Pain Is Being Meted Out in this “Iceberg Market”

The S&P 500 is near all-time highs, Tesla is off to the races and Apple’s market cap just popped above $3 trillion.

Things are good.

What’s with the talk of icebergs? Things may look okay above the surface, but below it, there’s trouble.

While the S&P 500 is just off its highs, the small-cap Russell 2000 Index has no shortage of stocks that are tumbling. Since that index’s high on November 8, 2021, nearly half of its members (922 to be exact) have declined 10% or more, with 571 of them down more than 20%. About 9% of all the stocks in that index have fallen by more than 40%—in about two months.

One of the “pain” stocks is Peloton, purveyor of stay-at-home exercise bikes. It has cratered to around $31 in a total nightmare of a ride from last winter’s highs in the $160s.

Another lockdown play, Zoom, has tumbled to $160 from as high as $559 a little more than a year ago.

If lockdown stocks like Peloton and Zoom are cratering, you’d think maybe it’s because “reopening stocks” are catching a bid. Not exactly. Among the S&P 500’s worst performers in the last three months are Penn National and Caesars, both in the casino business. You can fly to their facilities on Southwest, whose stock is down to $46 from $64 last spring. Two cruise lines, Norwegian and Carnival, are also notable for having recently fallen out of bed.

This is happening inside a market that is up, and up good. The fourth quarter was a wonderful one: the Russell 1000 returned about 10%.

Funny then that a market that witnessed that index rocketing saw the higher-quality S&P 500 rally more, by 11.5%. It shouldn’t happen that way. Most people anticipate that quality stocks are supposed to earn their stripes when the market is tumbling, not when it witnesses sharp advances.

But that’s the thing—when stocks like Tesla, NVIDIA, Advanced Micro Devices and Apple are all in huge bull trends, gathering the headlines because of their sheer size, investors are not apprised of the fact that the under-the-surface part of the iceberg is wreaking havoc.

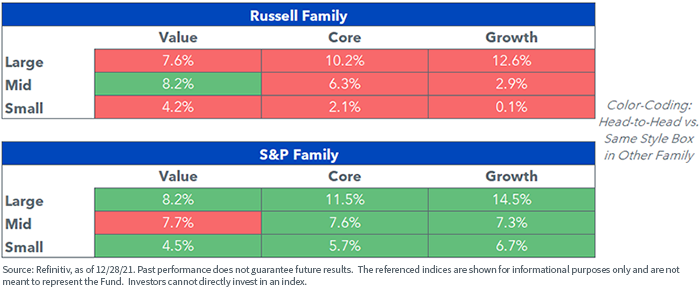

You can see the deterioration in lower-quality, speculative stocks by making a comparison between the Russell and S&P families in recent months.

In figure 1, eight of nine style boxes have witnessed the higher quality S&P indexes post a higher return than their Russell counterparts.

Figure 1: U.S. Stock Market Total Return, 9/30/2021 – 12/28/2021

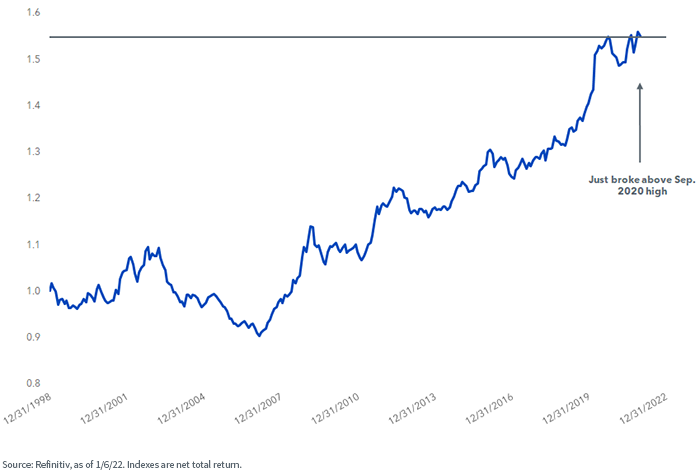

In global baskets, the relative performance of the quality sub-basket of the MSCI All Country World Index (ACWI) just broke out to new highs, courtesy of the iceberg’s subterranean strugglers holding back the beta indexes.

Figure 2: MSCI ACWI Quality Relative to MSCI ACWI (Total Return)

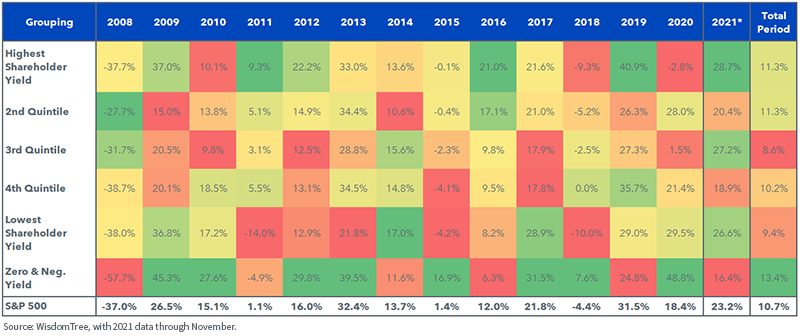

In 2021, stocks that ranked highly on the sum of their dividend yield plus buyback yield—their shareholder yield—took leadership in 2021. These stocks—the 20% of companies with the highest shareholder yield, returned 28.7% last year, or about 550 basis points more than the broad market. Companies that pay zero dividends and/or dilute their stockholders had the worst run of 2021.

In these early sessions of 2022, they continue to be a headache for the market.

Figure 3: S&P 500 Returns by Shareholder Yield (Sum of Dividend & Buyback Yields)

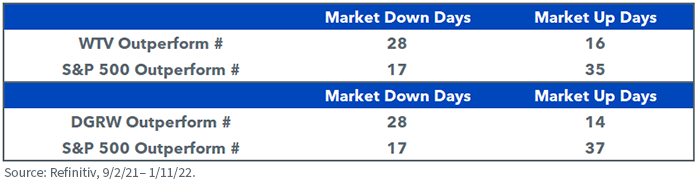

We have noticed a downside/upside capture phenomenon in the WisdomTree U.S. Value Fund (WTV), which screens for shareholder yield and the WisdomTree U.S. Quality Dividend Growth Fund (DGRW). In recent months, the market’s down days often saw WTV and DGRW hold up better than the S&P. Then they would lag on a chunk of the up days (figure 4).

Figure 4: WTV & DGRW Performance since September 2

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Returns less than one year are not annualized. For current standard performance, holdings and expenses, visit the fund page: WTV, DGRW.

Summary

If 2022 looks anything like the final few months of 2021 and the first couple weeks of 2022, be careful with companies that check the boxes for speculation: zero earnings, super-sensitivity to interest rates, shareholder dilution. Such stocks have been severely punished in recent months.

Take a look at the methodology for WTV; its components are buying back about 5% of their stock, which amounts to a large bidder in a market that has become unsettled. For comparison, the S&P’s buyback yield is 1.4%.

WTV’s 15th birthday is in February, so you’ll have a pre-Lehman collapse inception date to work with.

Unless otherwise stated, all data as of 1/6/22.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Securities that pay dividends, as a group, may be out of favor with the market and underperform the overall equity market or stocks of companies that do not pay dividends. In addition, changes in the dividend policies of the companies held by the Fund or the capital resources available for such company’s dividend payments may adversely affect the Fund.

Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.