Introducing the WisdomTree Growth & Momentum Fund

There are two key challenges to growth investing: 1) identifying companies that are in the early stages of the growth cycle and 2) avoiding the inevitable drawdowns that many growth stocks experience after significant positive performance.

The WisdomTree U.S. Growth & Momentum Fund (WGRO) is designed to solve for these challenges. Using a proprietary underlying Index created by O’Neil Global Advisors, WGRO seeks to: 1) improve the timing of entry points into growth stocks during small pullbacks and 2) avoid holding stocks that are extended.

WGRO – A Core U.S. Growth Holding

As a core U.S. growth holding, WGRO seeks to capture the upside of an aggressive-growth portfolio while limiting the drawdown and volatility that is inherent with growth investing.

WGRO seeks to track the price and yield performance, before fees and expenses, of the O’Neil Growth Index, which is comprised of mid- and large-capitalization companies that provide exposure to high-growth and momentum U.S. listed stocks.

We believe the advantage of WGRO is its use of O’Neil Global Advisors’ proprietary underlying Index, which emphasizes fundamental and technical factors. O’Neil was founded in 1963 by William J. O’Neil, a well-known stock picker and investor who has become famous for growth investing. The firm has more than 56 years of history as an accomplished growth investment manager, with strategies that are designed to help clients earn a profit on their portfolio.

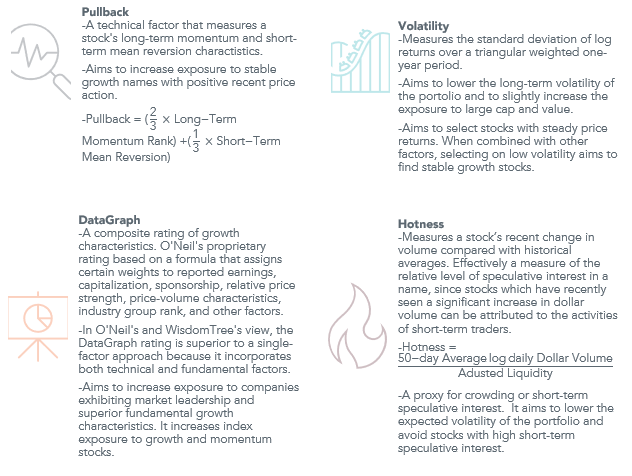

The Four Proprietary Factors – Emphasizing Both Attractive Technicals and Fundamentals

The O’Neil factors seek to identify strong long-term stocks that have pulled back and currently offer what are believed to be attractive entry points.

A Unique Way to Access Growth and Momentum

Due to the volatile nature of the growth universe, WGRO is reconstituted and rebalanced monthly to approximately equal weight to avoid idiosyncratic risk.

WGRO’s monthly refresh is a key point of differentiation from the largest momentum ETFs in the market today. Competing strategies rebalance, at most, quarterly, and some as infrequently as semi-annually.

By rebalancing monthly, WGRO is able to quickly respond to changes in the market. Its use of technical factors helps the strategy avoid stocks that are extended and, therefore, likely to correct, or fall, in price. Additionally, WGRO does not stay invested in sectors and industries that are significantly lagging the market. Instead, it invests in sectors, industries and stocks that are market leaders technically.

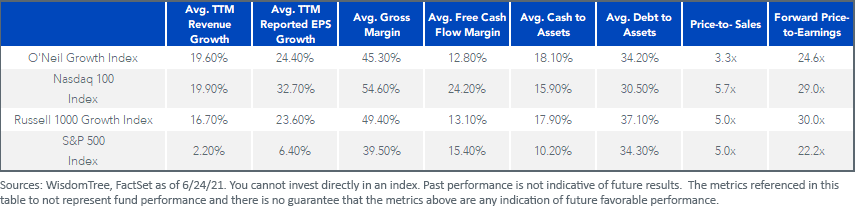

WGRO also stacks up favorably versus benchmark Indexes for growth, like the Nasdaq 100 Index and the Russell 1000 Growth Index—it has a favorable or similar revenue growth, earnings growth and margin profile compared to the benchmarks. WGRO is valued below benchmark Indexes based on price-to-sales and forward price-to-earnings, making the basket attractive on both fundamental growth characteristics and valuations.

For definitions of terms in the chart, please visit our glossary.

Positioning WGRO

We believe WGRO is well suited for investors’ allocation to mid- and large-capitalization U.S. growth stocks. The strategy seeks to provide upside during growth-led markets with less downside risk after the market tops and corrects.

In a positive return environment, we believe WGRO’s exposure to companies with high DataGraph ratings, like earning and sales growth, can outperform the broader market in a period of normal to moderate economic growth.

Meanwhile, in a drawdown environment, WGRO seeks to avoid technically extended stocks in order to mitigate the magnitude of drawdowns. We believe WGRO can outperform the overall market during periods when extended, high-valuation momentum stocks experience corrections.

We think WGRO can be positioned as the core U.S. aggressive-growth holding for investors seeking the potential for higher returns with lower volatility and drawdowns.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. The Fund invests in mid- and large-capitalization companies that provide exposure to a portfolio of high-growth and momentum U.S. exchange-listed companies. Securities that exhibit momentum characteristics may be more volatile than the market as a whole. Growth stocks, as a group, may be out of favor with the market and underperform value stocks or the overall equity market. The Fund may experience high portfolio turnover in connection with the rebalancing or adjustment of its Index. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit. The Fund does not attempt to outperform its Index or take defensive positions in declining markets, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.