“Zero”ing in on a Rate-Hedged Solution

Can Treasury (UST) yields rise even if the Federal Reserve (Fed) doesn’t raise rates or taper their quantitative easing (QE) program? The 2021 experience has shown investors that they certainly can. Thus far in Q1, this is exactly what has happened, as essentially the entire spectrum of the Treasury coupon curve (notes and bonds) has done just that. In fact, other than t-bills, the only other maturity that has managed to “escape” this rising rate fate—for now—has been the UST 2-Year note. Moreover, even 10- and 30-year TIPS yields have increased this year.

So how does a fixed income investor position their portfolio for rising rates? One potential solution is the WisdomTree Interest Rate Hedged U.S. Aggregate Bond Fund (AGZD). This strategy takes the Bloomberg Barclays U.S. Aggregate Bond Index, the Agg, and overlays a short position in Treasury futures to target a duration of zero years. Thus, the investor is provided with a “long” portfolio that is representative of the Agg, but without the duration of 6.4 years. In addition, this approach also offers a more diversified underlying basket of investment-grade asset classes, such as Treasuries, mortgage-backed securities, corporate bonds and agency securities, as compared to other rate-hedged options such as traditional floating rate notes, which are typically limited more to corporates with a concentration in the financial sector.

For month-end and standardized performance click here.

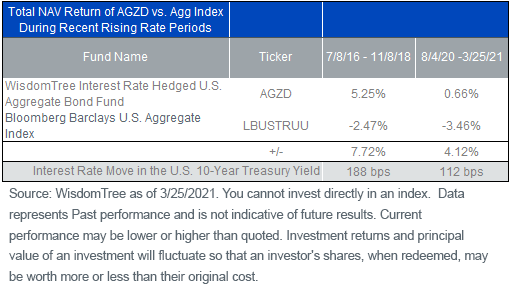

The above table offers a snapshot of how AGZD has fared versus the benchmark during the two most recent noteworthy rising rate periods for the UST 10-Year yield (the 2021 instance included). In each case, the UST 10-Year yield rose in excess of 100 basis points (bps). As you can see, AGZD registered positive readings while the Agg was producing rather visible negative performances, which resulted in total return differentials of +7.72% for the 2016–2018 period and +4.12% thus far in 2021.

Why Now

Some readers may ask the question: Why should I rate hedge now after Treasury yields have risen so much? In our opinion, the run-up in rates is not over. At the March FOMC meeting, the Fed’s median economic projections revealed a setting where inflation is going to be either at or above the policymakers’ 2% target, while the unemployment rate is expected to drop to 4.5% this year, 3.9% in 2022 and 3.5% in 2023. However, the Fed’s consensus forecast doesn’t look for a rate hike at all during this timeframe.

It is it any wonder why inflation expectations are at a decade high in some cases? In other words, the Treasury market may very well be thinking the Fed will fall behind the “inflation curve.” That is the risk of a “pedal to the metal” monetary policy, which, quite frankly, the markets are not accustomed to. Our base case sees the UST 10-Year yield rising back up toward the 2% threshold this year, with a possible overshoot. Against this backdrop, we continue to advocate positioning your fixed income portfolio for a potential further rise in rates, especially viewing any rally in Treasuries as a second opportunity to do so.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. The Fund seeks to mitigate interest rate risk by taking short positions in U.S. Treasuries (or futures providing exposure to U.S. Treasuries), but there is no guarantee this will be achieved. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. The Fund may engage in “short sale” transactions of U.S. Treasuries where losses may be exaggerated, potentially losing more money than the actual cost of the investment and the third party to the short sale may fail to honor its contract terms, causing a loss to the Fund. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.