Where Is the Treasury 10-Year Yield Headed?

One week after the January FOMC meeting, the money and bond markets are still “buzzing.” Without a doubt, Chair Powell & Co. put on a “hawkish” show for investors, and one question that I keep getting asked is, “where do you think the Treasury (UST) 10-Year yield is headed?”

Obviously, the lion’s share of the focus has been placed on the number of potential rate hikes and where the Fed Funds target range could be by year-end. However, the level of Fed Funds traditionally has more impact on the front end of the yield curve, whereas maturities such as the UST 10-Year are less directly impacted by the “cost” for overnight money.

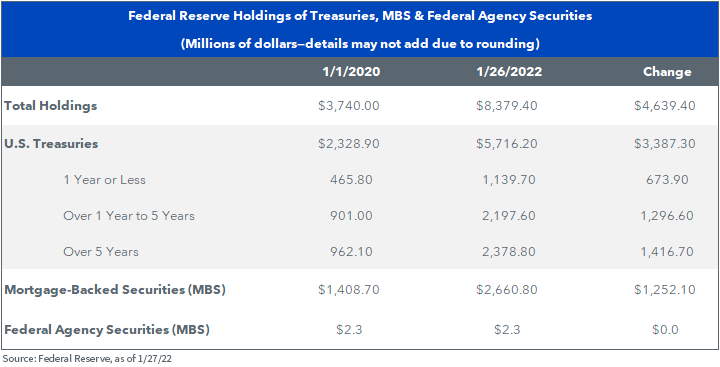

This is where the Fed's balance sheet—specifically their holdings of Treasuries, MBS and federal agency securities—can come into play. As I noted in my post-FOMC blog piece last week, it is this aspect of future Fed policy that also bears watching and carries the potential to have a more explicit effect on the UST 10-Year yield. At his FOMC presser, Powell stated the policymakers will be “talking about balance sheet runoff over the next few meetings.” If you look at the FOMC schedule, that could potentially put the June 15 meeting in play for the announcement and/or starting point for quantitative tightening (QT) to commence.

So, let’s look at the Fed’s aforementioned holdings of Treasuries, in particular, to put things in perspective. As the table reveals, total holdings more than doubled to roughly $8.4 trillion as a result of the COVID-19-related QE program, with Treasuries making up nearly 75% of the overall increase. Within the UST component, 42% of the Fed’s buying occurred in maturities that are five years or greater. Against this backdrop, it is reasonable to assume that this sector of the UST curve, which includes the 10-Year maturity, will see a visible drawdown once the Fed begins this part of its exit strategy. In addition, the federal government will be “losing” a rather noteworthy buyer at the same time trillion-dollar deficits need to be financed.

Back to the question at hand. Looking at things from a technical analysis perspective, the UST 10-Year yield has already broken through its Fibonacci 50% retracement level of 1.79%. The next “stops on this train” are 2.13% and then 2.56%. In my opinion, a “reasonable case” scenario seems to be pointing toward the UST 10-Year yield heading into a potential 2.25%–2.5% trading range later this year, especially if inflation remains elevated and the economy continues to maintain a relatively “healthy” growth trajectory.

Conclusion

Interestingly, a “camp” of investors believes the rise in rates has already occurred. I think the Fed will have something more to say about that going forward, and while the march toward higher yields has begun, we may still be in the early innings. In fact, the Fed seems poised to be the catalyst for higher rates not just for this year but for 2023 as well.