How to Avoid Being Like the Other 98% of Investors

For many emerging markets (EM) investors, navigating 2021 has felt like walking through a minefield. The Chinese government’s rolling wave of regulations raised uncertainty, fear and even panic.

First up was Ant Financial. Ant’s desires to list shares publicly accelerated fintech regulations—and it looks increasingly like Ant Financial will end up being regulated more like a traditional bank and less like a technology company—impairing the multiples on the business. There will also be state-owned firms investing in its credit rating business, which China believes is key to state interests.

After Didi issued shares to the market, it was cited for consumer data violations, as China was focused on data security-related issues in their technology companies.

Tencent and other gaming companies were slammed when a state-run media outlet called online games “spiritual opium” and the government capped the amount of time that minors can play.

Luckily for them, they fared better than the private education companies, which were essentially wiped out in a rebuke of the competitiveness and affordability of tutoring. Yet what was under-reported here: China fired the education minister who took these actions without the approval of the central government. China is trying to lower the cost of educating and raising children, but the actions and fallout from a rogue education minister did not sit well.

The key for investors: what happened in the education sector that crippled the ability of firms to earn profits is not likely to be repeated.

A Headache on Top of a Migraine

This all comes at a time when China is also seeing a growth slowdown.

The fragility of growth was perfectly epitomized by the one positive COVID-19 case that caused a forced two-week shutdown of a major terminal in the world’s third-largest shipping port in China.

China further implemented environmental curbs also weighing on growth, as hard emission quotas forced some manufacturers to even shut down completely.

Now you can add a real estate slowdown to the list of headaches, with Evergrande being the latest problem in the news. While Evergrande presents a myriad of problems, we don’t see it as a systemic risk.

Even before the massive stock drop, Evergrande represented just 0.04% of the MSCI EM Index at the start of the year (a weight that now sits at less than 0.01%1).

China sold off significantly with all these uncertainties—creating opportunity for those who look past the headlines into longer-run prospects and what is happening below the surface.

A Quiet Bright Spot

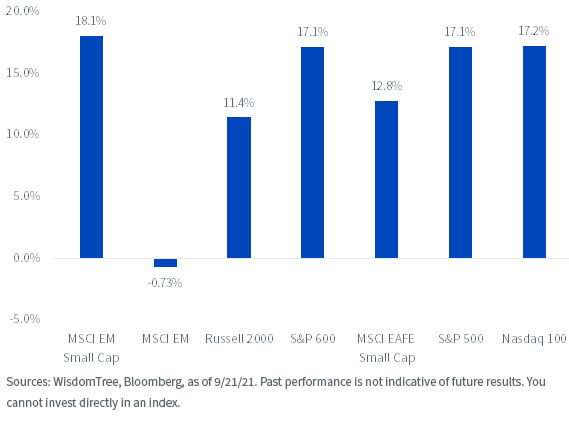

We don’t think the sky is falling in China or broadly in EM. And there’s a significant bright spot flying under the radar—EM small caps. EM small caps have outperformed the MSCI EM Index, the U.S. and developed international small-cap indexes and even the blue-chip U.S. stock gauges in 2021.

2021 Index Performance (Year to Date)

For definitions of terms in the chart, please visit the glossary.

Small Investors a Small, Happy Group

Investors can be forgiven for not realizing how well the asset class has done.

There is currently $750 billion invested in U.S.-listed EM mutual funds and ETFs. Of those assets, less than 2% of all EM fund assets are in dedicated small-cap funds.2

Forget regular investors—even merely among EM allocators, nearly all of them have missed out on the best performing part of the market.

In WisdomTree’s view, EM small caps offer many benefits to investor portfolios—especially when taking a fundamental tilt to the allocation like the WisdomTree Emerging Markets SmallCap Dividend Fund (DGS) does:

- EM small caps offer an organic way to gain access to the rise of the EM consumer theme, as most companies conduct the majority of their business within emerging markets

- EM small caps can offer an attractive income stream in today’s low-yielding environment in an unexpected place (current distribution yield on DGS: 5.50%3)

- As opposed to small-cap stocks in the developed world, EM small-cap dividend payers have historically been less volatile than their large-cap peers (DGS beta since inception vs. MSCI EM Index: 0.944)

Lastly, EM small caps are showing in today’s environment exactly how great of a diversifier they can be alongside large-cap EM companies.

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Standardized performance and 30-day SEC yields for DGS are available here.

How the WisdomTree Model Portfolios Allocate to EM

Most of the WisdomTree Model Portfolios take a barbell approach to their EM exposure. For example, the WisdomTree Core Equity Model Portfolio allocates 13% split across DGS at 6% and the WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE) at 7%5.

This combination allows the models to own cutting-edge large-cap tech and growth names while also not being solely reliant on the continued dominance of those same companies.

We believe the two Funds are excellent complements to each other, as one has often zigged while the other zagged. When comparing the relative performance of each Fund against the MSCI EM Index, the correlation between them is -0.56. This means that when one of them outperformed, the other tended to lag, and vice versa.

This approach paid dividends this year, as Tencent, Alibaba and some of the other big names have lagged, but small caps have more than picked up the slack.

Relative Performance vs. MSCI EM Index Strongly Uncorrelated

Be Like the 2% of Contrarians

Similar to what we’ve seen in the U.S., the last few years have seen a domination by tech behemoths driving EM asset class performance. While it seems likely that some of the China-based companies may be forced to scale back their ambitions in some regard, we still think they will grow at a rapid pace.

However, should the heavy-handedness of the Chinese Communist Party continue, we believe sharp investors would be wise to carve off some of their large-cap exposure to complement with small caps.

After all, who wouldn’t want to try to find an edge over the other 98% of investors?

For current holdings of the Funds mentioned in this blog, please click their respective tickers: DGS, XSOE.

1Bloomberg, as of 9/22/21.

2Bloomberg, as of 9/22/21.

3WisdomTree, FactSet, as of 9/22/21.

4Zephyr StyleADVISOR, from 10/31/07–8/31/21.

5As of 8/31/21. Allocations subject to change over time.

6Bloomberg, from 12/31/14–9/22/21.

Important Risks Related to this Article

WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total returns are calculated using the daily 4:00 p.m. net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

This information must be preceded or accompanied by a prospectus; click here to view or download the prospectus. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other important information about the Fund. Please read the prospectus carefully before you invest.

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector and/or smaller companies generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs.

Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. XSOE invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets.

Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.