Follow the Rules with Mid-Cap Allocations

Teenagers can be a handful, but your U.S. mid-cap equity allocation doesn’t have to be.

On February 23, WisdomTree celebrated the 14th birthday of its U.S. core equity ETF family, and the WisdomTree U.S. MidCap Fund (EZM) got to blow out the candle.

Launched in 2007, EZM pioneered our rules-based, earnings-weighted methodology, an alternative to market capitalization-weighted strategies that track mid-cap Indexes like the S&P 400 or Russell Midcap Index.

While WisdomTree has always believed in the size premium for mid- and small-cap companies, we find that what you own is more important than owning them outright. That means it’s important to be selective in your pursuit of healthy, opportunistic mid-cap companies, and we think that EZM’s rules-based approach is designed to deliver exactly that.

A Perfect Storm for Valuations

EZM’s 14th birthday comes at an interesting time. Early in 2021, equity market valuations are at historic highs, boosted by an unprecedented backdrop of accommodative monetary policy, fiscal stimulus, the specter of inflation and more.

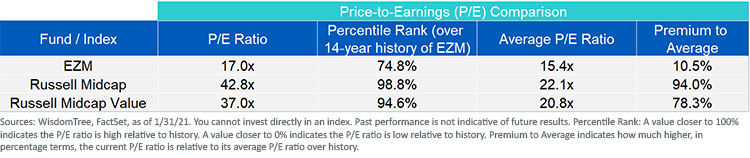

The Russell Midcap Index’s P/E is 43x as of January 31 and has been more than 40x since November. The sky-high multiple is also almost twice its average of 22x since EZM’s inception. This has also been the only period that the Index’s P/E has been more than 40x since EZM launched in February 2007, indicating investors’ willingness to pay historically high multiples.

Even the Russell Midcap Value Index is not immune to steep valuations, which is both ironic and concerning when you remember that value investing is predicated on identifying companies with fundamental health and not overpaying for them.

EZM, on the other hand, has a P/E ratio of 17x, a fraction higher than its average since inception of 15.4x.

Remember, EZM’s underlying Index selects and weights companies by their contribution to the Earnings Stream (using trailing 12-month earnings), signaling that a methodology that favors greater earnings can explicitly keep valuations in check.

A Junk Rally in Equities

Suffice it to say, valuations are stretched, and the TINA (“there is no alternative” to equities) mantra seems here to stay. Investors can’t seem to get enough equity exposure, and they’re consequently buying up speculative companies with underlying health concerns in the process.

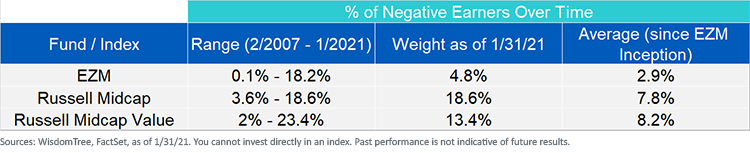

Take a look at the percentage of unprofitable companies in the Russell Midcap Index. The weight of those with negative earnings is the highest it’s been dating back to 2007. Unprofitable mid-cap companies weren’t even this prevalent during the depths of the financial crisis.

This harsh reality sheds a spotlight on an earnings-weighted strategy that favors companies with stronger profits. EZM epitomizes this: The weight of unprofitable companies that constitute it is less than 5%, a tick higher than its meager long-term average of 3%. Historically, the highest weight of companies to ever make their way into EZM was during the global financial crisis in 2008, and the numbers have hardly come close since then.

Pure-Play Mid-Cap Exposure

It’s 10 p.m.… Do you know where your mid-caps are?

They’re not in the Russell Midcap Index.

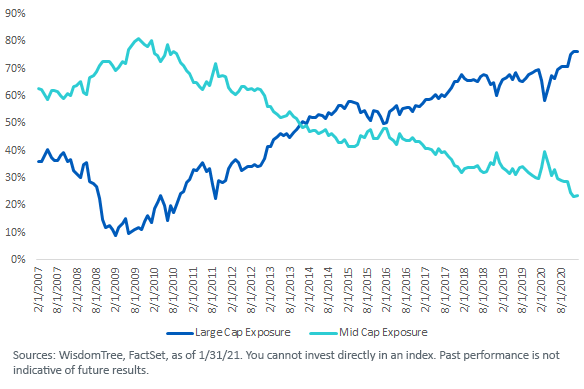

While equity markets have rallied to new highs from the throes of the pandemic, the Russell Midcap Index has started to look like a mid-cap Index in name only. As of January 31, the percentage of companies WisdomTree classifies as mid-cap (with market capitalizations between $2 and $10 billion) has steadily fallen to about 24% of the Index. Meanwhile, large-cap companies (with market caps more than $10 billion) make up the remaining 76%.

Let that sink in.

Three-quarters of a mid-cap Index is effectively large cap. Investors using funds to track that Index are literally only getting about a quarter of what they think they’re getting, and the trend has exacerbated since the end of the financial crisis.

Size Exposure in The Russell

Compare that to EZM, where the benefits of a rules-based, earnings-weighted methodology that rebalances once a year are evident.

The percentage of mid-cap weight in the Fund? 99%.

The percentage of large-cap companies in the Fund? 0%.

The proof is in the pudding.

Compared to conventional, market cap-weighted strategies dedicated to mid-cap exposures, EZM has proven its worth over a 14-year history. It delivers pure-play mid-cap exposure with an emphasis on profitability and valuation control due to its unique methodology.

In today’s market, it is vital to defend against exorbitant valuations and segments that bleed upward along the size spectrum, all while preserving profitability. Fortunately, the WisdomTree U.S. MidCap Fund can do all three, and it has a 14-year history to prove it.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.