Managing Risk via Small-Cap Dividend Growers

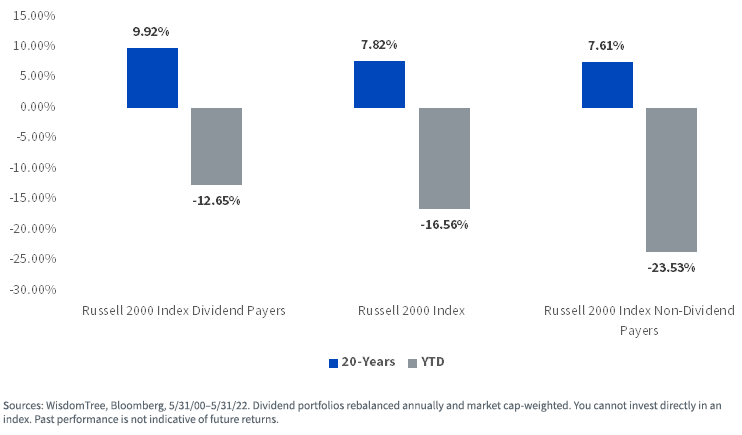

So far in 2022, the biggest determinant of total returns has not been value versus growth but rather dividend versus non-dividend payers. While much of the attention has been focused on large-capitalization equities, we’ve noticed an even more marked dispersion among small caps.

The outperformance of small-cap dividend payers in 2022 is also not a new phenomenon—over the last 20+ years, dividend payers in the Russell 2000 have outperformed non-dividend payers by more than 2% per year.

With valuations near all-time lows and a strong dollar potentially weighing on large-cap profitability, we believe now may be the time to increase exposure to small caps, as long as you’re looking through the lens of dividend growth.

The WisdomTree U.S. SmallCap Quality Dividend Growth Index (WTSDG) selects dividend-paying companies with the best combined rank of earnings growth and quality factors, such as ROE and ROA, and weights by their dividend stream. The WisdomTree U.S. SmallCap Quality Dividend Growth Fund (DGRS) seeks to track WTSDG, before fees and expenses.

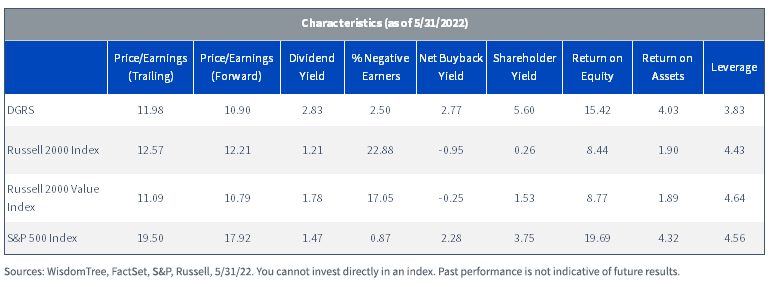

WTSDG methodology tilts the portfolio to what we believe are well managed, high-quality, profitable companies with strong balance sheets, better valuations and lower leverage.

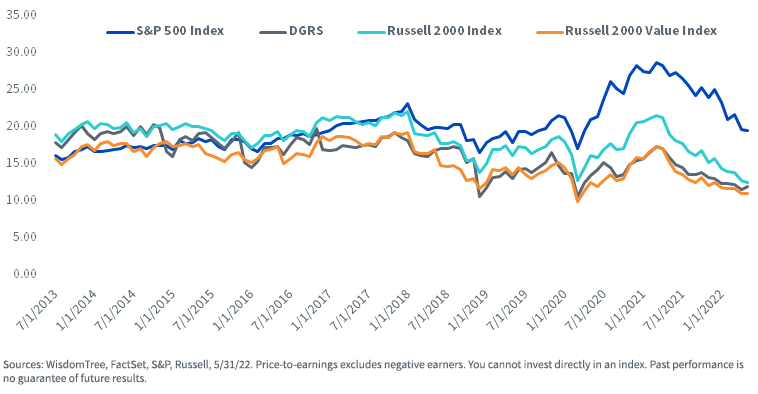

Valuations

While technically classified by Morningstar as a small-cap blend strategy, DGRS has historically traded at similar valuations to small-cap value. At present, that means P/Es approaching levels not seen since the market lows of March 2020.

Price-to-Earnings

Quality Stocks

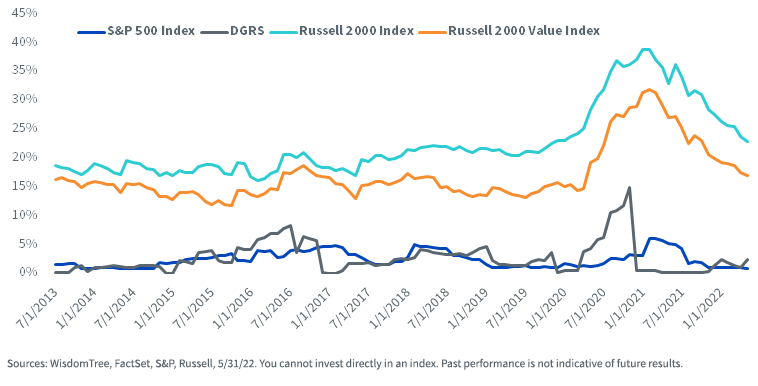

Despite compelling valuations, investors remain concerned about earnings quality as the risk of recession rises.

As of May 31, 2022, small-cap indexes such as Russell 2000 and Russell 2000 Value had more than 22% and slightly above 17% exposure to companies with negative earnings. Compare that to DGRS, our quality small-cap Fund, which only had 2.5% invested in unprofitable companies.

Percentage of Companies with Negative Earnings

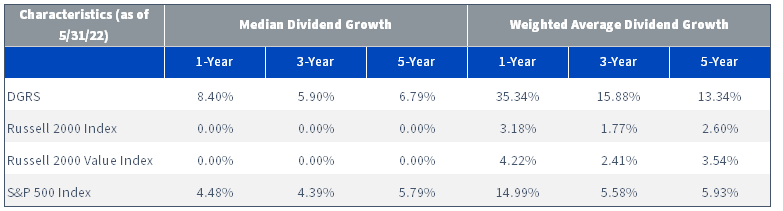

Anchoring to Dividends

Small caps have been susceptible to significant drawdowns when the risk of a recession rises. In the current environment, which rewards dividend payers, market cap-weighted small-cap benchmarks have come under significant pressure, given that only 36% of the Russell 2000 Index currently pays a dividend. We contrast this with a strategy like DGRS that is not only comprised of dividend payers but also focuses on companies WisdomTree believes are best positioned to grow their dividends over time.

In fact, the median constituent in DGRS has grown its dividends by 8.4% over the last year, nearly double the rate of the S&P 500. Since the Russell Indexes are comprised of a significant number of non-dividend payers, the median issuer is around zero. However, when looking at weighted averages, constituents in DGRS have not only been outpacing small-cap peers but large caps as well.

Tying It All Together

For the most recent standardized performance, 30-day SEC yield and month-end performance, click here.

For investors looking to diversify away from U.S. large caps, we believe small-cap dividend growers may be a compelling option. With dividend yields and growth rates nearly 2x the S&P 500, P/Es near single digits and historic lows, we believe DGRS may offer compelling value in an environment where dividend payers and dividend growth remain top of mind in investor portfolios.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.