What’s China’s Zero-COVID-19 Policy on Aggregate Economic Activity?

As countries like New Zealand abandon their Zero-COVID-19 policies, China again becomes the last remaining holdout, with people both in and out of the country calling for its abandonment. China also announced a vaccination drive for children three years and older.

China has been in the spotlight for its regulatory headlines, but those are settling down. I believe the most important issue for Chinese markets going forward will be economic growth and the profit outlook impacted by the real estate slowdown and energy crunch.

There are concerns regarding how China’s Zero-COVID-19 policy is impacting growth. Here’s my take:

1. The aggregate service sectors, which are most impacted by lockdowns, are still expanding, after a brief contraction in September. At this point, the energy crunch and real estate sector slowdown likely have a greater impact on the Chinese economy than other factors like its Zero-COVID-19 policy.

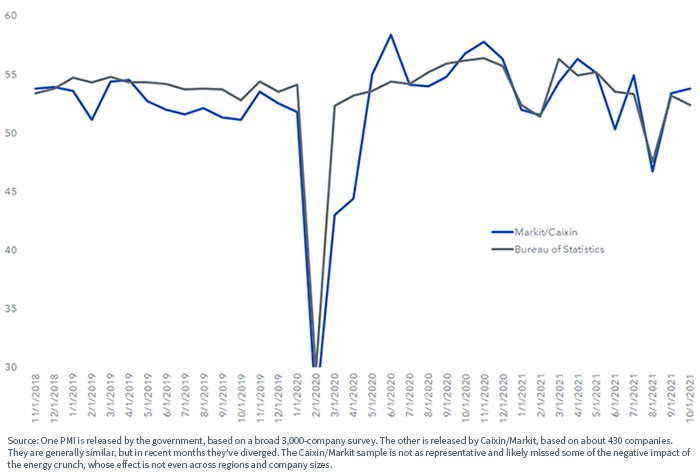

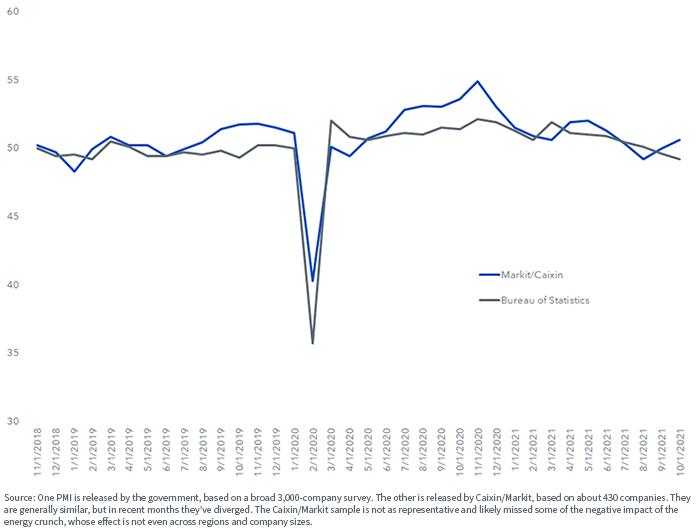

There are two Purchasing Managers’ Index (PMI) providers, the Bureau of Statistics and private provider Caixin/Markit, with higher than 50 indicating expansion. For each PMI, there are two main sub-components: the manufacturing and service sectors. As the below two charts show, the service PMIs are both back to their pre-pandemic trends. The manufacturing PMI is trending slower, with the larger sample and representative official PMI in <50 contraction territory.

China Services Purchasing Mangers' Index (PMI)

China Manufacturing Purchasing Managers' Index (PMI)

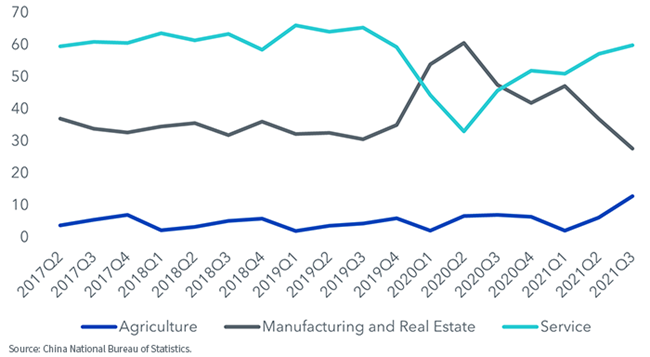

2. Many other statistics point to the service sector now getting back to pre-pandemic trend growth, which People’s Bank of China (PBOC) has stated as a range of 5%–6% GDP growth. China relied on exports and fixed asset investment for 2020 growth, but 2021 looks more like a normal trend, as the following chart shows.

However, there are new headwinds for energy and real estate, both of which are in a downtrend. The uncertainty for 2022 growth mostly comes from these two, not COVID-19, unless a significantly worse variant emerges.

Contribution to China GDP (%)

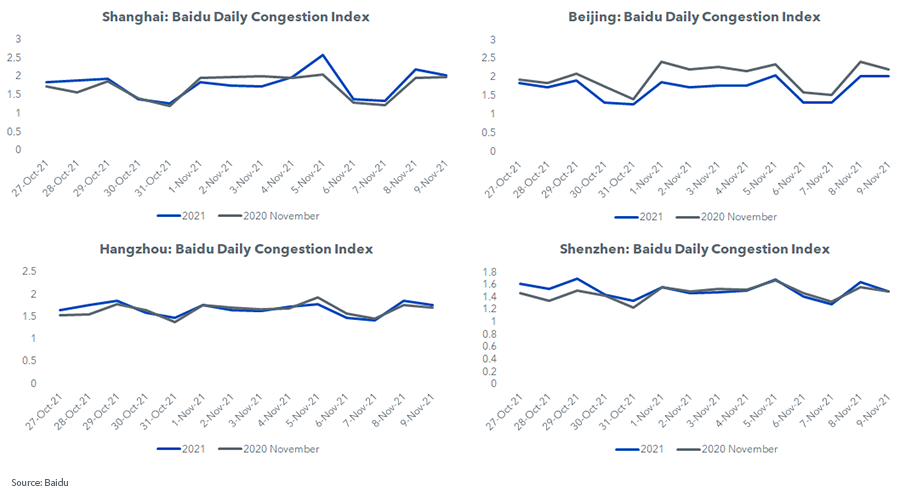

3. Many people question Chinese data. As there is significant money to be made with accurate economic data, private data providers and high-frequency data like the Baidu Congestion Index generally show that government economic data quality has improved in recent years.

The Baidu Congestion Index has shown that when a city reports COVID-19 cases, congestion is lower than the same month a year ago, suggesting a negative impact on the service industry. But the number of cases is low enough that, at any given time, the actual total number of people impacted is not widespread.

It is also true that inter-province travel has been impacted, with people reluctant to travel as stories of being quarantined for weeks emerge. But if people still spend money for services locally, then Zero-COVID-19 policy’s impact on the aggregate economy is not significant.

Here, I have Baidu Congestion Index charts for Beijing, Shanghai, Hangzhou and Shenzhen, all among the top six Chinese cities for the morning and afternoon peak hour congestion data of the last 14 days (blue) as compared to the average in November 2020 (gray). For impacted cities like Beijing, plus its political center, the congestion is indeed lower than last year, but for other cities like Shenzhen, which is not as impacted, the congestion is generally more or less the same as compared to last year.

Shanghai was considered a model city in China for deploying rapid testing, but it never used the strict lockdowns that other cities did after the initial 2020 lockdown. The recent news that 33,000 tourists in Disneyland got tested in one night showed that people are out being entertained again, and it was viewed positively in China as an example of living with COVID-19 in the Shanghai way—a light dig at other cities.

4. There is uncertainty as to what living with the virus looks like for China. As of October 31, Singapore had 1,710 people in the hospital with COVID-19 out of a population of 5.9 million, while Japan had 2,589 in the hospital out of a population of 124.8 million. At its peak in late August, Japan had about 220,000 patients in the hospital. China watches other Asian countries closely, particularly Singapore, Japan and South Korea. Although China has six million hospital beds, scaling Singapore to the Chinese population would mean close to half a million COVID-19 patients in hospitals and an additional five million in some form of quarantine or community treatment. The hypothetical economic impact on the service sector of living with COVID-19 in that kind of Singapore-like scenario is not necessarily lower than the current Zero-COVID-19 policy.

5. China also has a very significant political event, the 20th National Congress of the Chinese Communist Party, coming up in fall 2022, where the world will know whether the current president is able to consolidate power and get a recently unprecedented additional 10-year term.

The whole government is aiming for stability to prepare for that event. Staying with a Zero-COVID-19 policy would be the low-risk decision. Ordinary Chinese citizens don’t seem ready to abandon the policy, as evidenced by heated debates online every time a new country decides to just “live with the virus.” The people on the outside may not like it, but, ultimately, lasting social change only comes from the people within China making a collective political decision.

There are many sad stories about the effects of the Zero-COVID-19 policy. In Chinese media, the town neighboring Burma, Ruili, was in the headlines for constant lockdowns due to human smuggling and importing cases. Mental health and family separation stories are both prominent in Chinese and English media. However, the media needs to be cautious about going from the news to a narrative that the Zero-COVID-19 policy is the main factor causing the current economic slowdown.

In summary, the biggest uncertainty for 2022 is still growth—not COVID-19—and it depends on whether China could have a soft landing from the energy crunch and real estate slowdown.

For more insights on China from Liqian, make sure to check out her China of Tomorrow podcast. You can listen to the last podcast below.

Data References

https://www.moh.gov.sg/covid-19/testing/situation-report-pdf

https://www.mhlw.go.jp/stf/covid-19/kokunainohasseijoukyou_00006.html

Liqian Ren, Ph.D., joined WisdomTree as Director of Modern Alpha in 2018. She leads WisdomTree’s quantitative investment capabilities and serves as a thought leader for WisdomTree’s Modern Alpha® approach. Liqian was previously at Vanguard, where she worked for 12 years, most recently as a portfolio manager in the Quantitative Equity Group managing Vanguard’s active funds and conducting research on factor strategies. Prior to joining Vanguard, she was an associate economist at the Federal Reserve Bank of Chicago. Liqian received her bachelor’s degree in Computer Science from Peking University in Beijing, her master’s in Economics from Indiana University—Purdue University Indianapolis, and her MBA and Ph.D. in Economics from the University of Chicago Booth School of Business. Liqian co-hosts a podcast on China and Asian markets with Jeremy Schwartz, WisdomTree’s Global Head of Research, and she is a co-host on the Wharton Business Radio program Behind the Markets on SiriusXM 132.