The WisdomTree Q4 Economic and Market Outlook in 10 Charts or Less

“I just dropped in to see what condition my condition was in”

(By Kenny Rogers & The First Edition, 1967)

When reviewing the current state of the global economy and investment markets, we recommend focusing on market signals and weeding out market noise. We believe the five primary economic and market signals that provide perspective on where we go from here are GDP growth, earnings, interest rates, inflation and Central Bank policy.

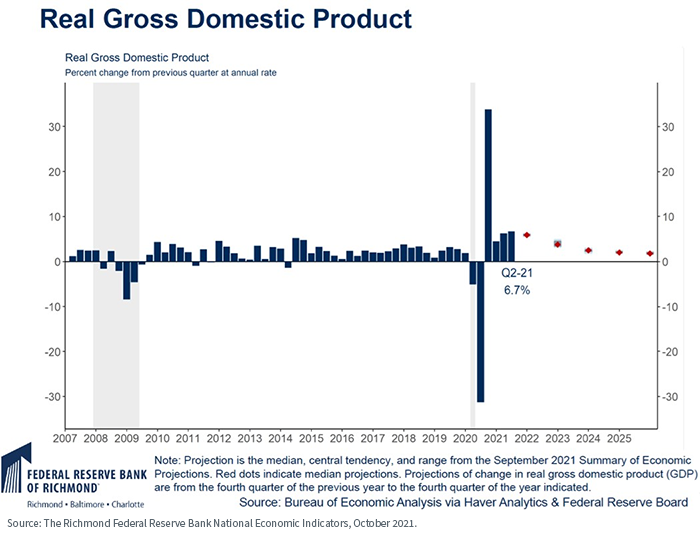

GDP Growth

U.S. economic growth remains positive but seems to be slowing. Part of this is the inevitable decline from the hyper-growth levels of the spring and summer. Part of it is the lingering effects of the Delta variant of COVID-19 (which seems to be passing from the scene, thankfully). Part of it is ongoing supply chain disruptions, which are real and will not go away anytime soon. And part of it is the fiscal and monetary policy uncertainty in Washington, D.C. There is growing concern that the Fed is “behind the curve” with respect to inflation, which increasingly does not look to be “transitory.”

All that said, we generally are optimistic on the economic outlook for Q4—we believe we may see a second “economic reopening” cycle begin to reappear as COVID-19 fades and legislative policies become clearer.

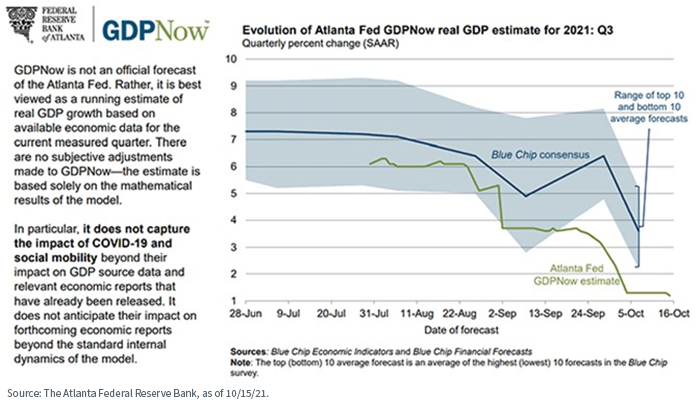

Perhaps more concerning to the markets in the short term is the Atlanta Fed’s “GDPNow” indicator, which suggests an abrupt decline in Q3 GDP growth for the reasons described above. As a caveat, this “GDPNow” metric has not always been especially accurate—but the number is what it is. A Bloomberg consensus survey suggests a Q3 GDP level closer to 3%, while a Wall Street Journal survey indicates an anticipated Q4 growth rate of roughly 4.8%.

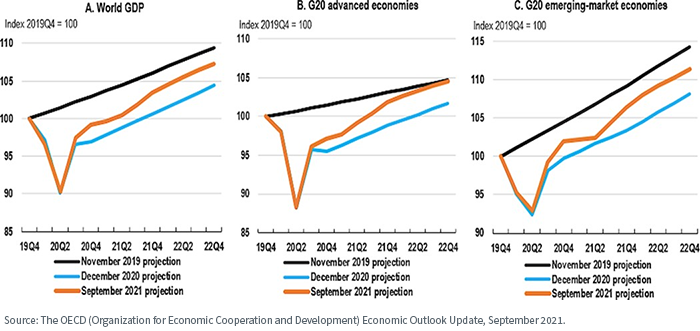

Economic growth outside the U.S. is expected to remain positive, especially in developing economies, despite the economic and governmental policy uncertainties that are mounting in China.

Translation: A potentially volatile but generally positive environment for “risk-on” assets, especially as COVID-19 vaccination rates increase in developing economies. But uncertainty has crept back into investors’ minds.

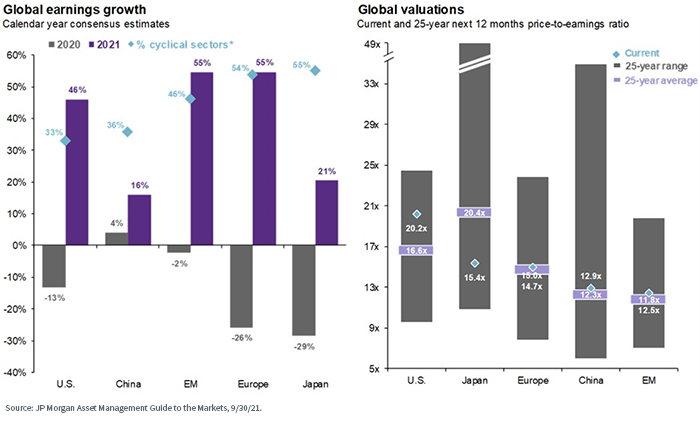

Earnings

The U.S. Q3 earnings season is just underway, and while expectations are for slower growth than in Q2, they are still expected to be strong—but investors will be watching closely

Earnings growth outside the U.S. is also expected to be solid, especially in “cyclical” sectors, if, as we anticipate, we enjoy a second global “economic reopening” regime.

Translation: A continued positive environment for global risk assets. Valuations are stretched, but accommodative global central banks, a growing economy and decent earnings should help buoy global equity markets. We believe “quality” (i.e., companies with strong balance sheets, earnings and cash flows) may become increasingly important as we sail into potentially volatile seas.

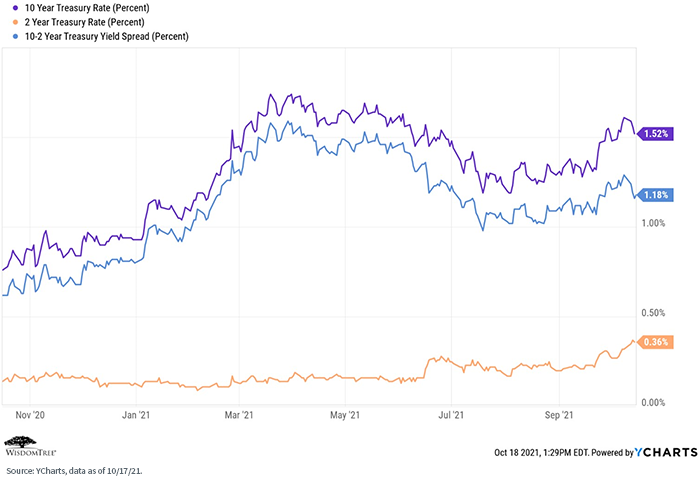

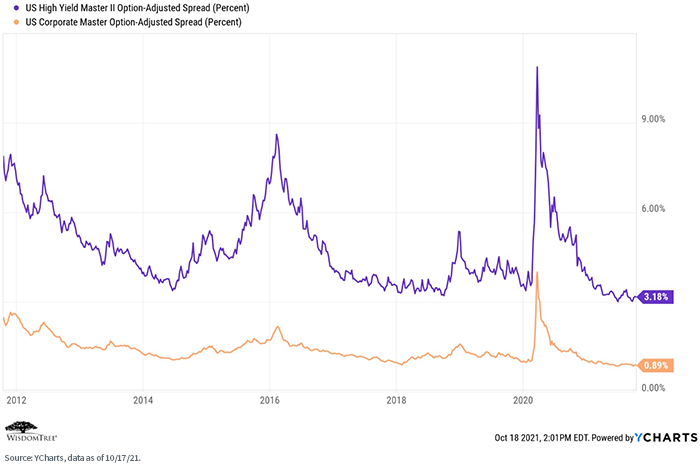

Interest Rates and Spreads

It’s been quite the roller coaster for interest rates over the past 12 months. Our opinion is that they will continue to “grind higher” for the rest of the year, approaching 1.75% or perhaps even 2.00%. At the same time, spreads remain incredibly tight. This will put a headwind on total return potential for fixed income.

Translation: We maintain our positioning of being under-weight in duration and over-weight in credit relative to the Barclays BarCap Aggregate Bond Index, with a focus on quality security selection, especially in high yield. Corporate balance sheets are solid, so coupons should be relatively safe. We may see potential pockets of opportunity in securitized credit, interest rate-hedged bonds, floating rate Treasuries and EM bonds (both local currency and U.S. dollar-based). But now is not the time to be taking excessive risk in your fixed income portfolio.

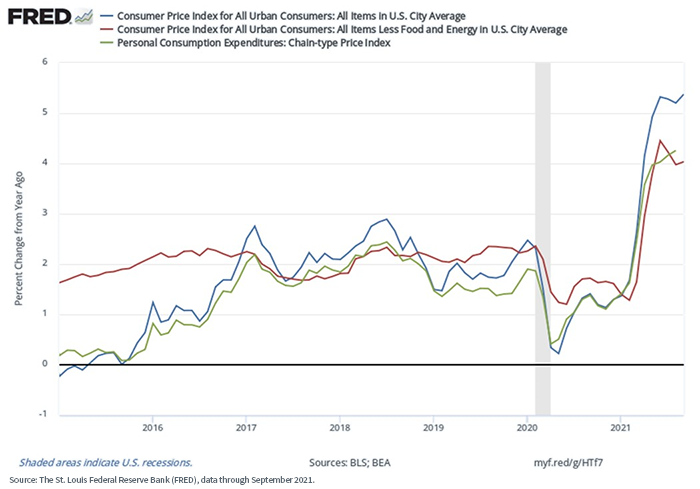

Inflation

The consensus on inflation seems to be transitioning from a mindset of “transitory” to one of more “structural,” especially with respect to wages. This IS the story of Q4 because inflation feeds on itself—the more consumers anticipate it, the worse it gets, as consumption is “pulled forward” ahead of assumed higher prices later on.

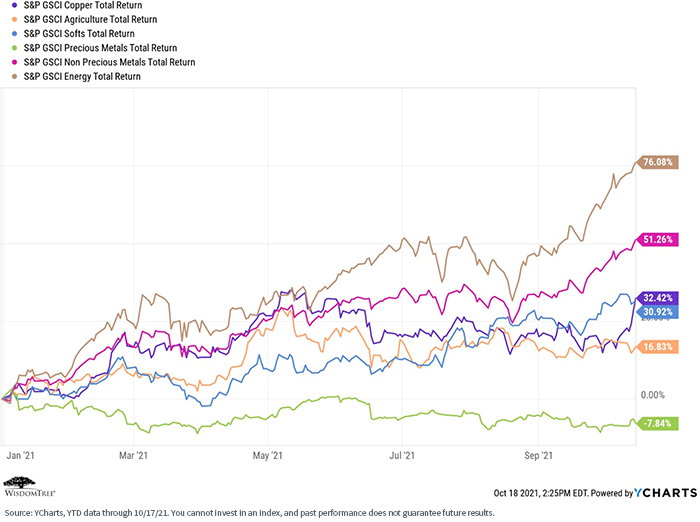

After stabilizing earlier in the year, commodity prices are accelerating again, especially oil and energy due to global supply shortages.

Translation: This is a distinctive “inflationary” signal, as it will add to input price pressures. Historically, equities have provided reasonable protection against moderate inflation, but commodities have proven to be effective inflation hedges. We maintain our position in broad-basket commodities within several of our Model Portfolios.

Central Bank Policy

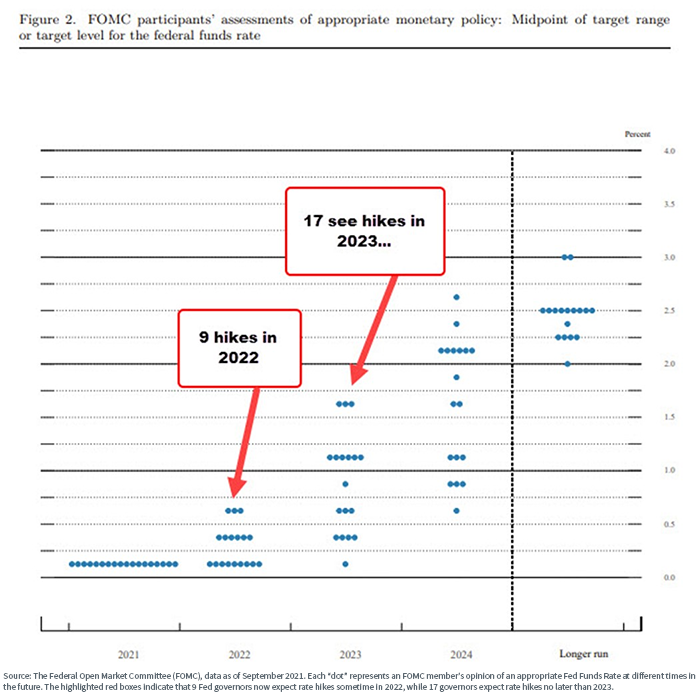

The Fed may be “behind the curve” on inflation (or at least many folks believe it is), but there are clear signs that it recognizes the current inflationary trend may not be “transitory.”

Translation: Inflation is the story of Q4. Supply chain disruptions will eventually work themselves out, though perhaps not until well into 2022. But all eyes are on the Fed’s November meeting with respect to “tapering,” and it is between the proverbial rock and a hard place—move to tame inflation and potentially put the brakes on economic expansion, or let inflation “run hot” and, potentially, out of control.

The “Known Unknowns”

While the market signals we follow point to generally positive economic and market conditions for the rest of 2021 (with inflation being the big caveat), conditions are always subject to exogenous events. The ones we can identify but not foresee the outcomes of we refer to as “known unknowns.”

As we write this in mid-October, the known unknowns we can identify include:

- The outcome of ongoing additional infrastructure/fiscal stimulus negotiations. The pendulum has swung back and forth on these issues over the past several months, with increased “infighting” in both parties. Our general opinion is that the federal government will always, eventually, vote to spend more money, so we believe something will pass, but what that looks like is still unclear.

- Likewise with the impact of proposed increases to taxes and regulation in the U.S. Few people believe taxes will not increase, but the devil is in the details. Rising energy costs as winter approaches are throwing somewhat of a wrench into the “green agenda,” as politicians don’t want to face unhappy voters next year in the face of higher energy costs.

- The future direction of the relationships between the U.S. and China, Iran and Russia, which remain rocky. There remain high levels of bipartisan animosity, specifically toward China.

- We believe (hope?) that we have turned the corner on COVID-19, but the residual effects (lockdowns, remote learning, mask mandates, vaccine mandates, etc.) remain politically divisive and economically sapping.

Summary

When focusing on what we believe are the primary market signals, the “condition our condition is in” remains relatively healthy, and we maintain our position that 2021 will enjoy a generally positive economic and market environment. But the economy is showing signs of slowing, and inflation has—for the first time in almost a generation—once again moved to the “headlines” of economic news.

So, while we are cautiously optimistic in our outlook for the remainder of 2021, we think we may be in for increased volatility, and we continue to recommend focusing on a longer-term time horizon and the construction of “all-weather” portfolios, diversified at both the asset class and risk factor levels.

For a deeper graphic dive on these issues, please see our Q4 Economic & Investments Chart Book.