An Update to Cliff Asness’s Study on the Benefits of a Levered 60/40

Upon launching the WisdomTree U.S. Efficient Core Fund (NTSX), previously referred to as the WisdomTree 90/60 U.S. Balanced Fund, we updated some of the seminal research from Cliff Asness on the diversification benefits that come from applying leverage to a traditional 60/40 portfolio approach. Today, we are excited to launch international and emerging markets versions of these strategies with the WisdomTree International Efficient Core Fund (NTSI) and the WisdomTree Emerging Markets Efficient Core Fund (NTSE). While this piece focuses on U.S. markets, our research has shown similar results outside of the U.S.

Additionally, while there is a new mantra that academic studies fail to replicate after researchers publish their findings, what was interesting was that in the 25 years after Asness published his paper, the results actually improved!

We now have another three years since the launch of the WisdomTree U.S. Efficient Core Fund to test out how this strategy works in real time—in addition to the research and historical hypotheticals.

Primer on the Research

In Asness’s 1996 piece, titled “Why Not 100% Equities: A diversified portfolio provides more expected return per unit of risk,” one of his core arguments was that an “investor willing to bear the risk of 100% equities can do even better with a diversified portfolio.”

Asness showed how the use of leverage, which we discuss below, when applied to a traditional 60/40 strategy, could achieve a similar volatility as the 100% equity exposure but could help improve the return.

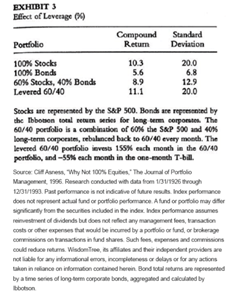

Asness’s paper, based on data from 1926 through 1993, applied a 155% leverage rate to a 60/40 portfolio (applied monthly), where the borrowing rate used for leveraging his 60/40 portfolio was done at a cost of financing by the one-month t-bill rate. This is a table from his paper:

Figure 1: Return and Volatility Table from Asness’s “Why Not 100% Equities” Paper

The Asness Research vs. the WisdomTree Efficient Core Approach

While aspects of the two are similar, there are, of course, some very important differences between the approach of the WisdomTree U.S. Efficient Core Fund, and its targeted exposures, and the research that Asness published.

The similarities between the two strategies come from the equity exposures. The large-cap “equity beta” exposure in NTSX targets S&P 500-like returns and, as such, overlaps what we see in Asness’s piece. However, there are more distinct differences on the bond exposure side of the equation.

Asness showed returns for bonds using the long-term corporate series from Ibbotson, funding these bond returns by borrowing at the one-month t-bill rate so an investor could earn both credit and duration premiums over the t-bill rate.

Bond Futures vs. Corporates

WisdomTree is implementing bond exposure in the WisdomTree U.S. Efficient Core Fund through laddered Treasury bond futures. No one earns “credit risk” premiums through this Treasury bond futures exposure, so there is less additional income to be earned from that perspective.

Although there are very important differences between our strategy implementation and the Asness study, we think that study is very useful in understanding the market dynamics at work in a levered 60/40 approach.

In a previous blog post, we showed an update of the Asness research in the 24 years after his first publication.

Now we update that to extend through 2020 and show how NTSX has compared to his simulations.

Our calculations use the same Ibbotson data series and methodology: borrowing -55% at the one-month t-bill rate that finances the 155% exposure every month in the 60/40 mix of S&P 500 and the Ibbotson corporate bond series. Our independent calculation of Asness’s test showed the same compound return figures.

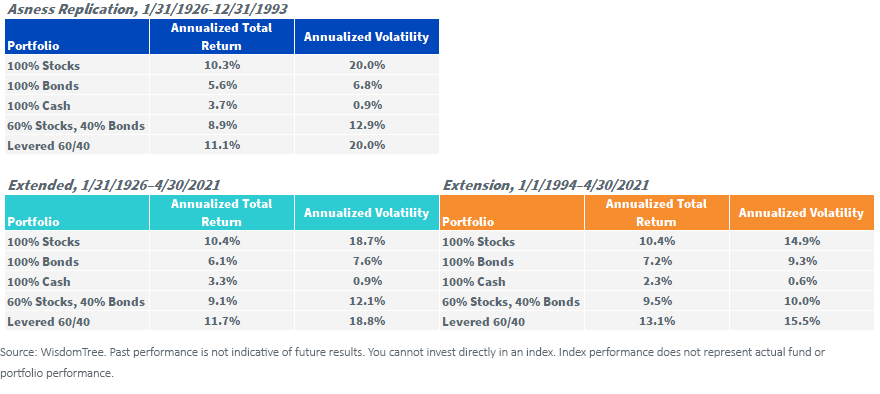

Figure 2: WisdomTree’s Replication of Asness’s Results (1/31/1926–12/31/1993)

For definitions of terms in the chart, please visit our glossary.

When we updated the figures for the next 27-plus years, we saw that stocks returned generally in line, but we also saw lowering equity volatility. While the compounded S&P 500 returns ticked up 10 basis points (bps) from 10.3% to 10.4% when updated through 2021, the bonds’ compounded returns ticked 160 bps higher, from 5.6% to 7.2%, so a 60/40 portfolio increased by 20 basis points from 8.9% to 9.1%.

Because cash rates generally also ticked down over the 27-year period after Asness published the paper, the levered 60/40 returns using Asness’s assumptions/calculations ticked up 200 basis points from 11.1% to 13.1% when updated to 2021, and the spread between 100% equities and the levered 60/40 widened out from 80 bps at the time of his original study to 130 bps over the full 1926–2021 period. When people publish research, often the research itself gets a reputation of “failing to replicate out of sample.”

Asness’s study, and the levered 60/40 portfolio utilizing the same approach he outlined in the paper, actually saw portfolio returns outperform in the following 27-year period compared to its historical back test. The levered 60/40 portfolio returned 13.1% for the 1994–2021 period, 270 bps ahead of the 100% equity line, compared with only 80 bps during his original test.

WisdomTree’s Live Fund out of Sample Results

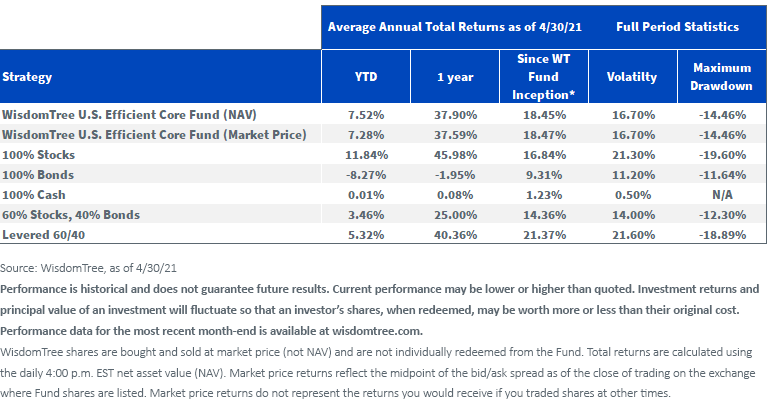

While replicating Asness’s research has been instructive as to the potential for this strategy, how did NTSX fare in real time?

In short, NTSX outperformed 100% stocks by 1.61% per year with lower volatility and drawdowns. While it lagged the hypothetical levered 60/40 by nearly 3% per year, this was primarily a function of much longer duration for their fixed income position and credit over-weights versus NTSX.

During periods of rising rates, we would expect NTSX to add value compared to the levered 60/40 hypothetical approach quoted in the Asness study. Additionally, we believe that Treasuries may be a better diversifier than corporate credit in helping to dampen equity volatility.

For standardized performance of NTSX, please click here.

Current Equity vs. Bond Debates

Right now, one of the core asset allocation conundrums remains: Interest rates generally are still near their lowest levels, and, as such, one doesn’t earn as much from bonds as in the past. Similarly, equity valuations are extended from historical levels, so forward-looking equity returns are also lower than normal.

The conundrum for traditional asset allocators, however, is that equity premiums (how much compensation stocks are offering over relatively “safe” assets like bonds) are likely still favoring stocks in asset allocation models.

Professor Jeremy Siegel, under whom I have studied extensively, believes the current equity premium over bonds is more than 5%, whereas his work over the last 200 years shows the real equity premium was closer to 3% historically.

Shifting bond exposures to equities, which have higher volatilities, when they are at high valuations is not easy to do. Substituting some of the traditional equities with a package of equities that also increases bond exposure could perhaps help solve one of these key asset allocation debates facing investors: stocks or bonds? Why not both for the same dollar invested?

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal.

Risks related to NTSX, NTSE and NTSI: While the Funds are actively managed, their investment processes are expected to be heavily dependent on quantitative models, and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Funds invest in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Funds’ use of derivatives will give rise to leverage, and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Funds may change quickly and without warning, and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as perception of an issuer’s creditworthiness.

Additional risks specific to NTSI: Investments in non-U.S. securities involve political, regulatory and economic risks that may not be present in U.S. securities. For example, foreign securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability, or geographic events that adversely impact issuers of foreign securities.

Additional risks specific to NTSE:

Investments in non-U.S. securities involve political, regulatory and economic risks that may not be present in U.S. securities. For example, foreign securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability, or geographic events that adversely impact issuers of foreign securities. Investments in securities and instruments traded in developing or emerging markets, or that provide exposure to such securities or markets, can involve additional risks relating to political, economic or regulatory conditions not associated with investments in U.S. securities and instruments or investments in more developed international markets.

Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.