Generating Yield in a Volatile Market

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

It has only been a little more than a month since we last visited the topic of generating yield in an evolving market, but market conditions have changed so rapidly since then it is time to revisit it, and in fact, this will become a recurring topic. The Fed recently began its “rate hike cycle” as it attempts to balance economic growth against rampant inflation, the stock market has been volatile and geopolitical tensions are as high as they have been in decades.

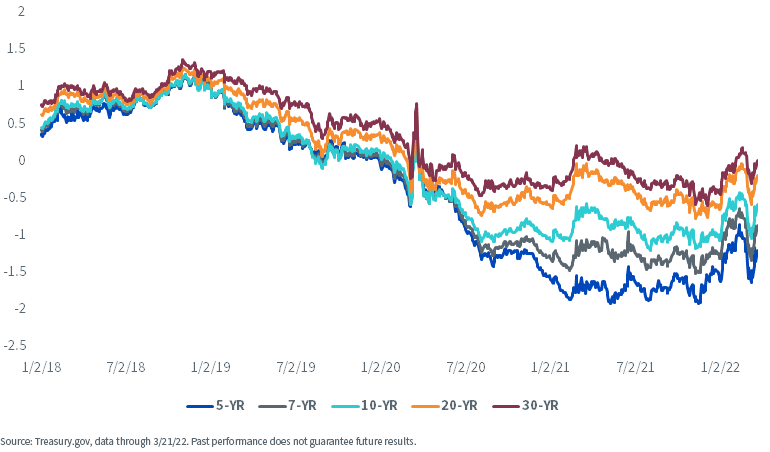

Let’s begin with rates, starting with the Treasury yield curve. Rates are rising without question as investors anticipate an aggressive Fed rate hike regime, but except for the 30-Year, Treasury real yields remain negative across the entire maturity spectrum.

U.S. Treasury Real Yields (%)

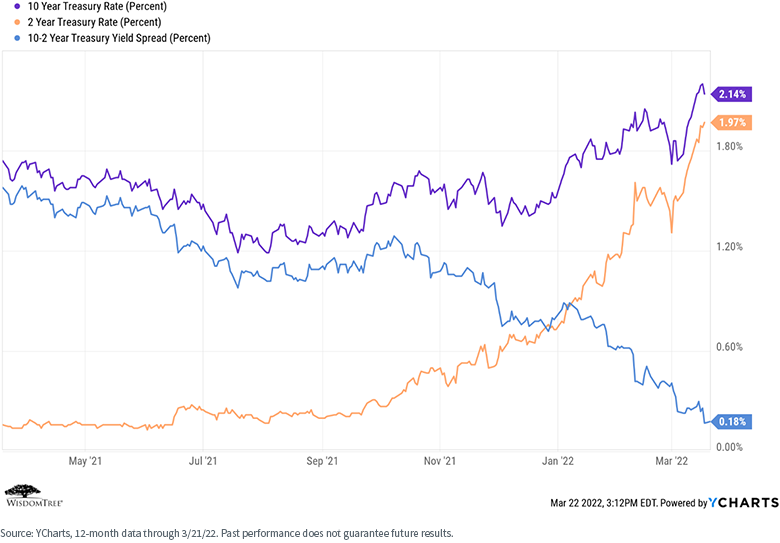

While nominal Treasury rates have also been rising, the real action has been at the short end of the curve, as we now approach a flat and perhaps inverted yield curve structure (we use the 10-Year minus 2-Year Treasury rates as a proxy for the “shape of the curve”). We think, with fits and starts, this upward trend will continue, but should the yield curve invert, we do not necessarily believe that signals an impending recession, as it has many times in the past. What is notable is how aggressively the 2-Year rate has risen in recent months even though the Fed has, thus far, only raised rates once.

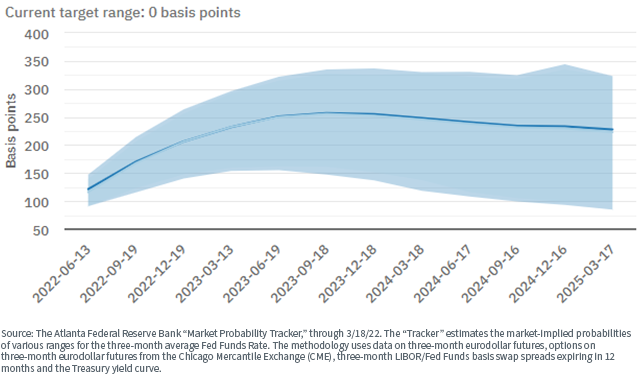

Speaking of the Fed, the market is now pricing in at least six rate hikes for the remainder of 2022, meaning at least a 25-basis-point hike in each of the remaining FOMC meetings, resulting in a Fed Funds Rate of at least 2.00% by year-end. There are others, like St. Louis Fed Governor James Bullard and our own Senior Investment Strategy Advisor, Professor Jeremy Siegel, who believe the Fed will have to be even more aggressive than that if it wants to get a handle on inflation.

The Expected Future Path of th Three-Month Average Fed Funds Rate

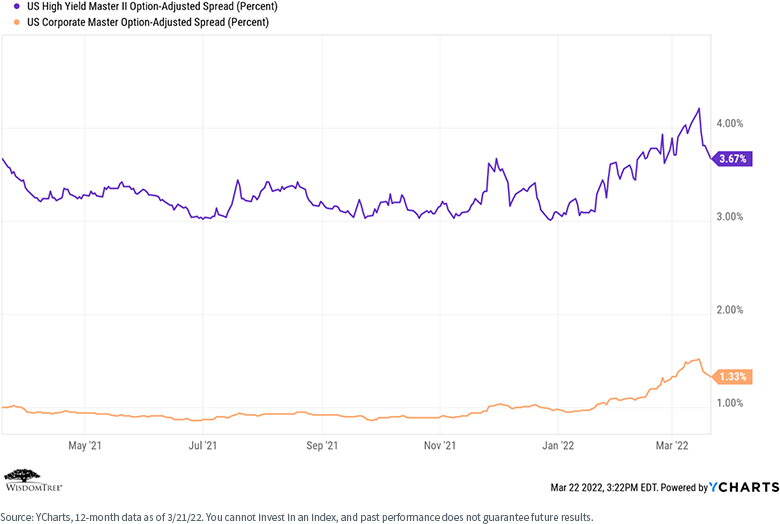

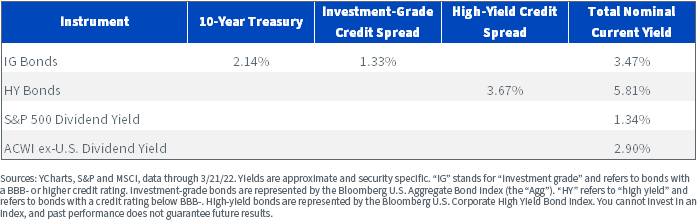

Finally, credit spreads awakened from their apparent somnambulance and have started to widen.

For definitions of terms in the table, please visit the glossary.

So, What Is a Yield-Seeking Investor to Do?

To summarize the above, we continue to believe rates will grind higher, and inflation remains the story through at least the first half of 2022. Rates are rising, and credit spreads are widening—it’s hard to be optimistic about the total return profile of the broader fixed income markets. We note, however, that corporate balance sheets are in solid shape, so we believe “coupons” (interest payments) have a reduced probability of default.

What about finding yield in the equity markets? Using the information from above, let’s compare current nominal fixed income yields to current equity dividend yields.

For definitions of terms in the table, please visit the glossary.

Investors can generate higher levels of current nominal income in the bond market than in the equity market (which historically is the more “normal” situation). At the same time, we see increased risk in the fixed income markets and believe that dividends and stock buybacks may represent a more sustainable approach to generating current income.

Our own fixed income Model Portfolios remain short duration and over-weight in credit, with an explicit focus on quality security selection, relative to the Bloomberg U.S. Aggregate Bond Index (the “Agg”). We are not looking to take excessive risk in our fixed income portfolios in a “reach for yield.”

That said, here are some ideas and solutions that may be of interest.

Model Portfolio Ideas

WisdomTree manages four Model Portfolios we think fit nicely into today’s yield environment, depending on investor objectives. From the most straightforward to the more complex, they are:

- The Short Duration Fixed Income Model Portfolio. In June 2021, we launched our Short Duration Fixed Income Model Portfolio, which is designed specifically to reduce interest rate (duration) risk while not sacrificing too much in terms of yield relative to the “Agg” Index. It can be used as a stand-alone fixed income Model Portfolio or a complementary sleeve to an existing fixed income allocation as a means of reducing duration risk without disrupting existing allocations.

As we write this blog post (March 25th), the effective duration of the Short Duration Fixed Income Model Portfolio is approximately 2.77 years, and the current yield* is approximately 2.81%. This compares to an effective duration of roughly 5.65 years and a current yield of roughly 3.42% in our core Fixed Income Model Portfolio. So, investors are taking a modest reduction in yield to essentially reduce their duration risk by 50%. - The Global Dividend Model Portfolio is an all-equity model designed specifically to generate optimal yield and current income without taking excessive risk. This can be used as a stand-alone Model Portfolio, but many advisors use it as a complementary sleeve to their existing equity portfolios in an attempt to generate additional income.

- The Global Multi-Asset Income Model Portfolio attempts to optimize risk-controlled current yield and income, but in addition to equities, it includes fixed income and other yield-generating strategies (e.g., preferred securities and energy master limited partnerships (MLPs)).

- The Siegel-WisdomTree Longevity Model Portfolio. Built and managed in collaboration with our since-inception Senior Investment Strategy Advisor, Professor Jeremy Siegel, this Model Portfolio attempts to “build a better mousetrap” to the traditional “60/40” portfolio by over-weighting in yield and dividend-focused equities (75% allocation) while using the fixed income allocation (25%) as a source of risk-controlled income and a hedge to the equity risk of the overall portfolio.

The last three Model Portfolios focus on generating all or much of their current yield from equity allocations versus fixed income allocations.

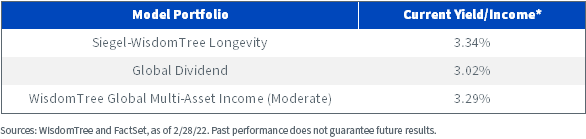

Let’s look at the current yield of these Model Portfolios (as of February 28, 2022).

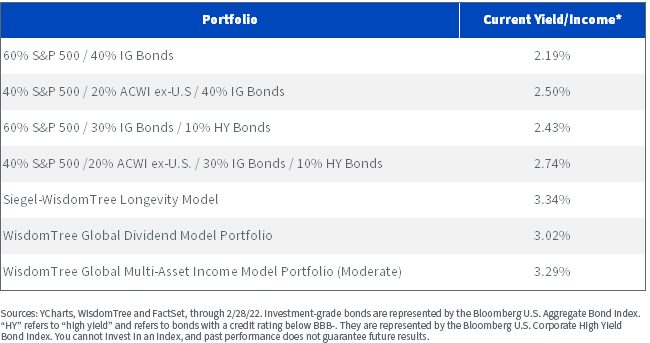

Now let’s examine some hypothetical “typical” client portfolios.

Conclusions

Today’s market environment is fraught with risks for fixed income investors. Despite the pick-up in nominal yields, we continue to believe that taking excessive risk in the fixed income market is not a prudent approach. We believe a more appropriate approach is to focus on the global equity markets to generate yield while still maintaining an adequate fixed income allocation, both to seek income generation and as a potential hedge to equity beta risk.

In today’s yield-starved world, we believe you can build intelligent portfolios that generate an optimal level of yield without taking excessive risk.

Financial advisors can register with WisdomTree to access fully transparent information (performance, fees, yield, allocations, etc.) via our Model Adoption Center.

*“Current Yield/Income” refers to the Model Portfolio 12-month dividend yield, which is calculated using the weighted average trailing 12-month distribution yields of the Fund constituents. Funds incepted less than 12 months do not have a trailing 12-month dividend yield.

Important Risks Related to this Article

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Please go to wisdomtree.com/mac/model-portfolios#strategicmodelportfolios_strategicbuildingblocks, wisdomtree.com/mac/model-portfolios#outcome-focused_globalmulti-assetincome, wisdomtree.com/mac/model-portfolios#outcome-focused_globaldividend or wisdomtree.com/mac/model-portfolios#featuredsiegelmodelportfolios_siegel-wisdomtreemodelportfolios and, for each Model Portfolio, see the Fund Performance tab for individual Fund standardized performance and the Fund Details tab for Fund-specific links for yield, most recent month-end performance and a prospectus.

Investors and their advisors should consider the investment objectives, risks, charges and expenses of the funds included in any Model Portfolio carefully before investing. This and other information can be obtained in the Fund’s prospectus by visiting www.wisdomtree.com for WisdomTree Funds. Visit the applicable third-party website for third-party funds. Please read the prospectus carefully before you invest. WisdomTree Asset Management, Inc., does not endorse and is not responsible or liable for any content or other materials made available by other ETF sponsors.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from the information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, is subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds, notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

Jeremy Siegel serves as Senior Investment Strategy Advisor to WisdomTree Investments, Inc., and its subsidiary, WisdomTree Asset Management, Inc. (“WTAM” or “WisdomTree”). He serves on the Model Portfolio Investment Committee for the Siegel-WisdomTree Model Portfolios of WisdomTree, which develops and rebalances WisdomTree’s Model Portfolios. In serving as an advisor to WisdomTree in such roles, Mr. Siegel is not attempting to meet the objectives of any person, does not express opinions as to the investment merits of any particular securities and is not undertaking to provide and does not provide any individualized or personalized advice attuned or tailored to the concerns of any person.

The Siegel-WisdomTree Longevity Model Portfolio seeks to address increasing longevity by shifting the focus to potential long-term growth through a higher stock allocation versus more traditional “60/40” portfolios.