WisdomTree Megatrends: Pulse Check

In early January 2022, we published an update on our megatrend suite of ETFs in the wake of the Fed’s announced tightening of monetary policy.

The new rate cycle caused steep sell-offs and more attractive, lower valuation entry points for investors seeking exposure to high-conviction secular and economic megatrends.

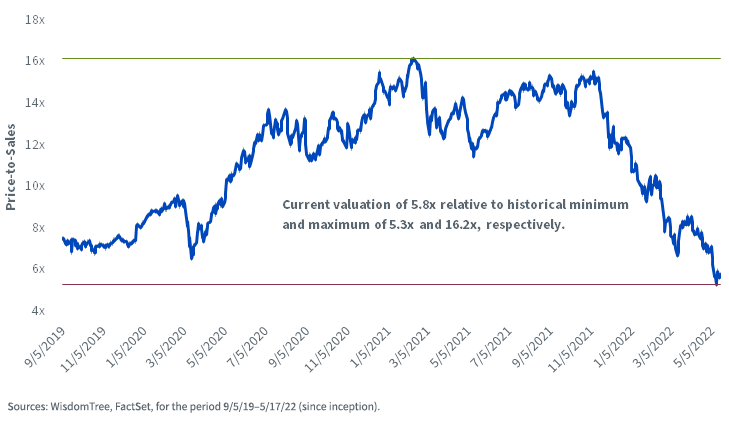

WCLD—Down 43% YTD1

The WisdomTree Cloud Computing Fund (WCLD) continues to be valued in line with historical lows, the strategy currently trades at 5.8 times price-to-sales, modestly above its historical minimum of 5.3 times. Relative to the Russell 1000 Growth Index, which is valued at 4.1 times, WCLD is trading at a 42.8% premium.

WCLD – Price-to-Sales

Only two names in the basket are positive year-to-date: Anaplan, Inc. (+42%), which is expected to be acquired and taken private, and Box (+8.9%), which projected sustained growth and an improved margin profile through 2025 at its March analyst day.2 The remainder of the basket is down a median of 46% year-to-date.

What’s driving the outsized decline relative to the Nasdaq 100 Index and Russell 1000 Growth Index, which are both down approximately 26% in 2022?

It’s hard to pinpoint a single driver—rising rates, recession fears and lack of GAAP profitability are certainly contributors. We believe short-term performance is primarily driven by the perception of changes in the big macroeconomic details and less by individual company fundamentals. Importantly, revenue growth for these companies remains persistent and impressive.

Median and weighted average trailing 12-month revenue growth across WCLD’s constituents is in a tight range of low-to-mid 30%, with no single company delivering below 10%. Meanwhile, revenue growth for the Russell 1000 Growth Index is generally lower and more dispersed, with median year-over-year growth of 22% and a weighted average metric of 30%. The growth within the Russell 1000 Growth Index is top heavy, with companies like Tesla, Apple and Microsoft being major contributors to the weighted average rate of growth that helps offset revenue contraction of 21 companies in the index.3

A natural argument may be that the trailing 12-month revenue growth figure still includes some of the COVID-19 benefit; but we still observe outsized revenue growth for WCLD relative to the Russell 1000 Growth Index when calculating quarter-over-quarter metrics. In the most recent quarter, WCLD constituents delivered 7% revenue growth, on a median, weighted-average and simple average basis. The Russell 1000 Growth Index posted revenue growth of -4%, 1.8% and 3.9% on a weighted-average, median and average basis, respectively.4

There are many factors for investors to consider when deciding whether to allocate to the cloud computing industry, and the industry’s consistent ability to deliver strong revenue growth should be one of them.5

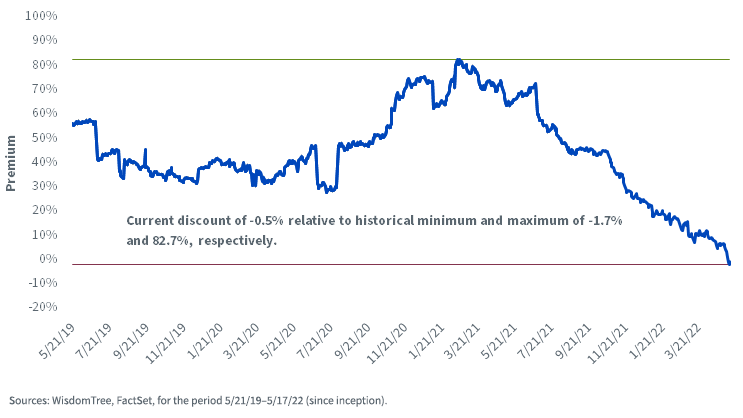

PLAT—Down 43% YTD6

The WisdomTree Growth Leaders Fund (PLAT), which invests in platform businesses operating large, scalable networks that disrupt traditional linear business models, is down 43% year-to-date. Similar to WCLD, only two names in the strategy are positive year-to-date, driven by M&A activity.

PLAT is trading in line with its historical minimum price-to-sale ratio and is valued at a 0.5% discount to the Russell 1000 Growth Index.

PLAT’s trailing 12-month growth rate is robust in the mid-30% to 40% range. Importantly, these rates are inflated by revenue growth from companies like Just Eat Takeaway.com, Zillow, Upstart, Delivery Hero and JD Health that have more than doubled their revenue year over year.

PLAT holds about 40% of its weight in common with the Russell 1000 Growth Index (for reference WCLD’s weight overlap is approximately 5%). As a modified market cap-weighted strategy, the top five companies in PLAT look a lot like the top holdings in the benchmark index, including Apple, Microsoft, Alphabet, Amazon and Meta. Given its weighting mechanism, it’s not surprising that PLAT has exhibited the same -4% quarter-over-quarter growth slowdown that we observed in the Russell 1000 Growth Index.

In our view PLAT is a similar, but higher-octane growth basket relative to the Russell 1000 Growth Index and it’s currently valued at a discount to the benchmark.

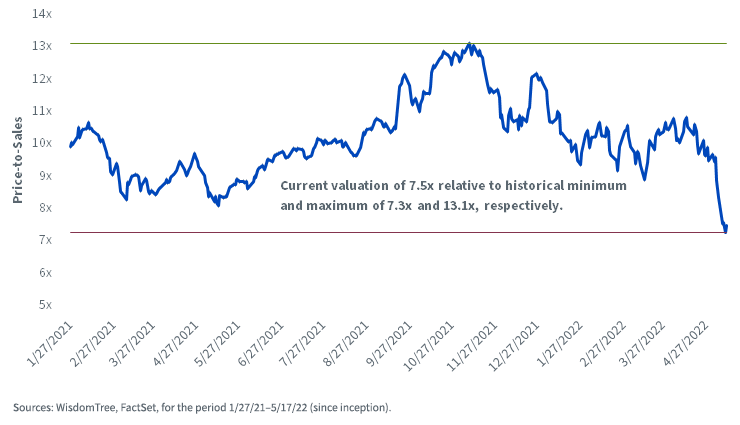

WCBR—Down 30% YTD7

In March, we wrote about the important role cybersecurity plays amid Russia’s invasion of Ukraine.

In our view, we continue to expect that the companies fortifying our nation’s technological borders will be increasingly valuable, both literally and figuratively, over the long-term. We suggested that investors weather the short-term cyclical changes and stay grounded in the original investment thesis that cybersecurity is at the epicenter of our increasingly complex world of interconnected systems and devices.

The WisdomTree Cybersecurity Fund (WCBR) has held up better than its closely linked peer, WCLD, but it has not been immune to market volatility. This basket is also trading closely in line with its historical minimum price-to-sales valuation, while generating high-20% to low-30% trailing 12-month revenue growth in aggregate.

WCBR – Price-to-Sales

WDNA—Down 25% YTD8

Networking and cybersecurity stocks are not the only stocks impacted by the recent market drawdown. The WisdomTree BioRevolution Fund (WDNA), which provides multi-sector exposure to genetics and biotechnology, is down 25% year-to-date.

WDNA is uniquely positioned to provide exposure to companies that are reading, understanding, writing and editing DNA for applications within the health care vertical and across interdisciplinary fields like agriculture, food, materials, chemicals and energy production. With WDNA's differentiated multi-sector mandate, approximately 20% of the Fund’s exposure is allocated outside Health Care and across the Materials, Consumer Staples and Energy sector.

Unlike WisdomTree’s aforementioned technology megatrend strategies, 21 stocks in WDNA are positive year-to-date. Many of WDNA’s top performers are agriculture and food companies (Nutrien, Archer-Daniels-Midland, Bayer, Dow, Corteva), which have come into high demand following Russia’s export ban on fertilizers.9 The strategy’s lower concentration in biotechnology stocks has benefited its performance relative to benchmarks like the S&P Biotechnology Select Industry Index, which is down 36% year-to-date.

On a weighted average basis, WDNA is currently trading at half the price-to-sales ratio as its benchmark, at 2.8 times versus 6.2 times for the S&P Biotechnology Select Industry Index.10 Given the wide range of valuations within the basket that can skew toward the extremes, it’s prudent to examine the median valuation as well. Below we chart the median historic valuation of WDNA, illustrating that the strategy is also hovering near its historic low of 4.9 times.

WDNA – Median Price-to-Sales

WDNA’s differentiated approach that encompasses more than just pharmaceutical, biotechnology and life sciences has provided the strategy with more defensive posturing than its benchmark amid the challenging first half of 2022.

A Megatrend Opportunity

One of investors’ prime concerns when evaluating megatrend strategies is valuations—we’re often asked, “Am I purchasing at the peak?” While no one can predict where equity markets are headed from here, we can confidently confirm that our megatrend strategies are valued far from their peaks and that they are, in fact, trading near historic minimum levels.

1 Sources: WisdomTree, FactSet, for the period 12/31/21–5/17/22. Performance at NAV.

2 Sources: WisdomTree, Bloomberg, for the period 12/31/21–5/17/22. Anaplan and Box are currently held at 2.6% and 2.0% weights, respectively, in WCLD.

3 Source: WisdomTree, FactSet, FTSE Russell, as of 5/19/22.

4 Source: WisdomTree, FactSet, FTSE Russell, as of 5/19/22.

5 There is no guarantee that any projection, forecast or opinion will be realized. Actual results may vary.

6 Sources: WisdomTree, FactSet, for the period 12/31/21–5/17/22. Performance at NAV.

7 Sources: WisdomTree, FactSet, for the period 12/31/21–5/17/22. Performance at NAV.

8 Sources: WisdomTree, FactSet, for the period 12/31/21–5/17/22. Performance at NAV.

9 As of 5/20/22, WDNA held Nutrien, Archer-Daniels-Midland, Bayer, Dow, Corteva in 0.8%, 2.0%, 1.3%, 1.7%, 1.9% weights, respectively.

10 Source: WisdomTree, FactSet, S&P, as of 5/17/22.

Important Risks Related to this Article

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Returns less than one year are not annualized. For current full performance, holdings and expenses, visit the respective fund page: WCLD, PLAT, WCBR, WDNA.

WCLD: There are risks associated with investing, including the possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the internet and utilizing a distributed network of servers over the internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Fund’s Index is heavily dependent on quantitative and qualitative information and data from one or more third parties and the Index may not perform as intended. Please read the Fund's prospectus for specific details regarding the Fund’s risk profile.

PLAT: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty; these risks may be enhanced in emerging, offshore or frontier markets. Technology platform companies have significant exposure to consumers and businesses and a failure to attract and retain a substantial number of such users to a company’s products, services, content or technology could adversely affect operating results. Technological changes could require substantial expenditures by a technology platform company to modify or adapt its products, services, content or infrastructure. Technology platform companies typically face intense competition and the development of new products is a complex and uncertain process. Concerns regarding a company’s products or services that may compromise the privacy of users or other cybersecurity concerns, even if unfounded, could damage a company’s reputation and adversely affect operating results. Many technology platform companies currently operate under less regulatory scrutiny but there is significant risk that costs associated with regulatory oversight could increase in the future. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties and the Index may not perform as intended. Please read the Fund's prospectus for specific details regarding the Fund's risk profile.

WCBR: There are risks associated with investing, including the possible loss of principal. The Fund invests in cybersecurity companies, which generate a meaningful part of their revenue from security protocols that prevent intrusion and attacks to systems, networks, applications, computers and mobile devices. Cybersecurity companies are particularly vulnerable to rapid changes in technology, rapid obsolescence of products and services, the loss of patent, copyright and trademark protections, government regulation and competition, both domestically and internationally. Cybersecurity company stocks, especially those which are internet-related, have experienced extreme price and volume fluctuations in the past that have often been unrelated to their operating performance. These companies may also be smaller and less experienced companies, with limited product or service lines, markets or financial resources and fewer experienced management or marketing personnel. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WDNA: There are risks associated with investing, including the possible loss of principal. The Fund invests in BioRevolution companies, which are companies significantly transformed by advancements in genetics and biotechnology. BioRevolution companies face intense competition and potentially rapid product obsolescence. These companies may be adversely affected by the loss or impairment of intellectual property rights and other proprietary information or changes in government regulations or policies. Additionally, BioRevolution companies may be subject to risks associated with genetic analysis. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.