Geography of China’s Growth and Governance Disparity

For outsiders, it is common to view China as monolithic, with its central government dominating international news.

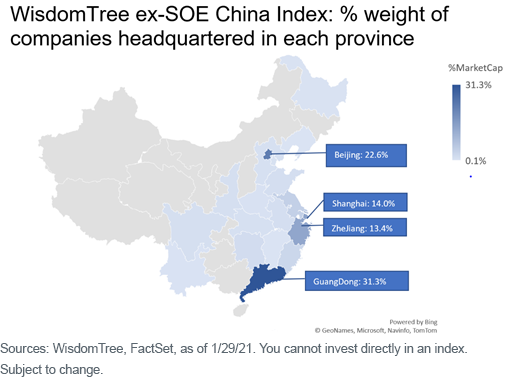

When we map the WisdomTree China ex-State-Owned Enterprises (ex-SOE) Index weight onto each province where companies are headquartered, it shows more weight in China’s southeastern region, which is generally believed to be more entrepreneur-oriented and better governed.

This geography concentration highlights the cultural element that comes from removing state-owned enterprises, which may lead to better corporate governance and a more interesting basket of companies than traditional market cap-weighted benchmarks1.

The WisdomTree China ex-SOE Index consists of companies headquartered in a few main growth centers in China:

- Beijing, with its dominance of the best education resources, is home to many SOE companies, but also tech firms like Baidu, JD and Meituan.

- The Yangtze River delta area and the Shanghai and Pearl River area next to Hong Kong are two other main areas of private company growth in China. Alibaba and Tencent are well-known representatives of these two regions.

China has a significant north-south divide in its economy and culture. This divide has been around for a while. Using data during the Qing Dynasty (1644–1911), historians collected the number of top-ranked students in national exams for counties within each province as a measure for human capital. The top provinces are either located near Beijing or in the Yangtze River delta area, with Jiangsu and ZheJiang provinces ranking consistently among the top five.

For historical reasons, the southeastern area is believed to be better governed, with more trust preserved in the community due to the common local languages and its own extended social network. Capital from Taiwan flowed significantly to ZheJiang province after 1980 through these networks. Financial capital from Hong Kong flowed toward GuangDong province around that time.

The north-south divide is also reflected in an episode of China’s own, “Do you trust Chinese data?” drama. As more high-frequency data becomes available, official Chinese GDP data has become a secondary source when gauging the Chinese economy.

- Around 2014, the central government was extremely concerned that several northern provinces’ reported GDP numbers were overinflated by local officials. In 2016, the LiaoNing province in the north was asked to reduce its reported GDP figure by 22.4%.

- In 2018, after the fourth national economic census, 12 out of 15 northern provinces’ GDP estimates were adjusted lower, while 14 out of 16 southern provinces were adjusted higher. Jilin and HeilongJiang, both northern provinces, have respectively been adjusted down more than 20%.

These adjustments partly reflect a general impression that northern local governments are more bureaucratic, less transparent and slower moving to support private businesses.

We often hear questions about what ex-state-owned factor we are betting on. Clearly, compared to the SOE sector, it’s a bet on growth and quality for the ex-SOE sector, with generally higher sales and revenue growth and higher return on equity (ROE).

We believe it is not just about growth and quality, but also other factors that are harder to measure but extremely important in emerging markets for private business success: relatively better governance, both within the company and within local governments and in their interactions with private businesses.

These cultural factors are one of the reasons we think the innovation and growth contained within the ex-SOE tilt will be long-lasting.

1About 22 companies and 4.7% weight in WisdomTree’s Index listed Hong Kong as their headquarters. It is well known many chose Hong Kong for listing and tax purposes, and some of these companies are relabeled to reflect the true company headquarter province when clear information dictates this change. There are 59 companies (9.3% weight within the MSCI China Index) in a similar situation that have been reclassified. Most Chinese companies are young and headquartered in the provinces where they were founded. So far, it is uncommon to move headquarters across provincial lines.

Liqian Ren, Ph.D., joined WisdomTree as Director of Modern Alpha in 2018. She leads WisdomTree’s quantitative investment capabilities and serves as a thought leader for WisdomTree’s Modern Alpha® approach. Liqian was previously at Vanguard, where she worked for 12 years, most recently as a portfolio manager in the Quantitative Equity Group managing Vanguard’s active funds and conducting research on factor strategies. Prior to joining Vanguard, she was an associate economist at the Federal Reserve Bank of Chicago. Liqian received her bachelor’s degree in Computer Science from Peking University in Beijing, her master’s in Economics from Indiana University—Purdue University Indianapolis, and her MBA and Ph.D. in Economics from the University of Chicago Booth School of Business. Liqian co-hosts a podcast on China and Asian markets with Jeremy Schwartz, WisdomTree’s Global Head of Research, and she is a co-host on the Wharton Business Radio program Behind the Markets on SiriusXM 132.