Searching for Yield, not Reaching for Yield

Interest rates around the globe are either outright negative or, in the case of the U.S., remain at historically low levels. I frequently get asked the question, “Where can I find income in such an environment?” My answer starts with this important concept for fixed income investing: be sure to search for yield rather than reaching for yield.

This concept lies at the heart of prudent fixed income strategy. An investor reaching for yield is, more than likely, taking on undue risk for their portfolio. In other words, if it sounds too good to be true, guess what? It is! In contrast, searching for yield in a bond portfolio requires a more disciplined approach to find income, and that’s what I want to discuss here.

With U.S. rates at historically low levels, investors are offered sparse income opportunities, but also little, if any, protection in the event U.S. Treasury (UST) yields retrace a portion of 2020’s sizable decline. We don’t expect to see a spike in rates, but investors have already seen early in 2021 that UST yields can rise even if the Federal Reserve (Fed) appears to be in no hurry to move in that direction. With rate moves like these, bond portfolios with even modest durations can still experience possible negative returns. This is why I have been emphasizing rate-hedging strategies in my blog posts.

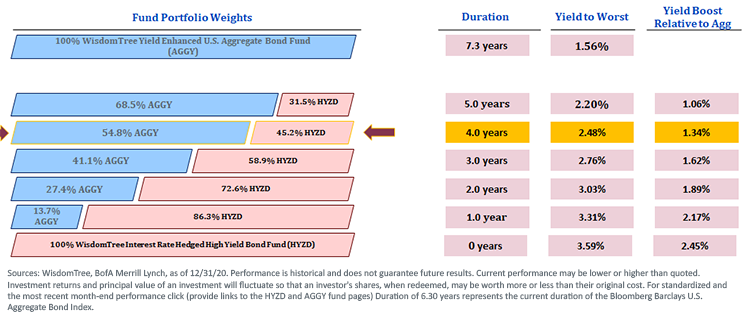

Is there a way investors can enhance yield in a disciplined matter while also hedging duration? WisdomTree offers a solution on this front by blending the WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY) and the WisdomTree Interest Rate Hedged High Yield Bond Fund (HYZD). AGGY uses a rules-based approach to re-weight the sub-components of the Bloomberg Barclays U.S. Aggregate Bond Index (the Agg), seeking to enhance yield, while broadly maintaining familiar risk characteristics. HYZD employs a quality screen to identify bonds with favorable fundamental characteristics and then tilts to those which offer more attractive income potential. In addition, HYZD uses an institutional style approach of shorting Treasury futures to target a duration level of 0 years.

For definitions of terms in the chart, please visit our glossary.

For standardized performance of the Funds in the chart, please click their respective tickers: HYZD, AGGY.

The above chart details how a 55% allocation to AGGY, combined with a 45% weighting to HYZD, would have resulted in a yield pick up of over 130 basis points relative to the Agg, while visibly reducing the level of interest rate risk.

Conclusion

This ‘core-plus’ strategy offers bond investors an approach that serves the following three key goals:

- maintains a traditional strategy of fixed income investing

- supplements income potential

- provides a rate-hedge in the event UST yields continue to move higher, which is our base case

Remember, it’s about searching for yield, NOT reaching for yield.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. The Fund seeks to mitigate interest rate risk by taking short positions in U.S. Treasuries (or futures providing exposure to U.S. Treasuries), but there is no guarantee this will be achieved. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions.

Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. The Fund may engage in “short sale” transactions where losses may be exaggerated, potentially losing more money than the actual cost of the investment and the third party to the short sale may fail to honor its contract terms, causing a loss to the Fund. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of certain Fund’s they may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.