2021 Outlook: Cyclical Rotation Ahead

Things have changed.

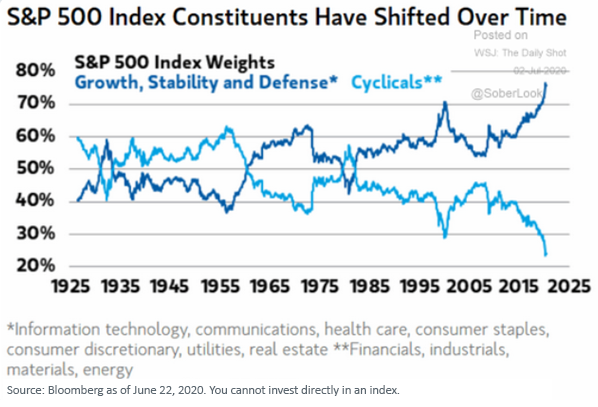

Looking at 100 years of data, this chart from Morgan Stanley shows that cyclical sectors have never had a lower weight in the S&P 500 Index.

Growth, stability and defense sectors have never had a greater weight—now more than three-quarters of the index.1

Cyclical sectors are Financials, Industrials, Energy and Materials. Growth, stability and defense sectors are Tech, Communications, Health Care, the Consumer sectors, Utilities and Real Estate.

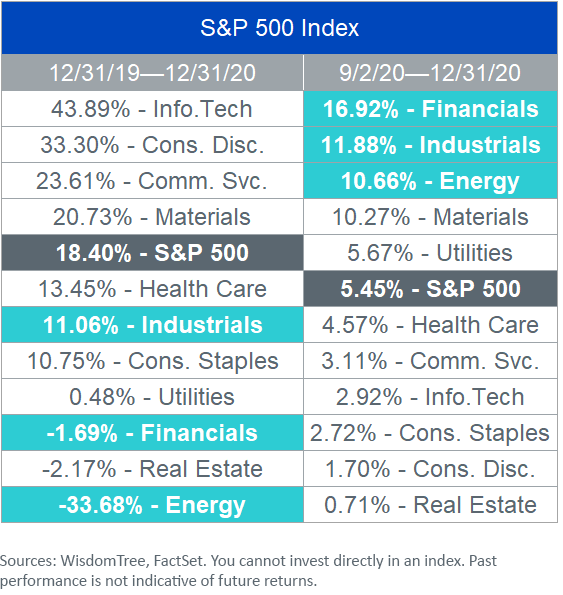

So much of 2020’s market performance can be attributed to this sector classification.

The growth, stability and defense sectors fared particularly well during the 2020 pandemic. Tech-enabled employees worked effectively from home. The counter-cyclicality of defense sectors shined as people stayed at home, stocked up on staples and streamed movies from the couch.

Cyclicals had their revenue wiped out directly by, or as a close by-product of, the economic shutdown.

- Airlines and airplane manufacturers within the Industrials sector had business grind to a halt.

- Banks provisioned losses for soured loans.

- Energy companies had to write down asset values from plunging oil prices.

- Materials businesses were impaired by a standstill in construction activity.

As we emerge from the pandemic shutdown in 2021, we believe investors should prepare for a more cyclical rebound with a better economic growth environment.

Just in the past few weeks, an inflection in outperformance can be seen from some of these beaten down sectors. Financials, Industrials, and Energy have had positive momentum as a result of increasing optimism for economic conditions in the year ahead.

Sector Returns

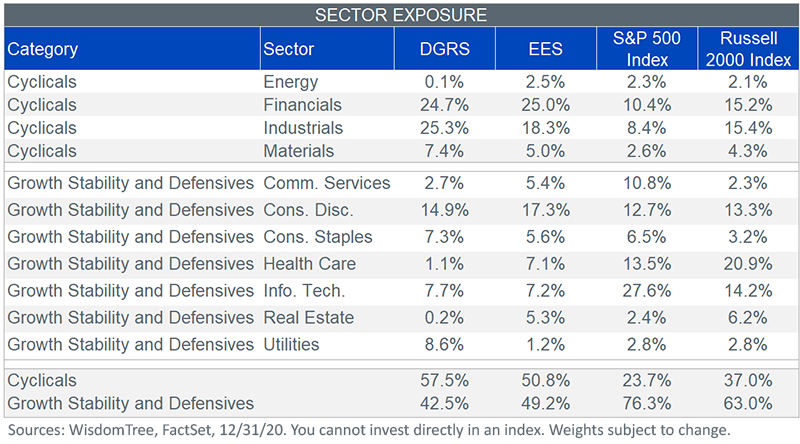

We propose two small-cap ETF ideas with sector exposures that are almost the exact opposite of the S&P 500: the WisdomTree U.S. SmallCap Quality Dividend Growth Fund (DGRS) and the WisdomTree SmallCap Fund (EES).

By their nature, small caps tend to be more cyclical than large caps. Because they have less diversified businesses, they are often more tied to economic fluctuations.

But, through sector categorization, this cyclicality is reinforced and accentuated.

- DGRS is 57% cyclicals, with more than double the Financials sector weight of the S&P 500 and nearly three times its Industrials and Materials sector weights.

- EES is 50% cyclicals, with more than double the S&P 500’s Financials and Industrials sector weights and nearly two times its Materials sector weight.

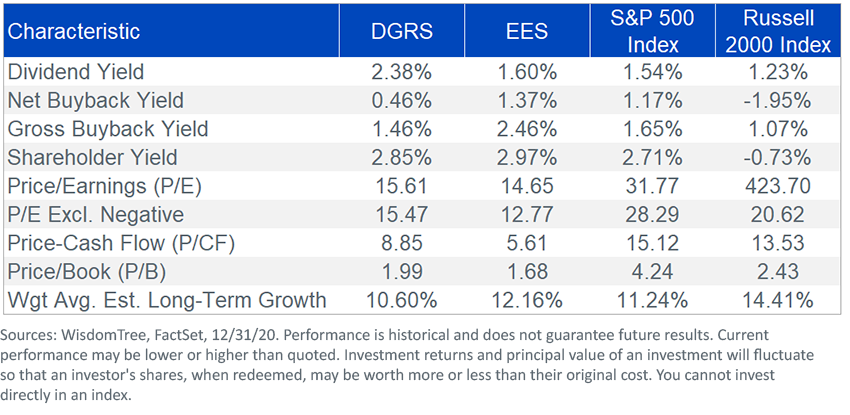

On a pure valuation basis, people often think of small caps as being particularly expensive on earnings-multiples—more than 37% of the Russell 2000 is currently unprofitable, after all. That’s up from about 20% pre-pandemic.

But as of December 31, less than 1% of DGRS was unprofitable, and EES starts with a profitable company universe as defined by a measure of core earnings.

- Quality and cyclical small caps: People tend not to think of small caps for dividends, because about 50% of the Russell 2000 has typically been non-dividend payers. But DGRS has a considerably higher dividend yield than the S&P 500. And these dividends have not come at the expense of share dilution. For a small-cap basket this is unique, as small-cap indexes generally tend to issue shares and see negative net buyback ratios.

- Positive core earnings: Starting with a universe of positive earners naturally reduces exposure to many of the small-cap “story stocks” that tend to cluster in biotech and info tech. The trade-off is slightly lower estimated long-term growth for EES versus the Russell 2000 in exchange for a price-to-earnings ratio (excluding negative earners) of 12.8 times—a discount of nearly 40% relative to the 20.6 times for the Russell 2000, and even more relative to the 28.3 times for the S&P 500.

For standardized performance of DGRS, please click here.

For standardized performance of EES, please click here.

For definitions of terms in the table, please visit our glossary.

Cyclical Rotation

WisdomTree’s 2021 outlook calls for some cyclical rotation both to small caps and cyclical sectors that were hit during the lockdowns. The very robust growth in the M1 money supply measures in 2020 that came from pandemic relief efforts supports our more optimistic outlook on the economy for 2021. We also see higher inflation coming as the economy opens up.

The big market cap indexes keep lowering exposure to cyclical sectors, as seen in the chart at the start of this blog post. For investors seeking to add exposure to that cyclical growth story, we believe DGRS and EES are two very good options.

1The Wall Street Journal’s Daily Shot email series featured this chart on 7/2/20.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.