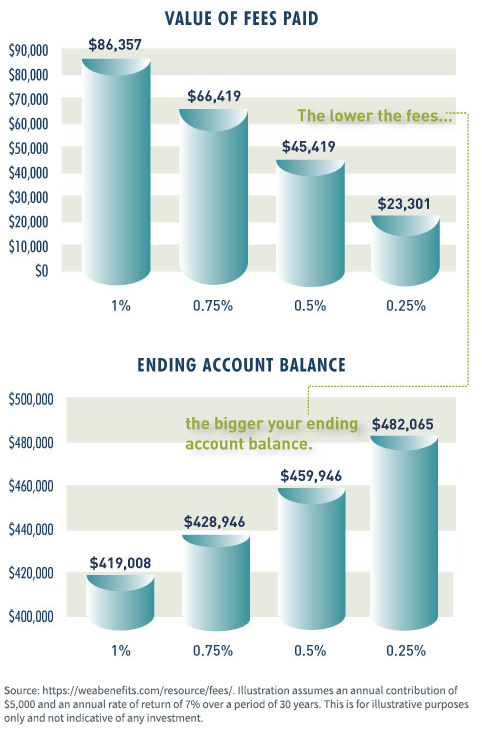

Fees matter—especially over long-time horizons.

The asset-weighted average expense ratio for active funds was 0.60% in 2021. That is exactly five times the asset-weighted average expense ratio for passive funds (0.12%) at that time.3

The illustration below highlights just how much of a difference higher fee investments can make over time.

The satellite component of the portfolio historically was constructed using actively managed mutual funds and/or SMAs. But what if you could build the satellite portfolio with structurally advantaged ETFs? Enter the WisdomTree Outcome Focused Model Portfolios.

We built these Models with “satellite” very firmly in mind.

While they can be—and are—used as stand-alone Models, they were built specifically to complement already existing portfolios to achieve specific investment mandates.

Our Outcome Focused Models include:

• Global Dividend, an all-equity portfolio seeking to optimize both total return and risk-adjusted yield.

• Multi-Asset Income, a portfolio that, as described, includes stocks, bonds and other assets in an attempt to optimize both total return and risk-adjusted yield.

• Multi-Factor, an all-equity portfolio that seeks to improve the risk factor diversification of an overall portfolio while still generating positive total return. This model is available in U.S., EAFE and EM versions.

• Volatility Management, a portfolio allocated to non-traditional or “alternative investment” strategies, including equity long/short, managed futures, diversified arbitrage, short-biased and options-based. The investment objective of including this Model is to improve the overall diversification of the portfolio by including lower correlated strategies and thereby deliver more consistent performance over full market cycles.

• Disruptive Growth, a portfolio that, exactly as it sounds, is “hyper growth” and seeks to take advantage of evolving or disruptive trends in the workplace, platforms, cloud computing, financial technology, cybersecurity, biotech and genomics, video games and esports, and sustainable investing.

If you know WisdomTree, you know we are not a passive beta shop, even though we are an ETF shop. All our products have one or more embedded “factor tilts” —dividends, value, size, quality, earnings and so forth.

In other words, all our strategies take “active risk” relative to an underlying passive beta index—risks that we believe, both academically and empirically, have the potential to deliver alpha over full market cycles in comparison to passive beta.

Think about an actively managed mutual fund (the typical component of a satellite portfolio). What is it? It is a portfolio manager (or team) taking on active risk in an attempt to deliver net-of-fee alpha, right?

Well, that is exactly what WisdomTree does.

The difference is that our active risk bets are rules-based and quantitative in nature. We are one of the few asset managers that self-indexes—we define a quantitative and rules-based filter or screen for a given product, develop an Index around those defined screens and then wrap an ETF around that Index.

So, in many respects, despite being an ETF shop, most of our products are more accurately compared to actively managed mutual funds than passive beta products. We typically will be more expensive than the passive beta product but much less expensive than the more comparable mutual funds, while taking on similar active risk.

So, let’s visualize some potential core/satellite portfolios using WisdomTree Outcome Focused Models versus actively managed mutual funds.

1. Purpose of the satellite is to optimize risk-adjusted income

2. Purpose of the satellite is to increase the overall diversification of the portfolio:

3. Purpose of the satellite is to optimize risk-adjusted income and overall portfolio diversification:

The beauty of core/satellite portfolio construction is that the possibilities are endless—you can construct the satellite portfolio with a myriad of investment objectives and populate accordingly.

We built our suite of Outcome Focused Model portfolios with this flexibility in mind. They are designed and managed to address a number of potential investment objectives and can be mixed and matched to meet multiple objectives. A primary purpose in doing so is to optimize active management fees and make core/satellite portfolio construction easy to implement using what we believe is a more cost- and tax-effective approach—a “better mousetrap.”

Optimizing Tax Efficiency

Tax efficiency is the second step in the “controllable alpha” aspects of portfolio construction. There are two levels of tax efficiency that advisors should be cognizant of—the investment wrapper level and the client account level.

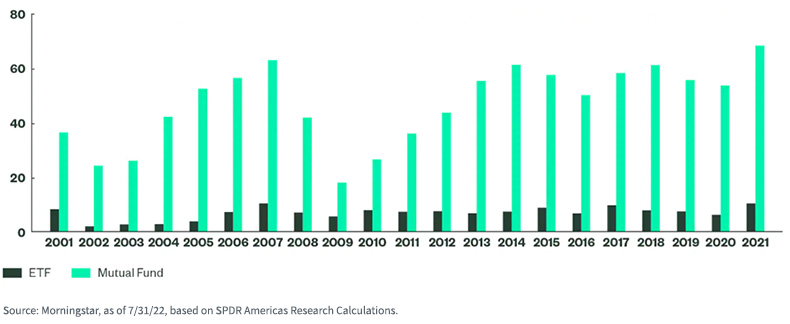

We already highlighted the investment wrapper—ETFs have historically paid fewer capital gains than their mutual fund peers.

How does this lead to alpha?

A study by finance professors at Villanova and Lehigh universities quantified that an ETF’s tax burden was 0.92 percentage points less than the typical mutual fund over the past five years. The following chart is from Morningstar:

Percentage of Funds Paying Capital Gains in Calendar Year (%)

The second level involves the client account—specifically the tax lots of the ETFs, mutual funds, bonds, stocks, etc. The tax management of accounts involves tax-loss harvesting, tax-aware transitions and tax-aware withdrawals. These services can be quite complex.

The good news?

Active tax management of portfolios is no longer the exclusive territory of high net worth clients with access to SMAs.

Advisors can now access technology platforms that perform tax portfolio transition services and then ongoing active tax management of the overall portfolio.

WisdomTree partners with a variety of trading platforms that can and will engage in tax management of ETF portfolios. Advisors can work with these platforms to transition existing portfolios into the desired portfolio in a tax-efficient manner based on client objectives and constraints, and then actively tax manage the new portfolio on a go-forward basis.

How does this lead to alpha? The FinTech platform 55ip reported that for accounts that used its ActiveTax Technology® overlay for all of 2020, advisors generated an estimated average of 2.58% in tax savings for their clients.4

To summarize, WisdomTree’s ETF structural bias, the active risk embedded into all our factor-tilted strategies and our partnership with technology platforms that enable active tax management of portfolios all combine to help advisors optimize the two things they have the most control over from an investment perspective—fees and taxes.

For those interested in learning about the rest of the habits, please keep an eye out for the other three blogs and make sure to read the entire white paper: “Four Habits of Highly Successful Advisors.”

1 With respect to Dr. Stephen Covey for his The Seven Habits of Highly Successful People, Simon & Schuster, Anniversary Edition, May 2020.

2 The seminal paper on active risk is “How Active Is Your Fund Manager” by Martijn Cremers and Antii Petajisto, first published as a working paper in 2006. It can easily be found by searching on the title and authors.

3 2021 U.S. Fund Fee Study. https://assets.contentstack.io/v3/assets/blt4eb669caa7dc65b2/blt36de8b5594de0582/62c6e888181754349ea2fa66/U.S._Fund_Fee_Study_2021.pdf

4 https://www.wisdomtree.com/blog/2021-03-19/the-so-called-certainties-in-life-seem-a-lot-like-mutual-funds

Important Risks Related to this Article

Investors and their advisors should consider the investment objectives, risks, charges and expenses of the Funds included in any Model Portfolio carefully before investing. This and other information can be obtained in the Fund’s prospectus by visiting wisdomtree.com for WisdomTree Funds. Visit the applicable third-party fund family website for third-party funds. Please read the prospectus carefully before you invest. WisdomTree Asset Management, Inc., does not endorse and is not responsible or liable for any content or other materials made available by other ETF sponsors.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Diversification does not eliminate the risk of experiencing investment losses. You cannot invest directly in an index

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: Your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds and management fees for our collective investment trusts.

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

WisdomTree is providing Model Portfolio information to 55ip pursuant to a license and related agreement with 55ip. There is an overlay fee when using a WisdomTree Model Portfolio in connection with 55ip’s technology, and WisdomTree is paying a portion of that fee to 55ip, which advisors would otherwise be required to pay. There is no assurance that such payments by WisdomTree will continue. Additional fees, including underlying fees to implement trading in transitioning a portfolio, may apply. WisdomTree and 55ip are not affiliated. WisdomTree makes no representations, warranties, endorsements or recommendations regarding 55ip, any 55ip technology, tax strategies or related information. WisdomTree has not reviewed or otherwise provided any content on 55ip’s website or for other materials created by 55ip, other than information about WisdomTree, and makes no representations, warranties or endorsements regarding such content and disclaims any responsibility associated therewith. 55ip is the marketing name used by 55 Institutional Partners, LLC, an investment technology developer, and for investment advisory services provided by 55I, LLC, an SEC-registered investment advisor. Such registration does not imply a certain level of skill or training.

Neither WisdomTree Investments, Inc., nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax advice. All references to tax matters or information provided in this material are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.

This material contains the opinions of the WisdomTree, which are subject to change, and should not be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product, and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Unless expressly stated otherwise, the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

Ryan Krystopowicz joined WisdomTree in March 2016 and serves as a Product Specialist, ETF Model Portfolios. He is a leading voice in the content and commercialization of WisdomTree’s Model Portfolio Research Study & Model Adoption Center. Ryan also contributes to the commercial success of WisdomTree’s Model Portfolio offerings by supporting Distribution and the management of host platforms. His passion for third-party model portfolios and investment outsourcing was cultivated during his tenure at a Registered Investment Advisor where he took on a variety of roles within research and operations. Ryan received a degree from Loyola University of Maryland and is a CFA charterholder.