Gimme Shelter

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Ooh, a storm is threatening

My very life today

If I don't get some shelter

Ooh yeah I'm gonna fade away

(From “Gimme Shelter” by The Rolling Stones, 1969. RIP, Charlie Watts)

We frequently caution investors and advisors to not get overly concerned about market movements during the summer months. Trading volume tends to be lighter and so market movements can be magnified.

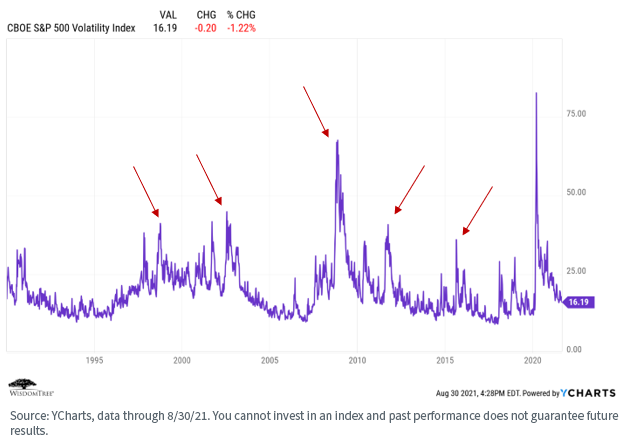

But September and October frequently are months of dramatically increased volatility. The CBOE S&P 500 Volatility Index (aka, the “VIX”) is a widely used metric of broad market volatility. The red arrows in the VIX chart below correspond (from left to right) to September 1998, September 2002, October 2008, September 2011 and September 2015. (The large spike at the far right was, of course, in March 2020 when the COVID-19 lockdowns began.)

The current VIX level of around 16% is a little lower than the historical average of roughly 18%–20%. That is, investors are displaying a certain level of complacency about the market. Some of that, no doubt, is the summer doldrums, some of it is the fact that the Q2 earnings season was so strong, some of it is a general belief in a global economic recovery, and some of it is optimism about the Federal Reserve (Fed) maintaining its current accommodative stance (strengthened by Fed Chair Jerome Powell’s recent Jackson Hole comments) as well as the potential for additional fiscal stimulus.

But there are uncertainties out there: the evolution of the delta and other variants of the COVID-19 virus and its potential impact on schools and lockdowns, inflation potential, fragile geopolitical relationships between the U.S. and China, Russia and Iran and, of course, the events in Afghanistan (which, while fairly insignificant in terms of the global economy and markets, may potentially have an impact on consumer sentiment in the U.S.).

Bottom line—historical precedent and the current facts on the ground suggest that we may see a dramatic spike in market volatility over the next three to four months. Fortunately, we can help.

As part of our Outcome Focused Model Portfolio solution set, we offer three Multifactor Model Portfolios (U.S., Developed International and Emerging Markets). These risk-factor-diversified all-equity models are managed explicitly as complements to more broadly diversified portfolios, as a means of potentially dampening the overall portfolio volatility.

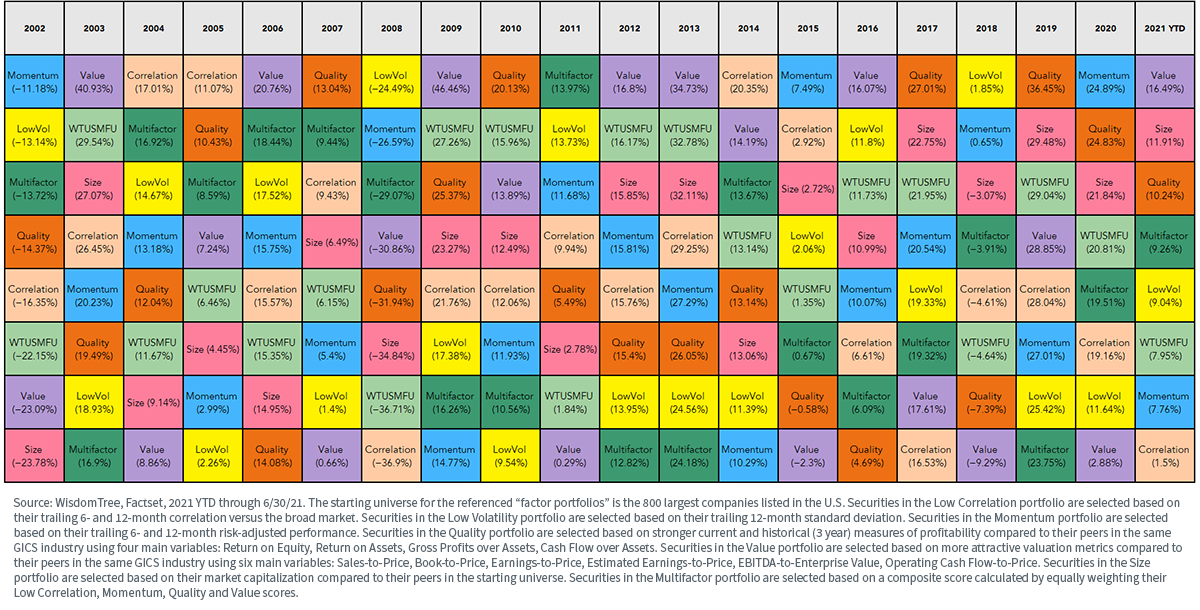

We wrote recently on the potential benefits of risk factor diversification, and this is exactly what our multifactor models are designed to do. Here is our risk factor “performance quilt” through June 30:

The point is not which factors currently are in the lead, but rather the swirling, constantly changing tapestry of leaders. Market conditions can and do change rapidly and are very difficult to predict.

That is why all WisdomTree Model Portfolios are diversified at both the asset class and risk factor levels—we believe it helps to improve the consistency of performance through various economic and market regimes.

While the three WisdomTree multifactor models can be (and are) used as stand-alone portfolios—one of our largest relationships uses the U.S. model as its core equity holding—they were designed as complementary “sleeve portfolios” to allow advisors to increase risk factor diversification without necessarily disrupting the allocations of their existing portfolios.

Additional Potential Benefits

The multifactor models offer other potential benefits beside improved factor diversification. Specifically, improved asset style diversification, better quality, lower valuations and a higher dividend yield.

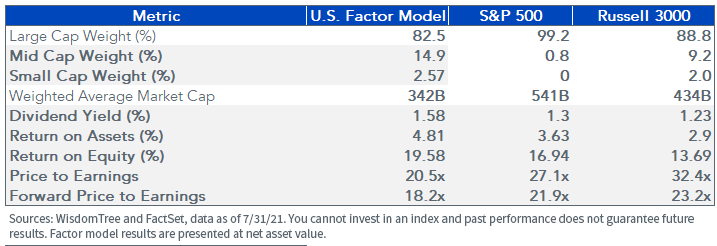

Let’s look at a comparison of various metrics between the U.S. multifactor model, the S&P 500 Index, and the Russell 3000 Index:

You can see that the U.S. multifactor model currently is less concentrated in large-cap stocks, is trading at lower valuations (P/E and forward P/E), provides a better dividend yield, and offers an improved quality profile (ROA and ROE) in comparison to both the S&P 500 and Russell 3000 indexes.

Conclusion

As we reach the end of summer, the markets are relaxed and making Panglossian assumptions about the future (“All is for the best in this the best of all possible worlds”). But the fall historically has often slapped the market in the face with big doses of reality and volatility. Perhaps advisors and investors should consider a different approach—“plan for the worst but hope for the best.”

You can learn more about our multifactor models on our Model Adoption Center on the WisdomTree website.

Important Risks Related to this Article

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Standardized performance and 30-day SEC yields for the U.S. Factor Model Portfolio’s constituent funds is available here.

ETF shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total returns are calculated using the daily 4:00 p.m. net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on, for tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client, and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the Funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses, or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.