Recent U.S. Equity Outperformance vs. Rest of World: Not Just Large-Cap Tech

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

A Decade-Plus-Long Run for U.S. Equity Markets

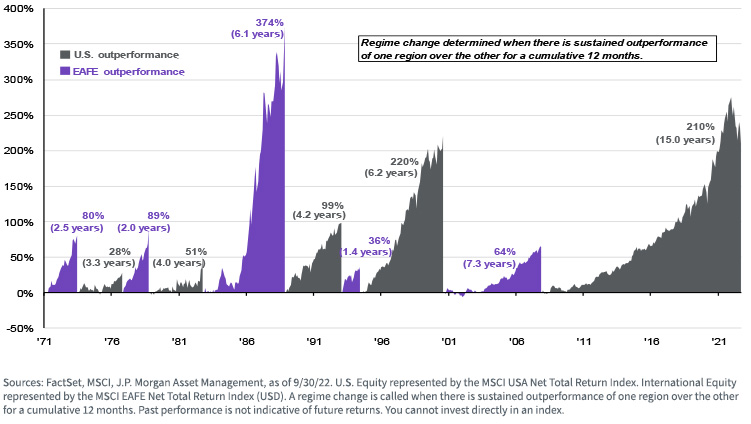

By some measurements, we are now more than 15 years into one of the most pronounced, long-lasting periods of U.S. equity outperforming international stocks in recent history.

Since the 1970s, the relative performance of U.S. versus international equities has been cyclical, and these cycles have lasted, on average, around five years. While it is impossible to predict the exact timing for when the current trend will reverse, one could certainly make the argument that international stocks may soon have their moment in the sun.

U.S. Equity vs. International Equity Cumulative Outperformance Cycles

Regardless of the market cycle, investors, in aggregate, tend to have a “home country bias.” Following this decade-plus-long run for domestic stocks, many U.S. investors are now questioning the need for international diversification altogether.

Despite the prevalence of home country and recency biases, our Model Portfolios reflect WisdomTree’s conviction in the long-term risk and return advantages of global diversification. Accordingly, we tend to utilize the MSCI All Country World Index (ACWI) as our reference benchmark from a regional exposure standpoint.

However, a notable caveat to the above is that our preference for dividend-paying, small-cap equities extends to both developed and emerging markets outside the United States.

Contrary to popular belief, these smaller, value-oriented companies have lagged their U.S. equivalents to nearly the same extent as the larger, market cap-weighted benchmarks.

For those investors who may now be contemplating a move into international equities and are focused on valuations, we believe small-cap dividend payers are an interesting area to consider.

U.S. Outperformance: Not Just Large-Cap Tech

U.S. equities delivered an 11.5% annualized return during the 12-year period ended September 30, 2022, as measured by the MSCI USA Index.

This compares to returns on international developed equities (MSCI EAFE Index) of 3.3% and only 0.7% for emerging markets (MSCI Emerging Markets Index).

U.S. Outperformance vs. Rest of World (Sep 2010–Sep 2022)

.jpg)

This period of U.S. dominance is often explained by a strengthening dollar or the significant appreciation of U.S. large-cap tech stocks. But these factors do not tell the entire story.

Below we show that U.S. equities have dramatically outperformed even the local market returns of international stocks.

U.S. Outperformance vs. Rest of World USD and Local Indexes (Sep 2010–Sep 2022)

.jpg)

Based on the performance of local equity markets over this same period, foreign exchange moves explain approximately 30%–40% of international developed and emerging equity underperformance. Clearly, a majority of the relative outperformance of U.S. equities was not solely currency related.

Many market commentators have also pointed to the FAANG stocks (Facebook/Meta, Amazon, Apple, Netflix and Google) to explain this recent relative performance cycle.

While the weight of these companies within traditional market cap-weighted indexes is significant, the U.S. outperformance story extends well beyond large-cap tech.

In fact, there has been a similar degree of relative outperformance over the past 12 years in U.S. value and small-cap stocks.

U.S. vs. Rest of World Annualized Returns (2010–2022)

.jpg)

A Potential Opportunity in Small-Cap Value outside the U.S.

These international small-cap value stocks, battered in recent years compared to their U.S. counterparts, now offer a compelling value and income opportunity.

Over the same 12-year period of U.S. outperformance ended September 30, 2022, the gap between the estimated Price/Earnings (P/E) ratio of the S&P 500 Index and MSCI ACWI Ex-USA Index has widened by more than 400%.

Estimated Price to Earnings (Sep 2010–Sep 2022)

.jpg)

What’s even more striking is how inexpensive value-oriented small caps outside the U.S. have become relative to the S&P 500 Index. The WisdomTree International and Emerging Markets SmallCap Dividend Indexes now offer P/E multiples in the single digits!

In addition to attractive valuations, the income offered by small-cap dividend payers outside of the U.S. is considerably higher than core U.S. equities.

Dividend Yield as of 9/30/22

Investing in Small-Cap Dividend Payers Abroad

The WisdomTree International SmallCap Dividend Fund (DLS), one of WisdomTree’s initial ETFs launched in 2006, tracks the WisdomTree International SmallCap Dividend Index, providing exposure to small-cap dividend-paying companies in the developed international world, ex-U.S. and Canada.

The WisdomTree Emerging Markets SmallCap Dividend Fund (DGS), launched in 2007, tracks the WisdomTree Emerging Markets SmallCap Dividend Index and provides exposure to small-cap dividend-paying companies in emerging markets.

Both Funds are value-oriented and provide the following enhancements to traditional market cap-weighted indexes:

- Screen the eligible universe of stocks to only include dividend-paying companies

- Remove those companies most at risk of cutting their dividend based on quantitative risk screens

- Take a dividend-weighted-to-index construction based on each underlying company’s Dividend Stream®

Conclusion

Perfectly timing the start of a new outperformance cycle for international stocks may be a fool’s errand. But we are now 15+ years into a prolonged period of U.S. leadership that has historically been quite cyclical.

While the strength of the dollar and the performance of large-cap tech companies have often been cited as drivers of recent U.S. outperformance, international small-cap and value stocks are now equally inexpensive relative to their U.S. counterparts.

For investors interested in diversifying outside the U.S. but focused on risk mitigation in the form of valuations and income, small-cap dividend payers in developed and emerging international markets offer a compelling investment case.

Important Risks Related to this Article

DLS: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund invests in derivatives in seeking to obtain a dynamic currency hedge exposure. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Derivatives used by the Fund may not perform as intended. A Fund that has exposure to one or more sectors may be more vulnerable to any single economic or regulatory development. This may result in greater share price volatility. The composition of the Index underlying the Fund is heavily dependent on quantitative models and data from one or more third parties, and the Index may not perform as intended. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

DGS: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector and/or smaller companies generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.