International Equities Enter 2021 with Momentum

This year may be a turning point for international equities.

For the first time in recent memory, investors are turning their attention abroad in pursuit of returns, discouraged by overextended valuations back home after last year’s surprisingly quick economic recovery.

Suddenly, international equities are regaining steam.

Over the past three years, the U.S. fund international equity category, classified by Morningstar, collected $24 billion in fund flows, while U.S. equity funds bled $238 billion in outflows.

The momentum is a fresh start after a dismal decade of international equity performance versus U.S. markets. Only twice over the past 10 calendar years has the MSCI EAFE Index outperformed the S&P 500 (2012 and 2017), and both times were by slim margins.

At WisdomTree, we think there is a unique opportunity presented in developed markets—one best accessed through a quality- and dividend growth-focused framework.

High-Quality Strategies Make High-Quality Portfolios

In 2015, we launched the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), which seeks to track the WisdomTree International Hedged Quality Dividend Growth Index (WTIDGH) before fees and expenses.

Less than a year later, we also introduced a non-currency-hedged version, the WisdomTree International Quality Dividend Growth Fund (IQDG), which seeks to track the price and yield performance, before fees and expenses, of the WisdomTree International Quality Dividend Growth Index (WTIDG).

Both Indexes employ the same strategy, which results in exposure to companies with strong earnings, healthy balance sheets and low leverage. They select the top 300 companies from the dividend-paying, international equity universe, ranked by a combination of dividend growth and quality factors. The only difference is that the former Index employs a currency-hedged strategy to mitigate fluctuations in foreign exchange, while the latter does not.

After seven years, these strategies have much to be proud of and even more opportunity going forward.

1. Impeccable Performance. The two Indexes, incepted in late 2013, have a compelling performance track record. Both the hedged and unhedged versions have delivered strong outperformance against the MSCI EAFE Index (on a local currency basis and in USD, respectively) over the long term. The consistency is reinforced by reduced volatility in both strategies, resulting in improved risk-adjusted returns and essentially free alpha, since return improved while risk was reduced.

2. Improved Fundamentals. There are two important points to consider:

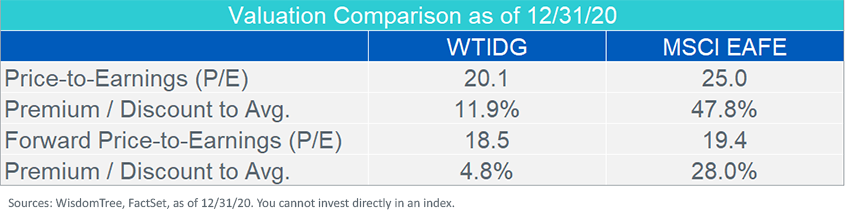

a. Valuations. As markets recovered from the onset of the pandemic last March, the P/E ratio of the MSCI EAFE Index surged from a -20% discount to its historical average (since WisdomTree Index inception in December 2013) to nearly a 50% premium. Forward P/E ratios followed suit, climbing to a 30% premium over the same time frame. But the WTIDG Index remains modestly valued at a 12% and 5% premium to its historical average on a P/E and forward P/E basis, respectively. This signals to us that there may be room for further appreciation and potential safety from a sharp retreat in valuations if markets begin to temper their exuberance.

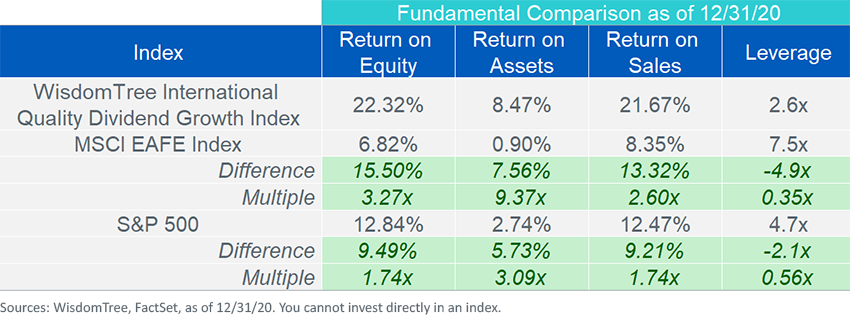

b. Quality Where It Matters Most. The ethos of the quality factor is a focus on profitability, efficient operations and strong balance sheets in order to deliver healthy results. WisdomTree’s Index exemplifies this, delivering more than 3x more return on equity (ROE), 2.5x more return on sales (ROS) and 9x more return on assets (ROA), all with about one-third the leverage of the MSCI EAFE. The quality pickup is also strong relative to U.S. markets. WTIDG delivers almost twice the ROE and ROS as the S&P 500, to go along with 3x the ROA and half as much leverage.

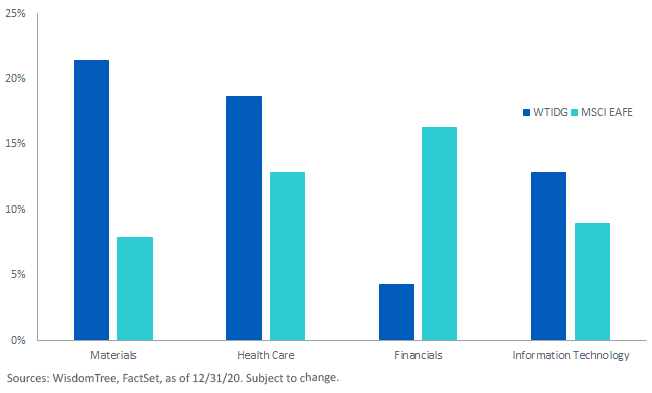

3. Sector Exposures with More to Offer. The nature of WisdomTree’s quality- and dividend growth-focused strategy results in unique sector exposures that contrast with the conventional, market capitalization-weighted MSCI EAFE. While Financials have been a longtime sector stalwart in international markets, WTIDG maintains a sizable under-weight to Financials of 12%. The strategy’s over-weights are to sectors in greater scarcity in international markets, such as Information Technology, Materials and Health Care. The resulting sector composition targets nimble companies with healthy fundamentals, rather than the traditional, stodgy heavyweights (i.e., banks) of international equity markets.

No Better Time Than Now

When it comes to investing in international equity markets, now may be as good a time as ever.

The results of WisdomTree’s unique approach speak for themselves. Whether you’re interested in a currency-hedged or unhedged strategy when investing abroad, there’s evidence that a quality dividend-growth approach can potentially improve risk-adjusted returns, create healthier fundamentals, reduce valuations and target sectors with attractive prospects for the future.

Unless otherwise stated, sources for all performance and information data are WisdomTree, FactSet, Morningstar, and/or Zephyr StyleADVISOR, as of December 31, 2020.

For standardized fund performance please visit the clicks on the respective ticker to visit the fund detail page: IHDG, IQDG.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is likely to be impacted by the events or conditions affecting that country or region.

Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.