Fed Watch: The Final Countdown

The Federal Reserve (Fed) had an incredibly busy year in 2020. From implementing policy measures to help the economy and stabilize the financial markets, to adopting a new average inflation targeting approach. With the final FOMC meeting for this year now in the books, the bond market’s attention will shift to what 2021 could bring from the Fed.

Based on the Fed’s own assessments, it doesn’t appear that the interest rate aspect of policy should garner headlines, with Fed Funds expected to remain in the current 0%–0.25% range for the entire year, and likely beyond. That brings us to the Fed’s balance sheet, where two key components need to be considered: quantitative easing (QE) and the various facilities that were put in place to help stave off a financial crisis.

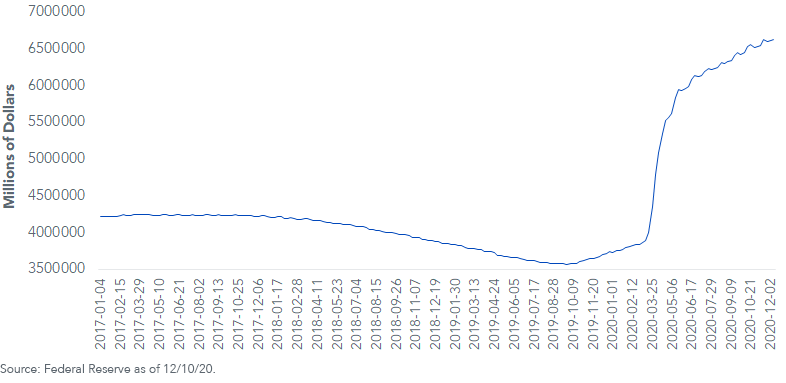

Fed Holdings of Treasuries, Agency Debt & MBS

As we witnessed following the global financial crisis, the aforementioned facilities will more than likely wind down of their own accord. In other words, if the demand isn’t there, they basically fade away without much fanfare. QE, on the other hand, is more of a potential headline-maker.

The Fed’s purchase of Treasuries (UST) and mortgage-backed securities (MBS), a.k.a. QE, will more than likely be the central focus of the bond market as it pertains to Fed policy in 2021. Specifically, how will the Fed communicate how long the current pace of QE will remain in place? We saw this process beginning at the December FOMC meeting.

As the enclosed graph highlights, after the initial spring surge, the upward trend has shown more of a sawtooth pattern. But make no mistake, the purchases are continuing. To provide some perspective, the Fed’s holdings of UST and MBS now stand at $6.6 trillion compared to about $3.8 trillion in February. At its global financial crisis peak, the level was ‘only’ about $4.25 trillion.

As you may recall, the Fed reinstated QE in September 2019 to help alleviate some pressures that were emerging in the funding markets at the time. This round of QE got a shot of adrenaline in response to the challenges that were beginning to surface in March as a result of the pandemic-related shutdowns. More recently, the policymakers have reverted the current round of purchases to an economic-centric stimulus consideration.

Bottom line: There appears to be some idea the Fed may begin to actually taper this current round of QE in the first half of 2022, as the economic situation evolves. The key question is whether the UST market has entirely allowed for such a timetable. Against this backdrop, Fed forward guidance will be essential in order to avoid any type of “taper tantrum” such as we saw the last time around. However, it could open the door for the markets to misinterpret the policymakers’ intentions.