Allocating to Emerging Markets amid Volatility

Even the most ardent emerging markets (EM) bulls have been forced to question the asset class’s investment merits this year.

Some of the headlines that have been weighing on returns: the Russian invasion of Ukraine, a strong dollar, and China’s “zero-COVID” policy stance and continued regulatory crackdowns.

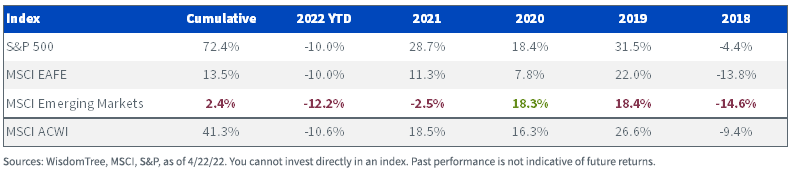

These headlines have only reinforced the narrative for some1 of the last several years of avoiding EM altogether. Nearly four months into 2022, EM is lagging the S&P 500 for the fifth consecutive year and lagging the MSCI ACWI by over 150 basis points (bps).

Index Total Returns since 2018

For definitions of terms in the chart above, please visit the glossary.

But not all pockets of EM have been a disappointment.

At the outset of the year, we suggested investors consider EM high dividends, with three key themes in mind: 1) a high inflation environment, 2) rising interest rates and 3) Chinese regulatory/Covid policy risks.

While we couldn’t foresee the Russia-Ukraine war, the conflict has intensified the first two themes, benefiting EM Energy and Materials companies.

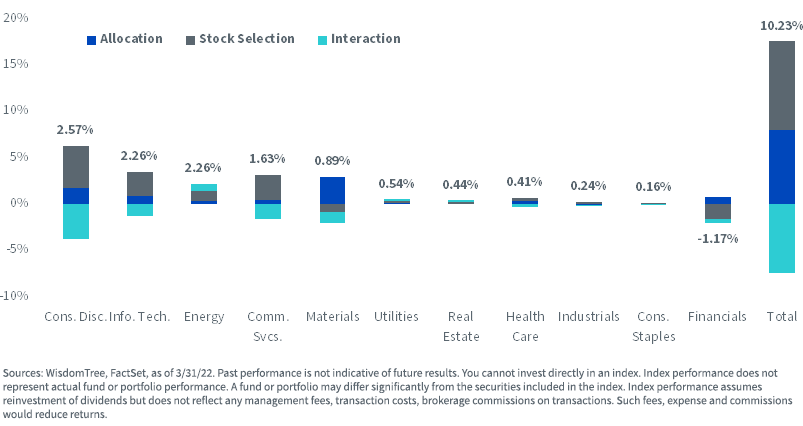

So far this year, the WisdomTree Emerging Markets High Dividend Index (WTEMHY) has outperformed the MSCI Emerging Markets Index by over 1,000 bps as it has benefited from the tailwinds of EM value leading growth and the rally in global commodity prices.

Below is a summary of the year-to-date sector attribution. More detail can be accessed on our website here.

Year-to-Date Sector Attribution: WisdomTree Emerging Markets High Dividend vs. MSCI Emerging Markets Index

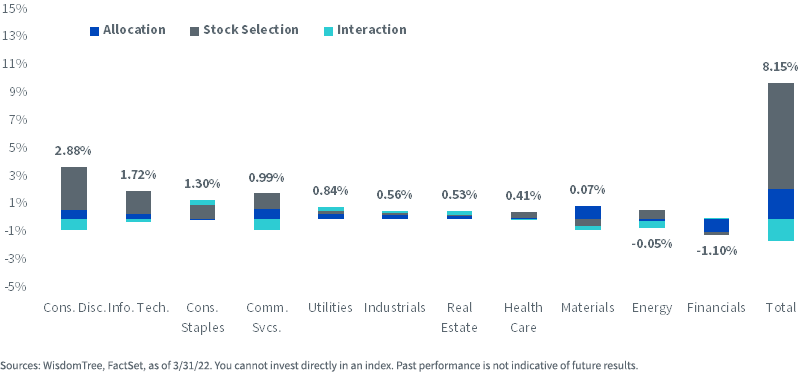

The WisdomTree Emerging Markets SmallCap Dividend Index (WTEMSC) also handily outperformed the MSCI Emerging Markets Index through the first quarter of the year. In large part, the Index has benefited from its underweight exposure to large Chinese tech and consumer companies that continue facing regulatory scrutiny.

Year-to-Date Sector Attribution: WisdomTree Emerging Markets SmallCap Dividend vs. MSCI Emerging Markets Index

The overweight exposure contributed 553 bps of negative attribution for WTEMHY relative to MSCI EM. With the Russian names in WTEMHY marked down to nearly 0% values and entirely removed from the MSCI EM Index, the relative overweight for WTEMHY is now just 70 bps.

Index Russia Exposure

The Russia headwind was offset by an underweight to China—specifically to China growth stocks—and an overweight to Brazilian Energy and Materials companies that have benefited from rising commodity prices.

The positive attribution of over 500 bps between Brazil and China fully offset the negative attribution from Russia.

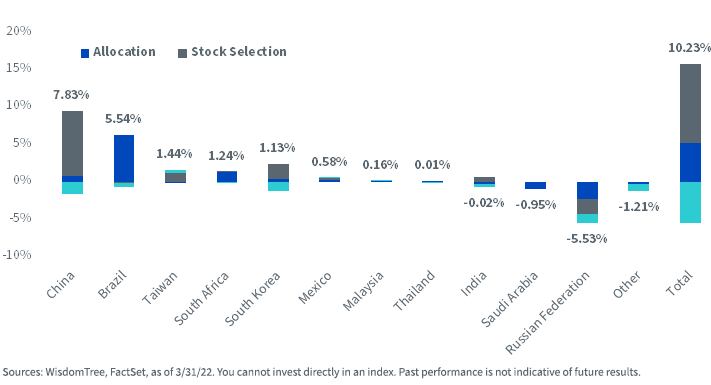

Year-to-Date Country Attribution: WisdomTree Emerging Markets High Dividend vs. MSCI Emerging Markets Index

WTEMSC had no exposure to Russia entering the year. The Index has benefited heavily from positive stock selection in China, Taiwan and South Korea as several large tech and consumer companies in those countries have fallen heavily amid a rotation into value stocks.

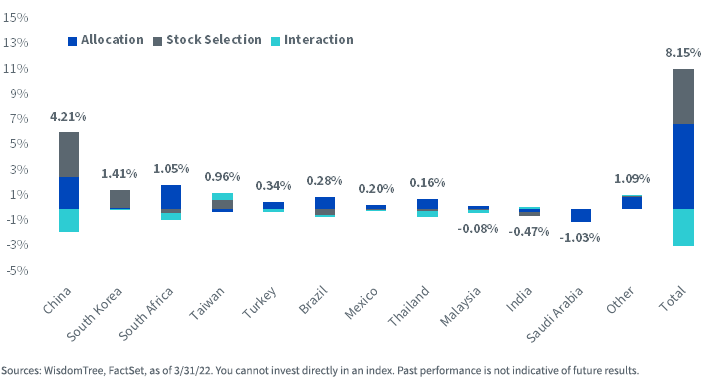

Year-to-Date Country Attribution: WisdomTree Emerging Markets Dividend vs. MSCI Emerging Markets Index

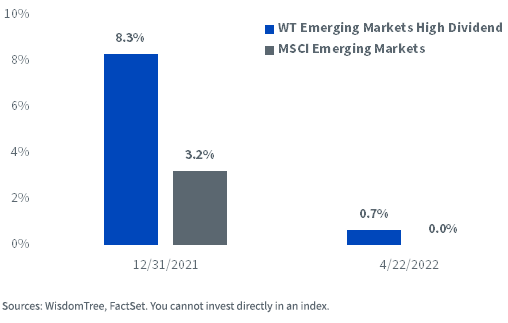

Early Innings of Value Reversal

The recent outperformance of these two WisdomTree Indexes highlights the resurgence of value strategies over the past few months.

Despite the turnaround of value relative to growth over the past year and a half, the past 10 years has seen value-tilted strategies, like those targeting high dividends, lag.

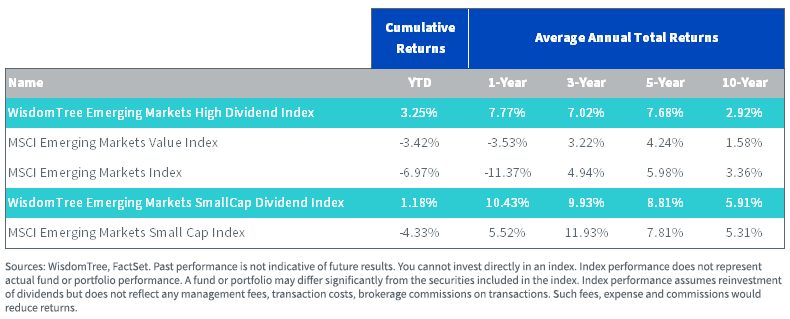

WTEMHY lagged the MSCI Emerging Markets Index by 44 bps annualized for the 10 years ended March 31.

The WTEMSC also tilts toward value based on its Dividend Stream weighting but is more of a core allocation due to a lack of a high yield selection criteria.

As a result, the small-cap dividend Index didn’t suffer as much of a value headwind over the past decade, outperforming the small-cap benchmark by 60 bps and the MSCI Emerging Markets Index by 255 bps.

Returns as of March 31, 2022

Conclusion

The themes we laid out at the beginning of the year—rising rates, high inflation, Chinese regulatory/zero COVID policy risks—still hold true after the first few months.

While the EM asset class has had no shortage of headline events this year, investors allocating to quality dividend payers have sidestepped much of the drawdown that has afflicted the broader market.

1 Heather Gillers and Matt Wirz, “War in Ukraine Tests Faith in Emerging Markets,” Wall Street Journal, March 21, 2022.

Important Risks Related to this Article

Investing in emerging markets involves risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and instruments or investments in more developed international markets; Loss due to foreign currency fluctuations, or geographic events that adversely impact issuers of foreign securities.